ING Gold Break Down

The report, written right before Gold's torrid rebound on Thursday, starts by noting the sharp sell-off in gold at the beginning of the month (mostly JPY carry-trade damage) . It then offers a cautiously optimistic outlook for gold prices, driven by ongoing geopolitical uncertainties and anticipated interest rate cuts by the U.S. Federal Reserve.

Current Market Dynamics:

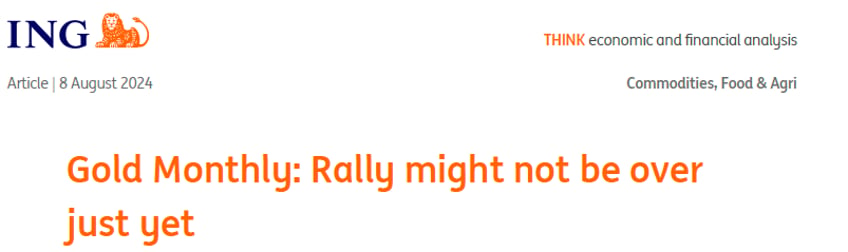

The report begins by addressing the notable drop in gold prices at the start of August, which coincided with a global sell-off in equities. This decline in gold, traditionally a safe haven, was attributed to liquidations aimed at covering margin calls on other assets. Despite this setback, gold remains up approximately 15% year-to-date.

Looking ahead, ING re-assesses several key factors expected to support gold prices. Economics, Geopolitics, and Known calendar events before updating central bank buying factors

Economic Drivers: monetary policy

Central among these is the anticipated shift in U.S. monetary policy. The Federal Reserve, having maintained its key interest rate at the highest level in over two decades, is now expected to initiate a series of rate cuts starting in September 2024. This shift, motivated by a slowing economy, would reduce borrowing costs, thereby enhancing gold’s appeal as a non-yielding asset.

Geopolitics: Known War risk

Additionally, ongoing geopolitical tensions—specifically the conflicts in Ukraine and the Middle East, and the strained U.S.-China relations—as continue to fuel demand for gold.

Event Risk: Known and unknown

The U.S. presidential election later in the year is also flagged as a potential catalyst for further volatility, which should drive investors toward gold. we would add to that BRICS summit and the seasonality taht marks Gold’s peak in summer and bottom in October

Central Bank Buying: safe to say they are still buying for the foreseeable future

Central banks remain key players in the gold market, with continued net buying reported, particularly from emerging markets.

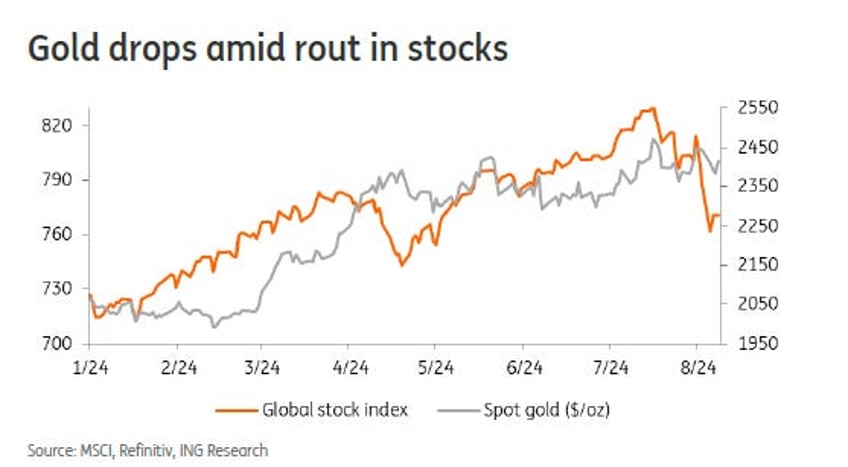

However, the report notes the recent slowdown in purchases by the PBOC, which has paused its gold acquisitions after an 18-month buying spree.

This pause, likely due to high gold prices, could temporarily dampen demand. Despite this, ING expects central bank demand to remain strong overall, providing ongoing support for gold prices.

ETF Inflows and Market Sentiment: Western interest is back maybe

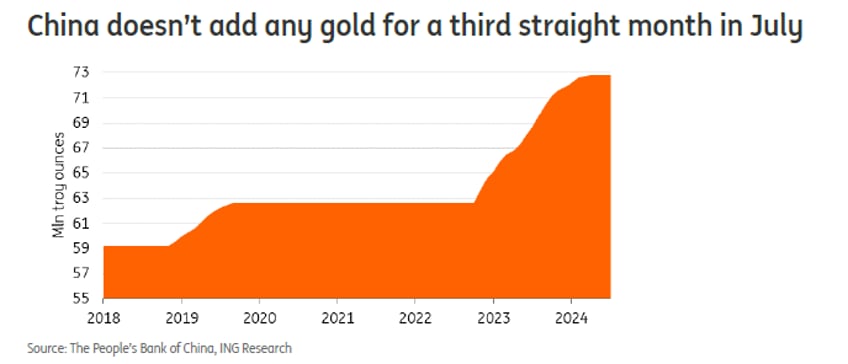

The report also observes a shift in investor sentiment, as evidenced by the inflows into global gold ETFs, which have seen positive flows for two consecutive months. This marks a reversal from the broader trend of outflows earlier in the year, particularly from North American and European markets.

ING suggests that this renewed interest in gold ETFs reflects a broader acknowledgment of gold’s potential as a hedge against both geopolitical risks and financial market volatility.

Price Outlook:

Looking forward, ING projects (a very conservative) that gold prices will continue to rise, peaking in the fourth quarter of 2024. The bank forecasts an average price of $2,380 per ounce in the third quarter, with a potential peak at $2,450 per ounce by year-end. This outlook is underpinned by the expectation of continued central bank buying, geopolitical tensions, and the anticipated easing of U.S. monetary policy. We think if it trades $2450, it will likely trade $2500

Continues including videohere

Free Posts To Your Mailbox