Behind the curtain, the latest FED beige book published earlier in the month can be summarized in five key points:

Seven Districts reported some level of increased activity, while five noted flat or declining activity, three more than in the prior reporting period.

Wages continued to grow at a modest to moderate pace in most Districts, while prices were generally reported to have risen modestly.

Household spending was little changed according to most District banks. Auto sales varied across Districts this cycle, with some noting lower sales due in part to a cyberattack on dealerships and high interest rates.

Most Districts saw soft demand for consumer and business loans. Reports on residential and commercial real estate markets varied, but most banks reported only slight changes. Travel and tourism grew steadily and were on par with seasonal expectations.

Districts also reported widely disparate trends in manufacturing activity, ranging from brisk downturns to moderate growth.

In a nutshell, the FED beige book shows that the recession likely began in May or June, despite what politicians and Wall Street banksters want us to believe.

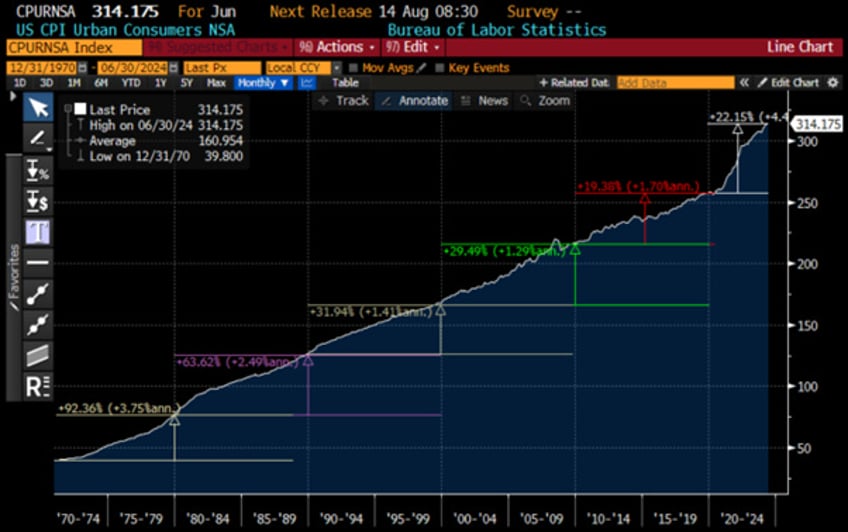

Regardless of the Forward Confusion narrative spread by Wall Street, the government, and the mass media, we are living in a new age of inflation. While inflation has existed since the beginning of the monetary economy, no economic system has institutionalized and perpetuated the devaluation of money to the extent we see today. According to official US CPI data, which are notoriously underestimating ‘real inflation’, over the past four years, the CPI has already increased by more than 22%, compared to 19.4% between 2010 and 2020, 29.5% between 2000 and 2010, and 31.9% between 1990 and 2000. The rate of CPI increase over the past four years is on track to record a similar decade-long increase not seen since the 1970s and 1980s.

US CPI Urban Consumers Index.

What do these figures mean? For more than half a century, the US dollar has depreciated by an average of almost 4 percent per year relative to the typical consumer goods an American household buys. These are the official inflation figures, which focus on private consumption. However, since at least the 1980s, there has also been disproportionately high asset price inflation in real estate, and many other long-term assets.

The situation is similar in Europe. Since the introduction of the euro in 1999, average consumer price inflation in the eurozone has hovered around 2% per year, meaning the European Central Bank has met its stated monetary policy target, if only on average. At the same time, real estate has been heavily inflated over the entire period, a fact not accounted for in official inflation statistics. Real estate prices have almost tripled in France and more than doubled in Germany over the last 25 years in EUR terms. All these signs indicate that we are indeed living in the age of inflation.

Eurozone All Items CPI YoY change since 1999.

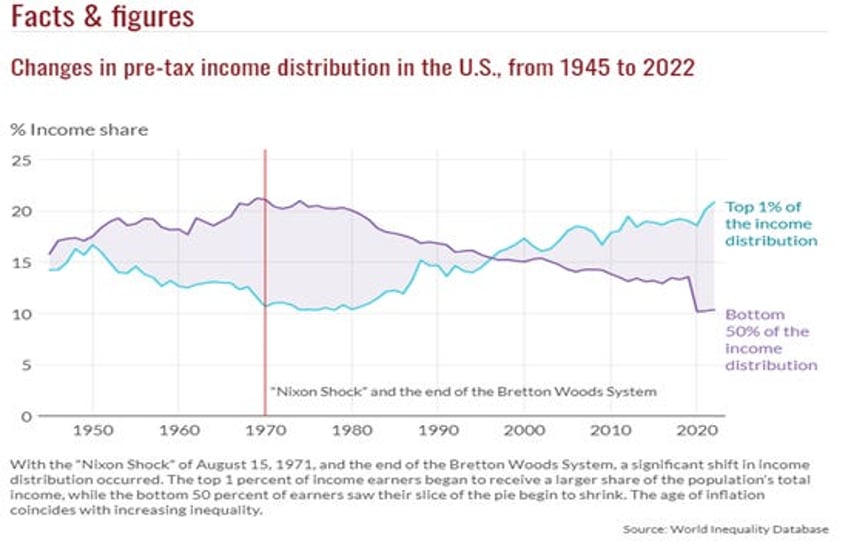

Economists agree that inflation can stimulate the economy in the short term. However, what seems beneficial initially can cause long-term harm. Short-term inflation boosts economic activity by lowering interest rates and expanding the money supply, increasing credit, investment, and consumption. Yet, persistent inflation changes the economic structure. Investors adapt, finding it more sensible to buy real assets like real estate, which rise in value, rather than investing in new productive ventures. This shift leads to speculative investments, crowding out productive ones, and ultimately stifles real economic growth, causing the economy to consume its existing capital instead of building it. The growing demand for long-term assets as protection against inflation acts as a ‘self-defence’ mechanism. Persistent inflation triggers a cultural shift away from traditional savings. As people realize saving money no longer works, they turn to buying property and other assets to preserve their wealth, leading to high vacancy rates in cities like London, Paris, and New York. This increasing demand drives asset prices up faster than incomes, widening the gap between the wealthy and the less affluent. Steady inflation, even if it is moderate on average, is driving a wedge between rich and poor.

Thomas Piketty, a French economist, explored inequality in his bestseller ‘Capital in the Twenty-First Century.’ He argues that the rate of return on capital exceeds long-term economic growth, predicting that capital owners will become increasingly wealthy relative to wage earners. Piketty suggests wealth taxes to counter this trend. His work, based on three centuries of data, inspired Senator Elizabeth Warren's campaign for a wealth tax. While his conclusions are subjective, his book claims to show a historical increase in returns to capital. Although inequality fluctuates over time, Piketty's findings are often cited by left-wing politicians, despite some scepticism about their broader economic validity.

The best example of inequality is probably that the world's richest 1% increased their fortunes by a total of $42 trillion over the past decade. This is nearly 36 times more than the wealth accumulated by the poorer half of the world's population. Despite this, billionaires ‘have been paying a tax rate equivalent to less than 0.5% of their wealth’ across the globe.

https://www.barrons.com/news/world-s-richest-1-gained-40-tn-in-a-decade-oxfam-79404b0d

For average-income earners without existing assets, social mobility becomes increasingly difficult due to high asset price inflation. While inflation can create opportunities for a few, who may quickly amass wealth by betting on the right investments, this is rare. Typically, inflation benefits only a select few, leaving the majority at a disadvantage. This dynamic erodes social cohesion, as individuals may accumulate wealth at others' expense without contributing value. The disparity often breeds resentment and envy, which can eventually undermine trust in the economic system. If enough people lose faith, it could lead to political upheaval and the dismantling of the current system. Indeed, rather than looking at GDP, investors know that the best way to measure the economic health of a country is to look at the misery index calculated by adding the unemployment and inflation rates. In the US, the Misery Index has been rising over the past months and is now back at its highest level since before the start of the 'plandemic'.

US Misery Index (US Unemployment Rate + US CPI YoY Change) & US Recessions.

For Keynesians who believe that rising government debt is a solution to reduce misery and avoid recessions, it should be noted that increasing US government debt compared to GDP has not alleviated misery or prevented recessions.

US Misery Index (blue line); US Public Debt to GDP (axis inverted; red line) and US Recessions.

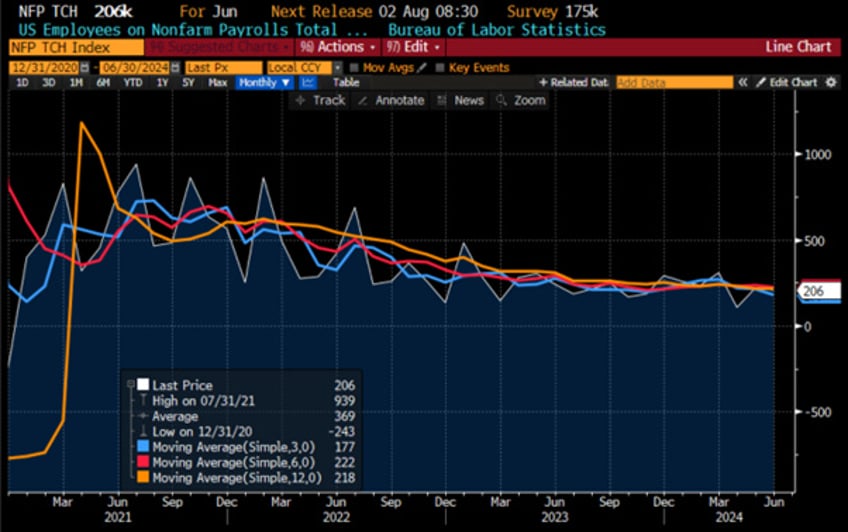

Job growth from manipulated official data has already been decelerating, with the 3-month moving average of non-farm payrolls falling to 177k, its lowest since 2020, and the 6-month average dropping to 222k. Additionally, jobless claims are rising, signalling a broader slowdown in employment.

Total Non-Farm Payrolls in Thousands 1-month data (while line); 3 months moving average (blue line); 6 months moving average (red line); 12 months moving average (orange line).

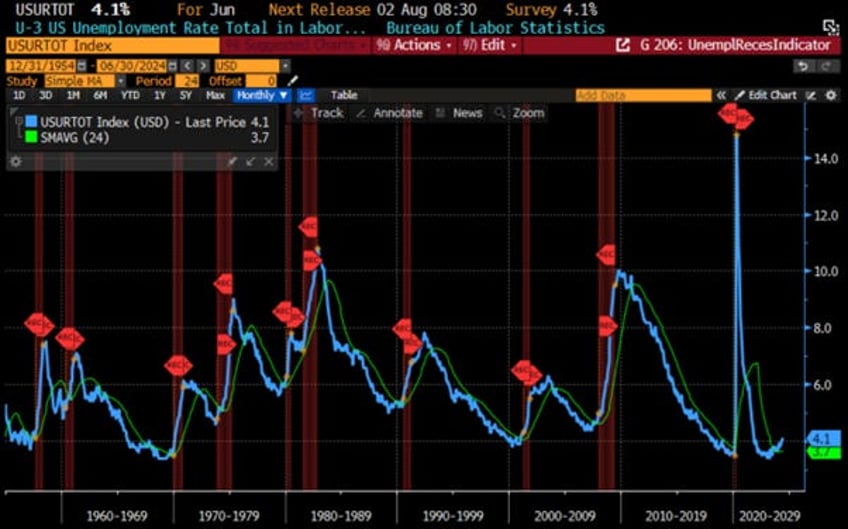

Indeed, seasoned investors recognize that for the past 70 years, whenever the unemployment rate has been above its 24-month moving average, an occurrence since the beginning of this year, the US has entered a recession. This time, however, the presence of persistently high inflation suggests that the US is already in a stagflation, where supply-driven shortages push inflation even higher, despite government efforts to downplay the situation.

US Unemployment Rate (blue line); US Unemployment Rate 24 months moving average (green line) & US Recessions.

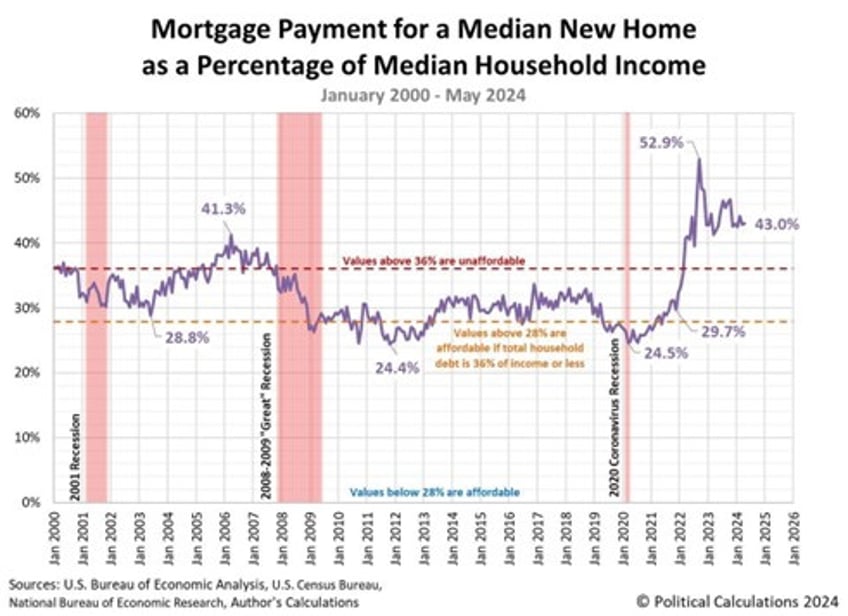

One of the assets contributing to growing resentment of inequality and misery among ‘We The People’ is the unaffordability of homeownership. Owning a home has long been a key milestone for many. According to real estate analytics firm ATTOM, in over one-third of the markets they examined, homeowners were spending at least 43% of their wages on housing, a level the firm deems ‘seriously unaffordable.’ This analysis includes both new and existing homes. Notably, this figure also matches the national average for the median new home sold and the estimated median household income.

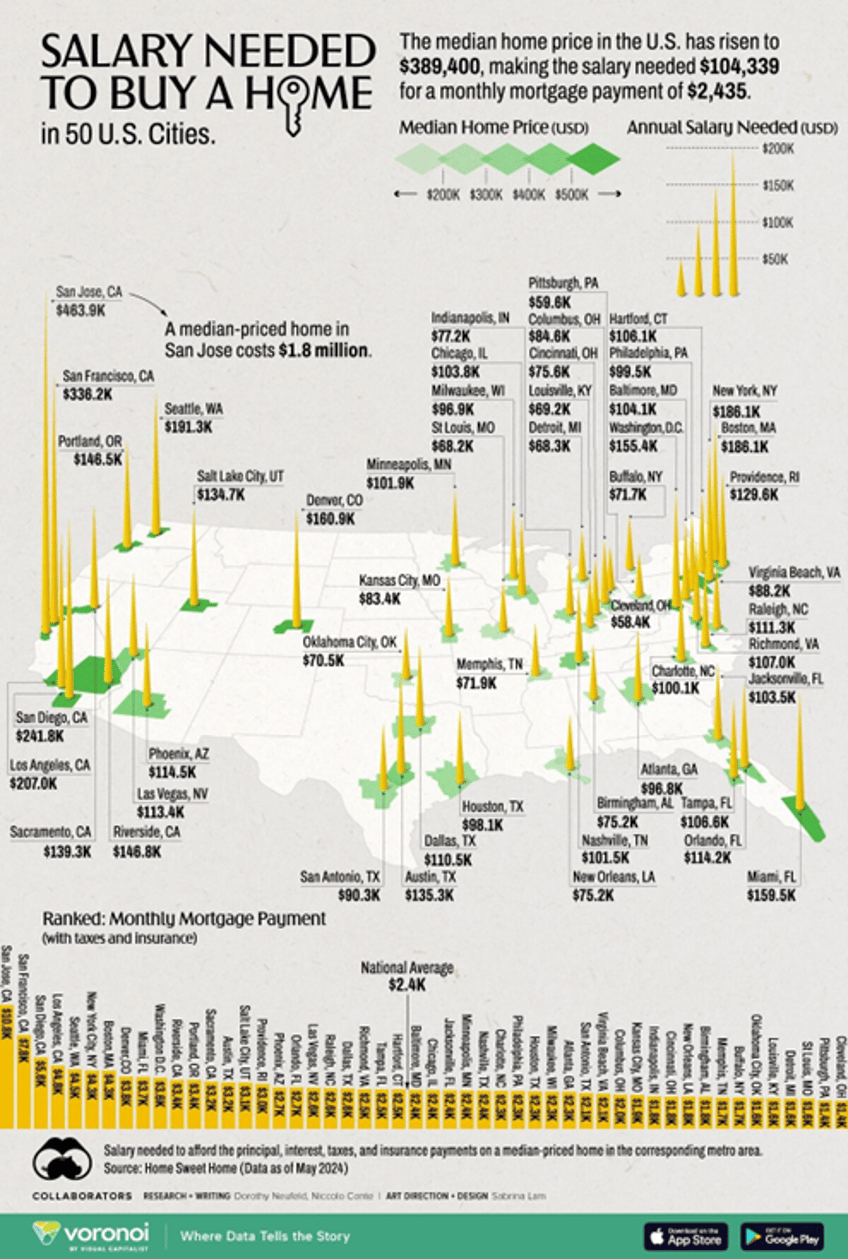

While that percentage applies across the US, real estate markets are local. A map showing how much monthly income a household in each of the 50 states needs to afford the median home sold there provides a clear view of which states offer the most and least affordable housing. It should not come to no surprise that the most unafordable houses are in ‘Blue States’ which have been ruled by reckless keynesians over decades.

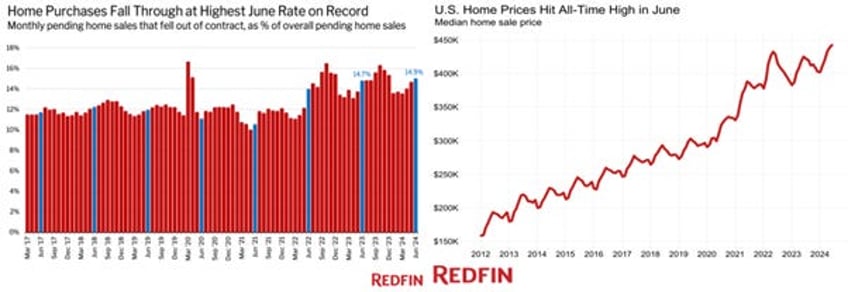

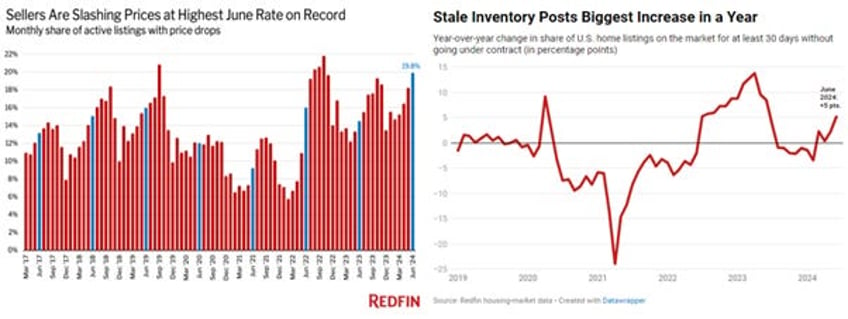

However, behind the curtain, the US housing market is beginning to show cracks. Despite expectations that tighter financial conditions would lower home prices, they kept rising for the past two years, driven by a narrow group of wealthy buyers not needing mortgages. Indeed, even the top wealth tiers are now feeling the pressure. The latest Redfin data shows that buyers are getting cold feet, with about 56,000 home purchases, or 15% of homes that went under contract in June, being cancelled as deals fall through at a record rate. The reason is that house hunters are struggling to commit because buying a home is more expensive than ever. The median home sale price rose 4% year over year to a record $442,525 in June, and the average interest rate on a 30-year mortgage was 6.92%. While this is slightly down from 7.06% the previous month, it is still more than double the all-time low reached during the pandemic.

On the other hand, while prices remain high, sellers are beginning to feel the pain of waiting for a buyer, with nearly 1 in 5 sellers reducing their asking price as homes sit on the market much longer than before. Some sellers are cutting prices because their homes are lingering and becoming stale, a consequence of the ongoing affordability crisis affecting buyers. The typical home sold in June spent 32 days on the market, the longest for any June since 2020. This is up three days from the previous year, marking the biggest annual increase since last summer. Listings are piling up; while the number of active listings, total homes for sale, was relatively unchanged from the previous month, it surged 12.8% from a year earlier, the largest annual gain on record.

More than a third (19) of the 50 most populous US metro areas recorded a seasonally adjusted drop in home prices in June, month over month. The biggest decline was in Nassau County, NY (-3.1%), followed by Austin, TX (-1.7%), West Palm Beach, FL (-1.1%) and Philadelphia (-1.1%).

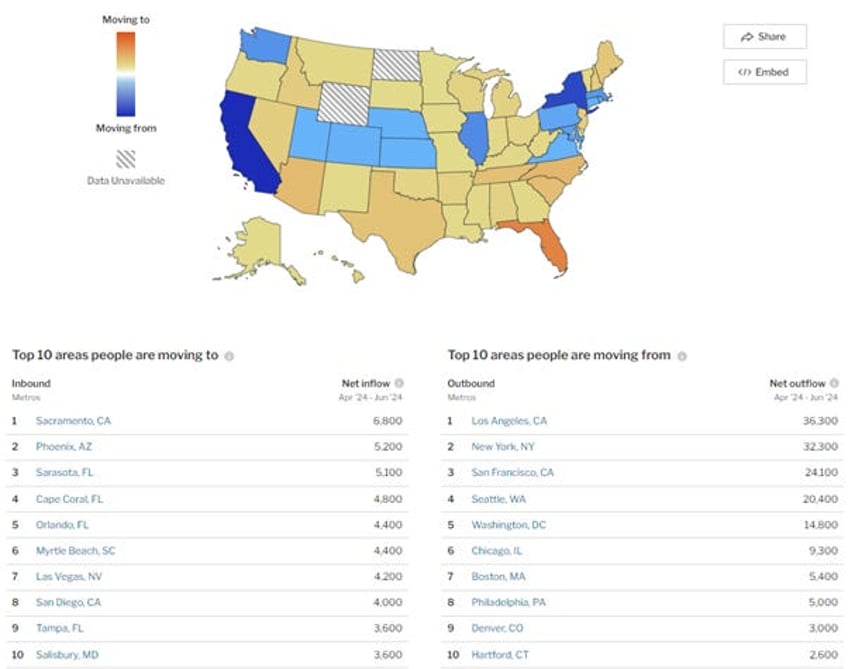

This price decline primarily occurred in ‘blue Keynesian states’ that are experiencing population outflows. Nationwide, 25% of homebuyers searched for a move to a different metro area between April 2024 and June 2024. The top five states homebuyers sought to move to were Florida, North Carolina, Arizona, South Carolina, and Tennessee, while California, New York, Illinois, Washington, and Massachusetts were the top five states homebuyers sought to leave. Among all major U.S. metros, Sacramento was the most searched-for destination for homebuyers looking to relocate between April 2024 and June 2024, followed by Phoenix, Sarasota, Cape Coral, and Orlando. Los Angeles was the most searched-for destination for homebuyers looking to leave, followed by New York, San Francisco, Seattle, and Washington.

That means that unless the FED cuts rates significantly in the next few months, which is highly unlikely in the current political and geopolitical environment, the housing market is on the verge of creating its own reflexive and self-reinforcing liquidation spiral. As more sellers cut prices, they will force even more sellers to follow suit, potentially leading to the return of a full-blown housing crash, just in time for the US to get a new tenant at the White House.

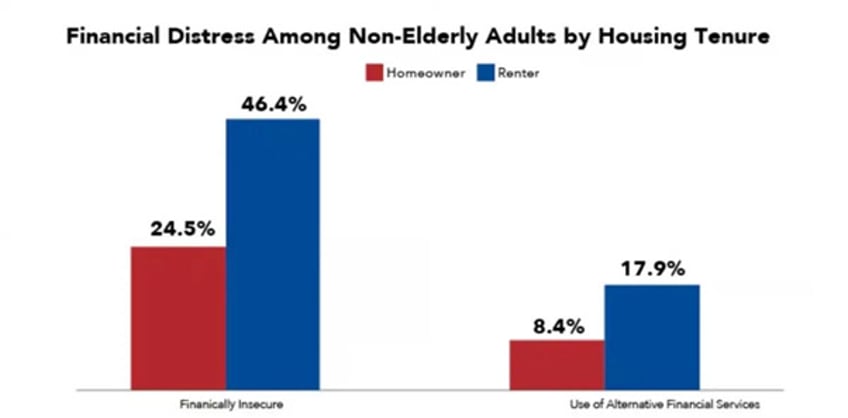

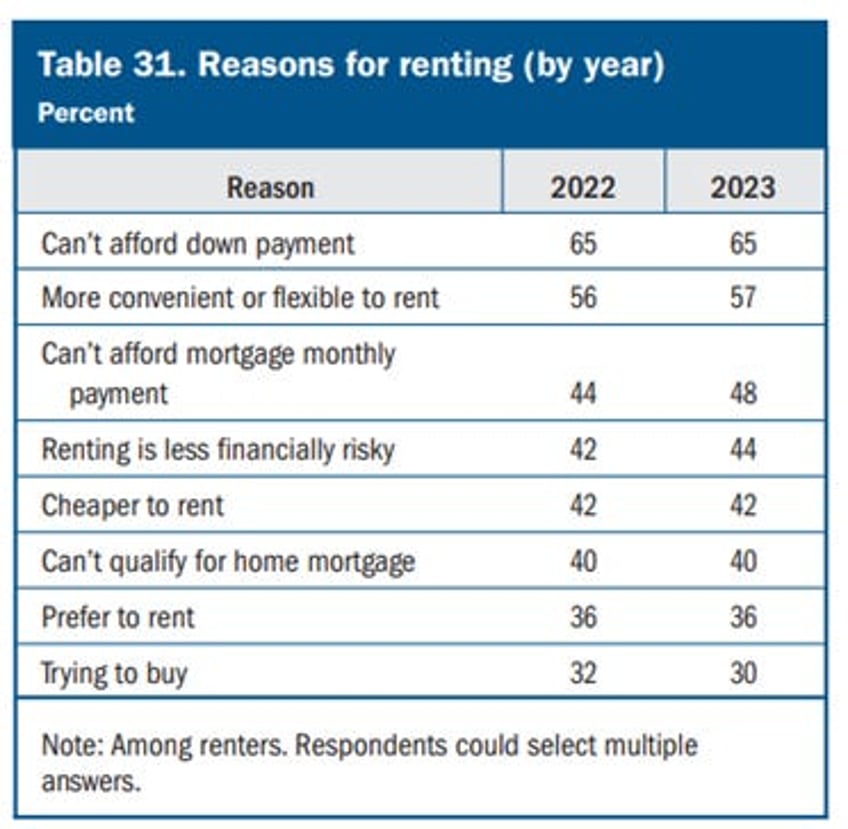

In this context, it's also no surprise that renters and homeowners are experiencing two entirely different economic realities. Renters are in dire financial straits, while homeowners continue to benefit from the cheap pandemic money for asset owners, leaving renters struggling with inflation. This disparity complicates the FED’s outlook, as homeowners use their discretionary spending power to splurge on travel, dining out, and other expenses, thereby propping up prices. Although it’s the FED’s money printers that are inflating prices, robust spending by homeowners means they are not feeling the same level of distress.

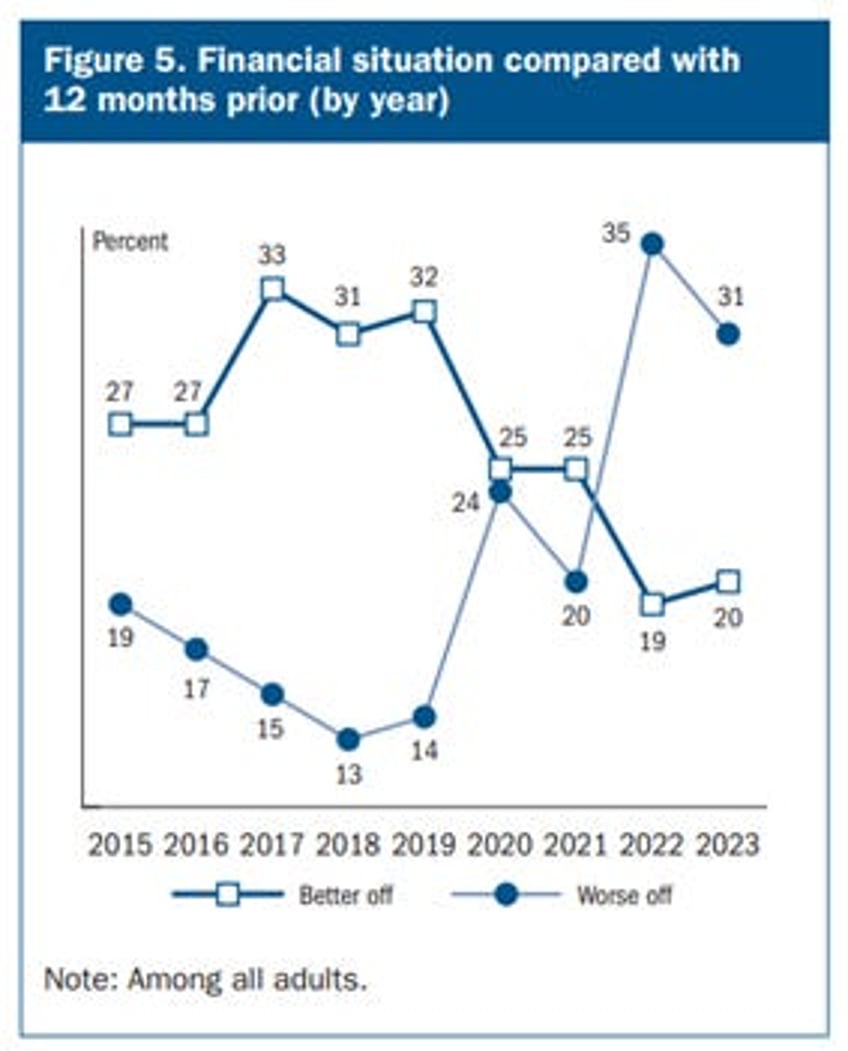

This is partly because asset owners are getting richer, while the poor are suffering from inflation and becoming poorer. As a result, even though the US has not yet been officially declared to be in a recession, consumers’ sentiment is as depressed as it has been in over a decade.

The latest great idea from the Keynesians ruling the US, to cap rental increases at 5% annually by removing tax credits from landlords who have over 50 units in their portfolio if they fail to adhere to this proposed law, will not solve the housing crisis. As usual, the government is blaming greedy landlords while failing to admit that the real problem is the government itself, shaking down its citizens and taking advantage of rising property values.

Decades of academic research from across the United States and around the world clearly show that rent caps, more commonly known as rent control, reduce the supply of available housing and fail to target the renters who need help the most, while simultaneously harming other residents and the communities they reside in. Even if landlords decide to offload their homes, there will be no buyers, as most renters cannot afford the down payment for buying a house or the monthly mortgage payments. At the end of the day, people will not conduct business if it is not profitable and while there are greedy landlords many have been forced to raise rental prices out of necessity.

The real issue stems from the uncontrolled immigration crisis, which has significantly reduced the number of available rental units. With 45.2 million renting last year and an increase of 8 million new migrants, there's a surge of over 17.65% now seeking rentals. These new arrivals cannot secure loans, show credit scores, or provide proof of employment. The government uses taxpayer funds to house them, raising the cost of living for everyone. Ultimately, governments cannot control the free market. Additionally, no one asks, ‘Has this been done before, and did it work?’ The answer is NO. Look at Spain, Germany, Austria, or any other country that attempted rental caps. The US faces a supply issue, and rental caps will only tighten the already limited supply of available rentals. It is all about Supply and Demand like in any free markets.

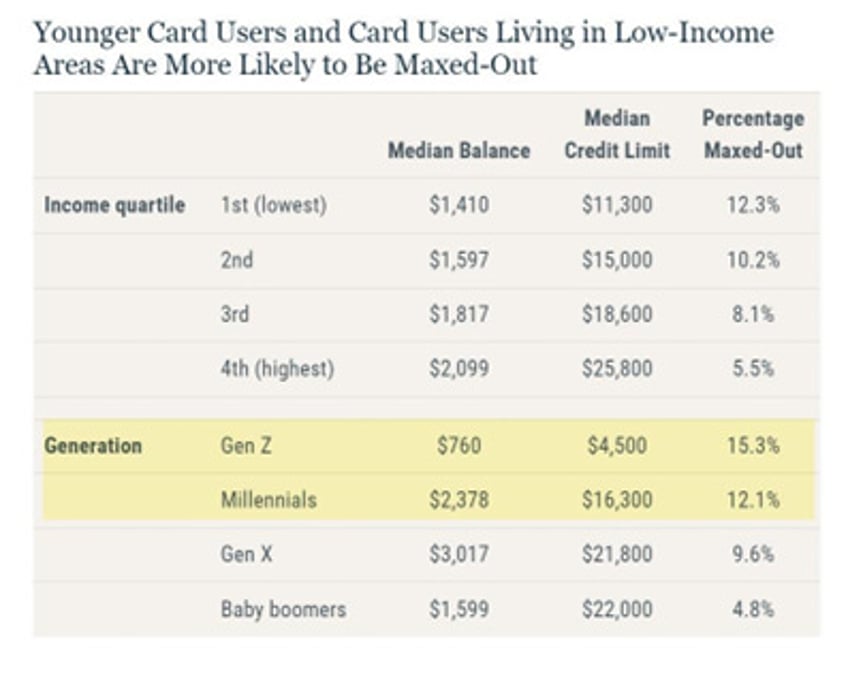

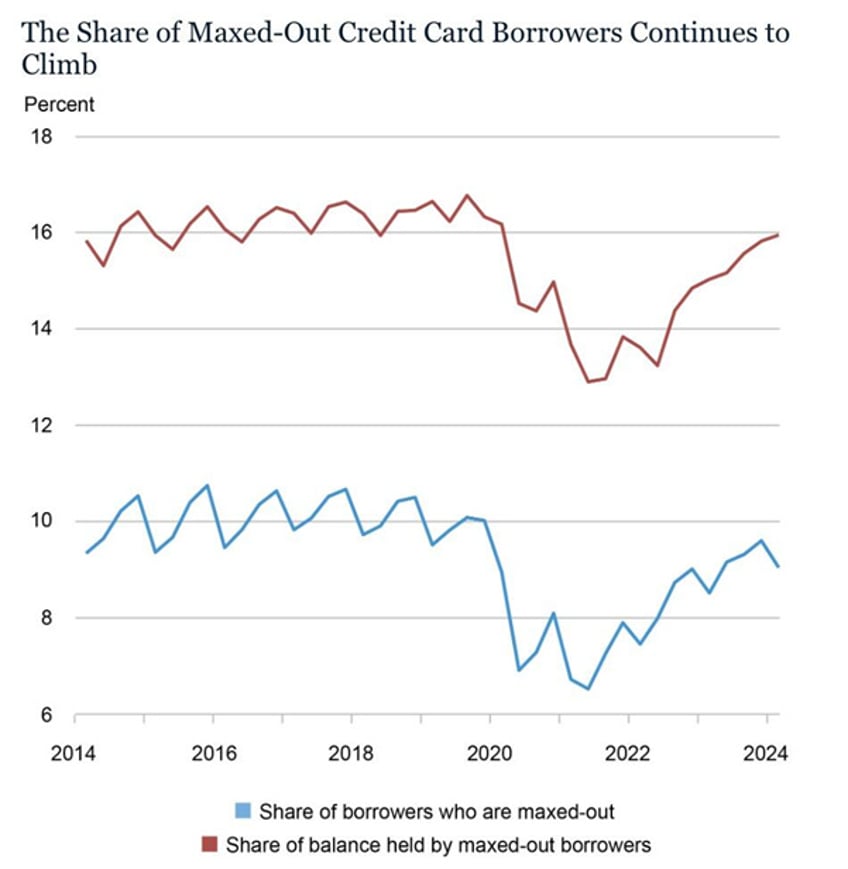

Across generations, those most at risk from the prolonged misery caused by stickier-than-expected inflation are the Zoomers and younger Millennials, who already have some of the highest credit card utilization rates.

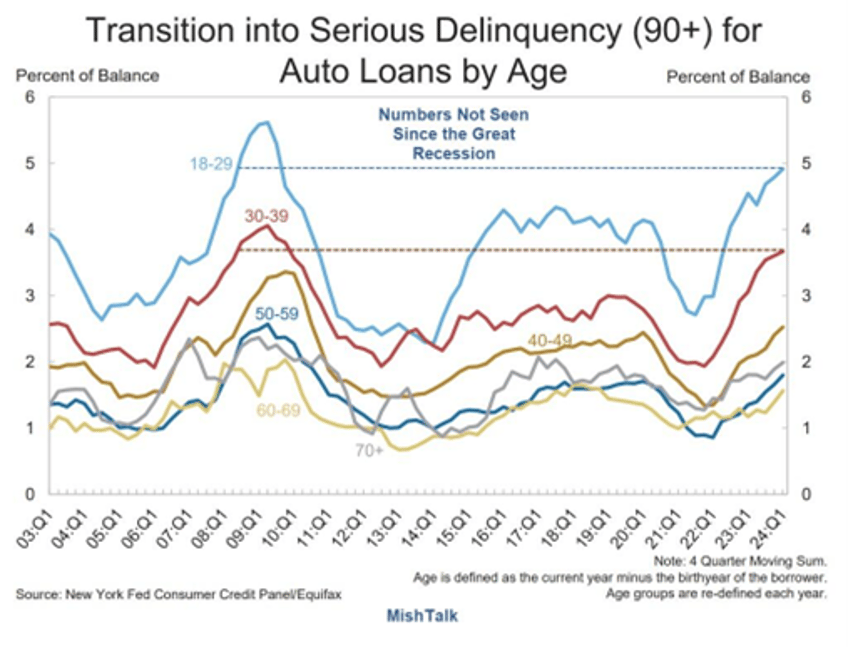

It is not just the housing market showing increasing distress among American consumers; the auto loan market is also experiencing rising delinquency. This trend was also highlighted by the poor earnings reports from Ford and Tesla as well as other companies in the car manufacturing sector, such as Autoliv.

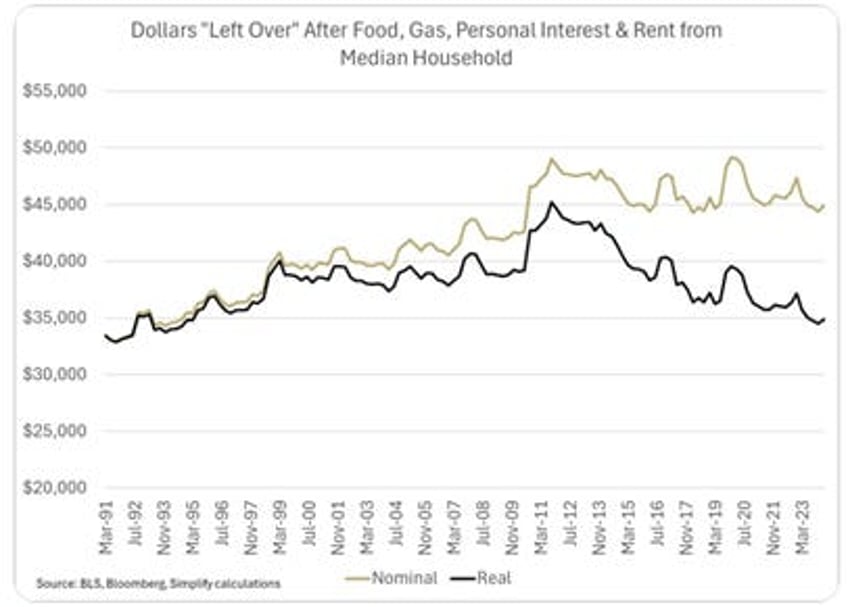

Another impact of prolonged high inflation and the accompanying misery is its effect on discretionary consumption as well as on basic needs, such as the ability to feed and heat oneself. Indeed, the dollars left over after essentials like food, gas, personal interests, and rent for the median US household have fallen by over 20% from their 2011 peak. In a country where real living standards for the median household have dropped 20% over the past decade, rising political divisiveness and instability should not be surprising. Looking ahead, more inflation seems inevitable; the key question is whether those in power want less political instability (achieved through increased wage inflation for US working- and middle-classes) or more political instability (where the status quo persists, leading to further declines in real income and increased wealth inequality, ultimately driving greater political instability).

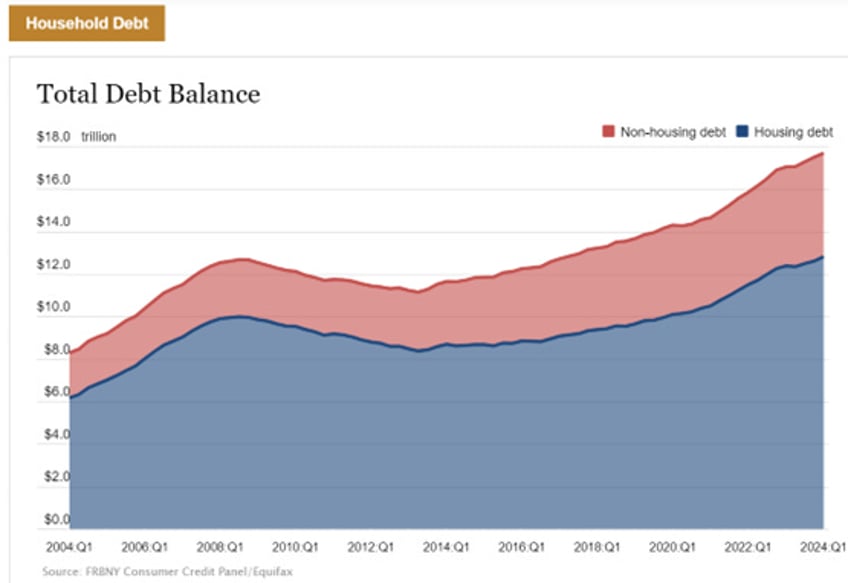

This comes at a time when according to the NY FED, in 2024, more people are maxing out their credit cards compared to 2023. The latest report shows household debt increased by $184 billion in the first quarter of 2024, with credit card balances dropping by $14 billion, which is typical for this period. However, credit card delinquency is rising, with 18% of borrowers using at least 90% of their credit limit, signaling an increase in maxed-out cards.

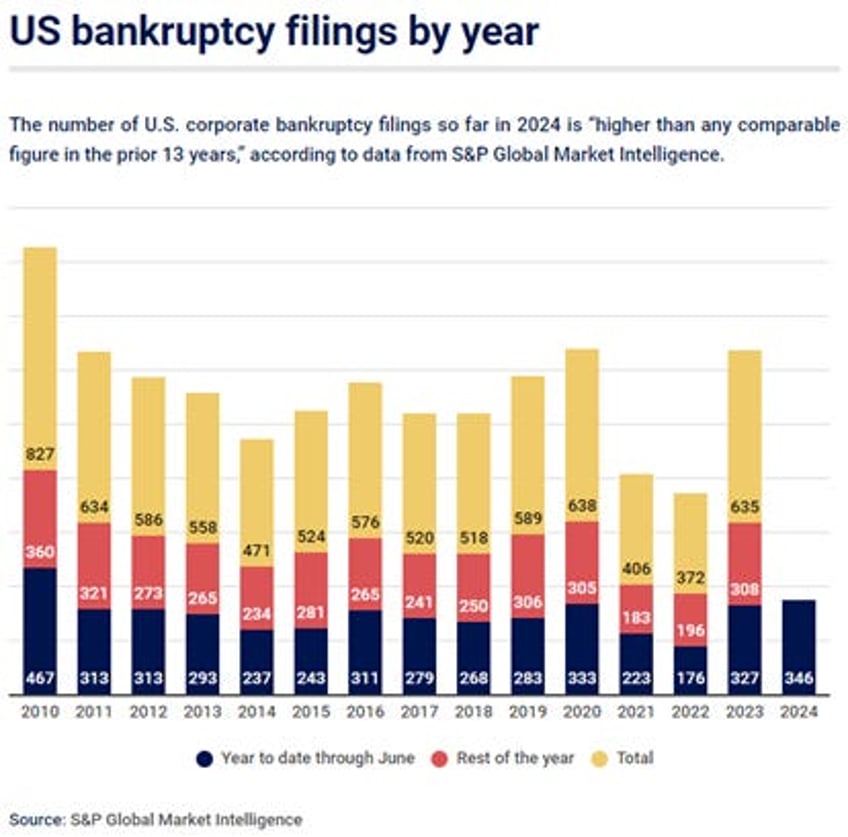

When misery spreads, an economy usually records a sharp increase in bankruptcies. In the US, bankruptcy filings rose 15% in the first half of 2024, reaching 217,000. Consumers aren’t spending, and businesses are unable to turn a profit. Prolonged supply chain issues, inflation, higher rates, and reduced consumer spending have all contributed to more failing businesses. Corporate bankruptcies reached a 13-year high last month, with commercial Chapter 11 filings showing a notable 43% annual spike from Q1 of 2023 to 2024. Overall, commercial bankruptcies rose 22% in Q1 of 2024, with 7,113 businesses going under compared to 5,820 in Q1 of 2023. The first half of 2024 saw 346 corporate bankruptcy filings, the highest in over a decade.

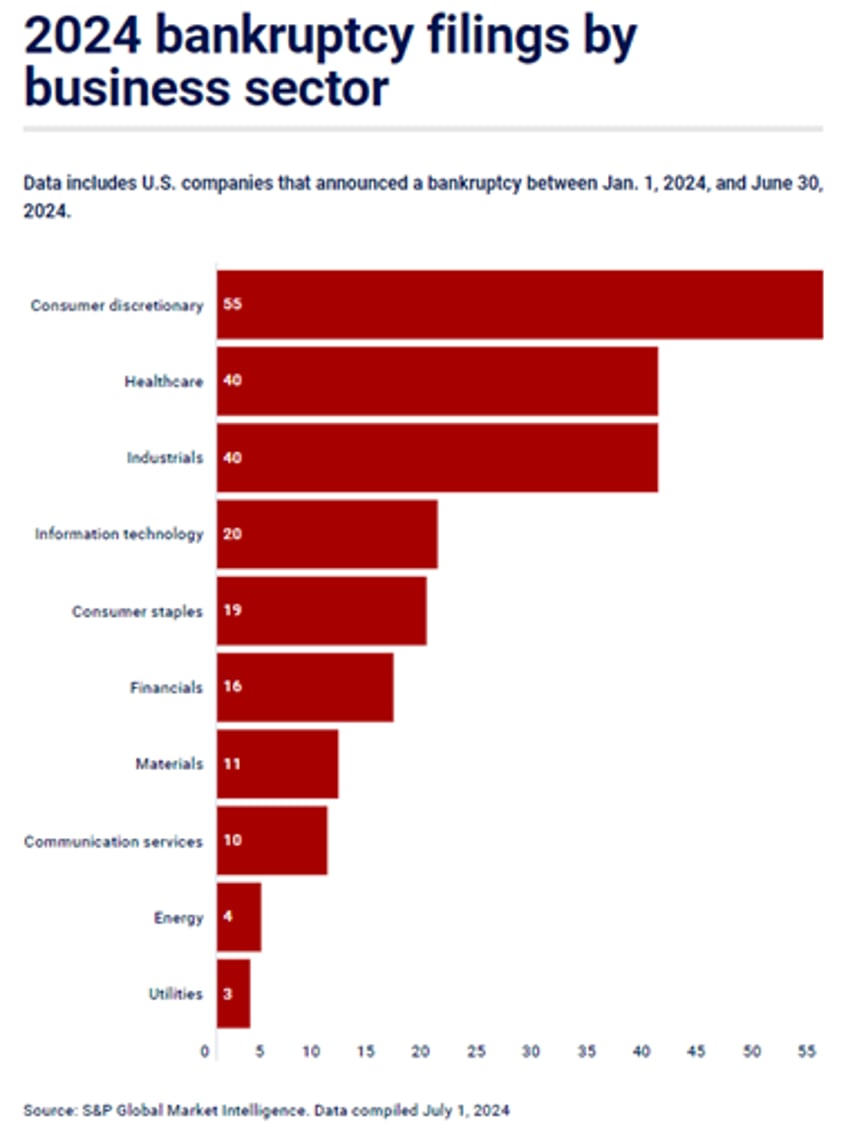

The majority of businesses that reported bankruptcy filings in 2024 were part of the consumer discretionary sector, with 55 total filings as of July 1, 2024, according to S&P Global. Companies in this sector manufacture goods or provide services that people want but don't necessarily need, such as restaurants, hotels, clothing retailers, and media companies.

More job losses are expected to follow the trend of failing businesses, while the increase in public sector jobs is harming the economy. Over 50,000 retail stores may close by 2028. Many businesses are moving offshore to places like Mexico, taking tax revenue and jobs with them due to high taxation. Mid-sized businesses struggle to borrow, and supply chain issues from COVID remain unresolved. Inflation, prolonged by government spending such as the Inflation Reduction Act, persists and looming wars suggest that inflation is far from waning, as a recession is already underway.

Even before more layoffs are announced, the latest earnings releases from major US banks highlight rising defaults. Citigroup, Goldman Sachs, and Bank of America reported a combined loss of $4.139 billion due to unpaid debts. The Federal Reserve Bank of New York warned in May that US household debt was signalling major problems. In Q1 2024, US household debt reached $17.69 trillion, an annual increase of $640 billion. Mortgage debt is the largest share, followed by auto loans, credit card debt, and student loans.

The personal debt crisis is affecting everyone, including the wealthy who rely on credit to maintain their lifestyles. According to the St. Louis Fed, the top 10% of ZIP codes with wealth concentration experienced the greatest proportional increase in credit card delinquencies, rising from 4.8% in Q2 of 2022 to 7.4% in Q2 of 2024.

Therefore, despite the prevailing ‘Forward Confusion’ goldilocks’ narrative, concerns about the US consumer have intensified recently given slowing labour market and consumption data. This is reflected in a sharp underperformance of restaurant stocks, an early sign of financial stress, rising misery and ultimately a recession.

US Misery Index (blue line); Relative performance of S&P 500 to S&P Restaurant index (red line); US recessions & Correlations.

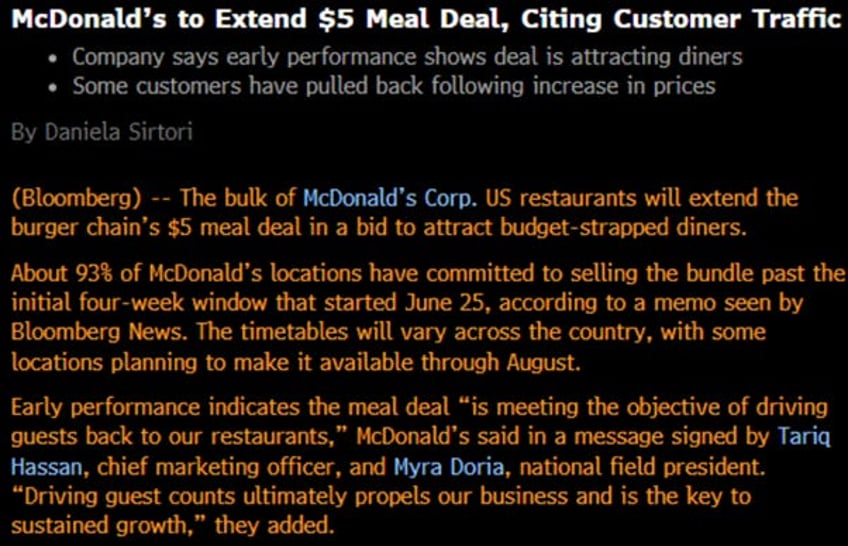

One of the best indicators of economic misery from the restaurant sector is that after McDonald’s launched its $5 meal deal for what was initially a 4-week period, the success of this promotion in driving guests back to the restaurants led the company to extend it indefinitely.

The current ‘vibecession’ is also evident in the decline in personal consumption expenditure, particularly in interest-sensitive categories like luxusry goods. To gauge the level of ongoing misery in the US, it’s more revealing to compare the performance of Walmart with S&P Global Luxury Retailers. Historically, Walmart’s outperformance has been a strong recession indicator, closely linked to the misery index. Recessions typically hit lower-income groups before affecting wealthier consumers. The rising ‘Walmart Recession Signal’ since late 2023 indicates that consumers are tightening their belts in response to stagflation, where higher costs mean getting less while paying more.

US Misery Index (blue line); Relative performance of Walmart to S&P global luxury retailers (red line); US recessions & Correlations.

It should therefore be no surprise to investors that companies like LVMH and Porsche reported weak quarterly earnings and outlooks. Even the supposedly wealthy are feeling the impact of a slower economy and prolonged high costs in their daily lives, resulting in less disposable income to splurge on discretionary luxury items.

In a nutshell, in a rising environment of misery, consumer-related stocks, especially consumer discretionary, will underperform the broader market.

US Misery Index (blue line); Relative perfornance of S&P 500 index to S&P 500 Consumer Discretionary index (red line) & Correlations.

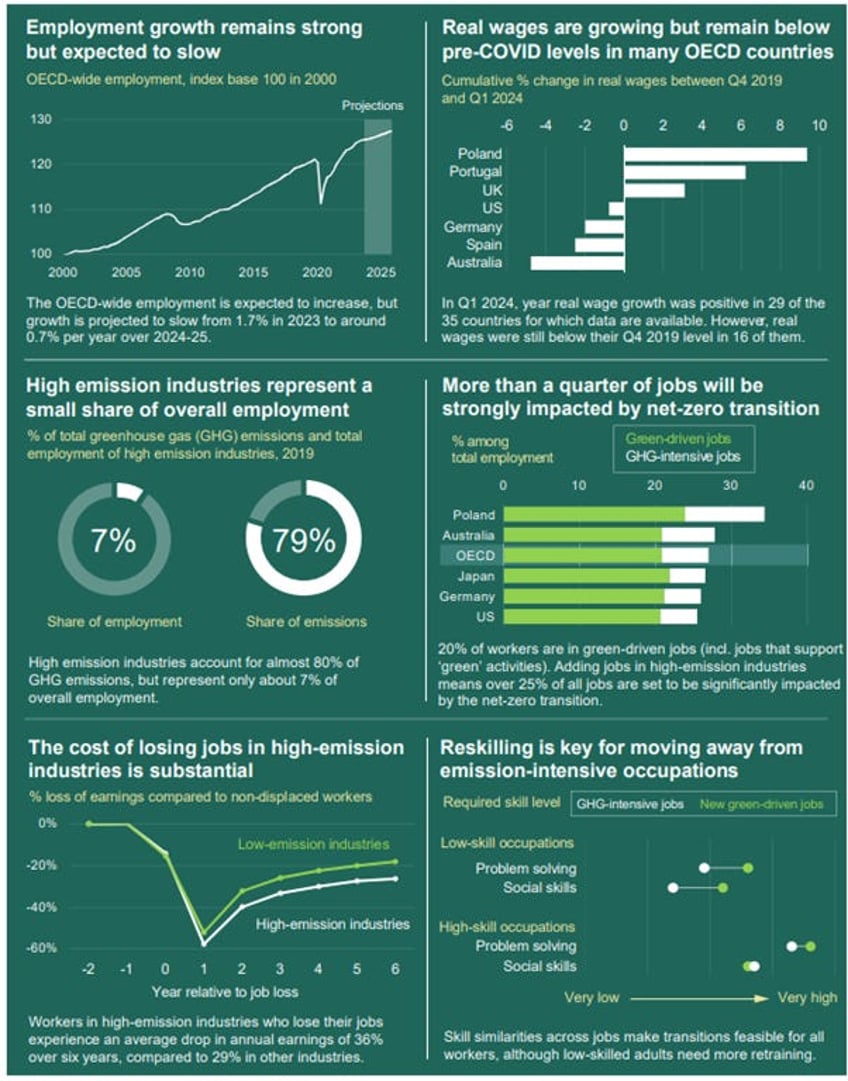

Another reason for widespread misery is that net-zero and other policies related to the ‘climate change scam’ are designed to make us, We the People, much poorer. For those still skeptical about the economic impact of net-zero and climate policies, the OECD's 'Employment Outlook 2024: The Net Zero Transition and the Labour Market' provides a stark warning. The report shows that while 20% of the global workforce will see job growth due to the net-zero transition, the remaining 80% will face significant challenges. It notes that low-income and rural households, which spend more on carbon-intensive necessities like energy and food, will be hit hardest by rising costs. The report also highlights that recent carbon pricing reforms have been regressive, and while recycling carbon tax revenue could mitigate some impacts, it’s crucial to target these transfers efficiently. The EU's carbon tax experience, with its inflationary effects and increased public discontent, exemplifies the problems. The OECD warns of higher inflation in essential goods, labor displacement, and the difficulty low-skilled workers face as high-emission jobs, which pay better than service jobs, are lost. In essence, these policies often lead to malinvestment, misallocation of capital, and worsened outcomes for workers and the middle class due to the government's limited understanding of societal needs and the mismanagement of resources.

While it should be evident that Keynesian policies are regressive for anyone not part of the plutocracy benefiting from these policies, it's unlikely that policymakers will counteract their negative effects. They have never done so in the past. To argue otherwise is irresponsible, especially when the OECD report highlights the disastrous results of ‘inclusive’ and redistributive policies since 2019. Malinvestment occurs in open economies but is corrected through creative destruction. In a government-controlled economy, malinvestment becomes the norm, leading to subsidized misallocation of capital instead.

The era of constant Keynesian stimulus has eroded the middle class and driven record levels of public debt. The net zero plan, the ultimate expression of top-down government intervention, will only exacerbate scarcity, persistent inflation, and impoverishment. True progress towards net zero requires technological innovation, free competition, and open markets to deliver cheaper and cleaner goods and services. Government management of public funds typically results in overspending, inflation, and greater poverty. Socialism fails consistently, and climate socialism will likely lead to increased poverty as well. As Milton Friedman famously said, if the federal government managed the Sahara Desert, there would soon be a shortage of sand.

The ultimate question for investors and consumers is how they can prevent inflation misery from leading to financial hardship for their households. The answer is relatively simple:

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/inflation-misery-sparks-recession

If this report has inspired you to invest in gold, consider Hard Assets Alliance to buy your physical gold: https://www.hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.