Editor’s Note: The figures have been updated for last night’s AAII release but subscribers originally received this e-mail Tuesday morning.

The S&P 500 Index looks increasingly due for an oversold rally…

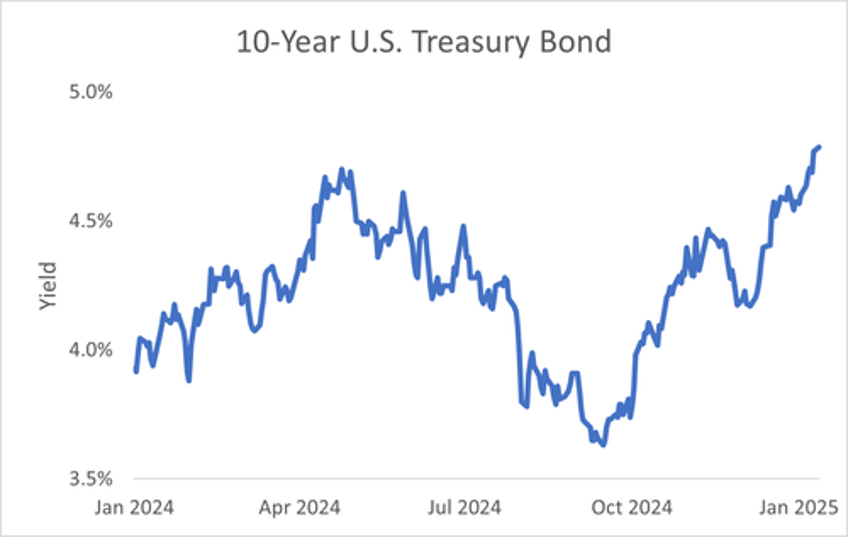

Since the middle of late September, institutional and retail investors have been increasingly focused on sovereign bond yields. Over the course of the last few months, the yield on 10-year U.S. Treasurys has risen from 3.6% to 4.8%. That’s a massive move, especially considering our central bank has lowered rates by 100 basis points during the same time frame.

That data is of particular importance because it’s viewed by Wall Street as a proxy for overall lending. In their eyes, if the 10-year yield rises, businesses and households will be less likely to borrow due to the rising cost. That’s a bad sign for money managers trying to invest for what the economy looks like 10 to 12 months down the road. Because less spending implies goods demand and economic growth could stumble, weighing on corporate profits.

Consequently, the higher rates go, the more stock sentiment will sour. And based on recent indicators, the mood has grown pessimistic quickly. Investors are uncertain of what might happen to inflation if the incoming administration of President-elect Donald Trump institutes trade tariffs. They’re worried increasing price pressures could kill the potential for more rate cuts this year and possibly cause the Federal Reserve to start raising borrowing costs once more.

But we must remember Wall Street tends to sell first and ask questions later. Momentum investors looking to hedge their bets, will raise cash due to the uncertainty of the inflation outlook so they have money to invest when the details become clear. And with Trump’s inauguration right around the corner, we could soon get a better picture about his administration’s true intentions. That should remove some of the overhang and act as a near-term tailwind for the S&P 500.

But don’t take my word for it, let’s look at what the data’s telling us…

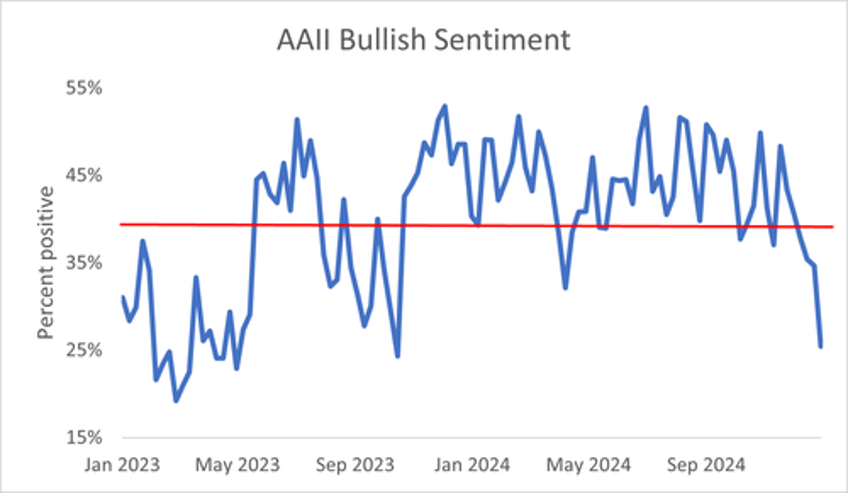

A great way to view investor sentiment is to look at the weekly survey produced by the American Association of Individual Investors (“AAII”). The data goes all the way back to 1987. Every week, members are asked whether they’re bullish, bearish, or neutral on stocks

Typically, the readings tend to be a contrarian signal. Because investor pessimism usually peaks around market bottoms while optimism is at its highest right when stocks are peaking. So, we want to pay attention whenever that mood breaks the trend.

And recently, that’s exactly what has happened. Look at the following chart from AAII on bullish sentiment…

The above image shows the percentage of AAII members who are optimistic about stocks. This data set covers the last two years. This past week’s reading was 25.4%. That’s significant because it’s below the historic average of 37.5% and 2-year average (red line) of 39.6%. In fact, the last two times we experienced similar pullbacks were in April 2024 and the fall of 2023.

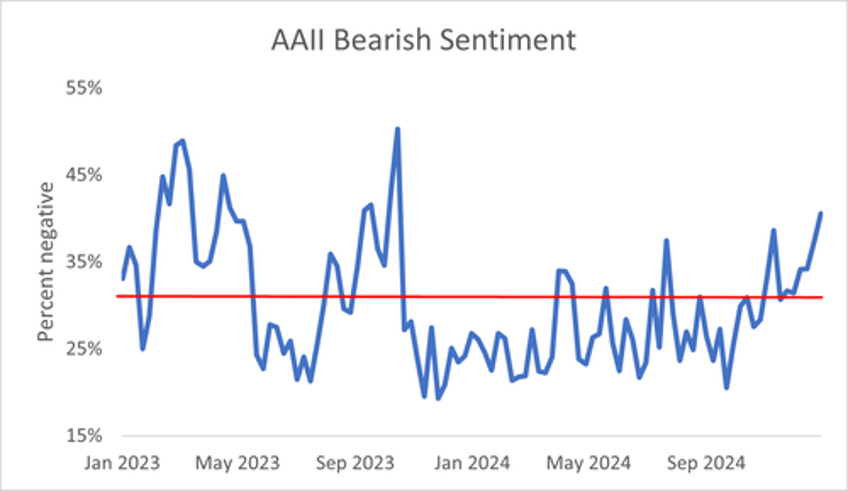

Now, let’s look at a similar display on bearish sentiment…

The above chart shows us the percentage of AAII members who are pessimistic about the stock-market outlook. It covers the same two-year span as the earlier bullish sentiment chart. This past week’s bearish sentiment reading was 40.6% compared to the historic average of 31% and 2-year average of 30%. As you’ll also notice, pessimism was last this high on a sustainable basis when bond yields approached 5% in the fall of 2023.

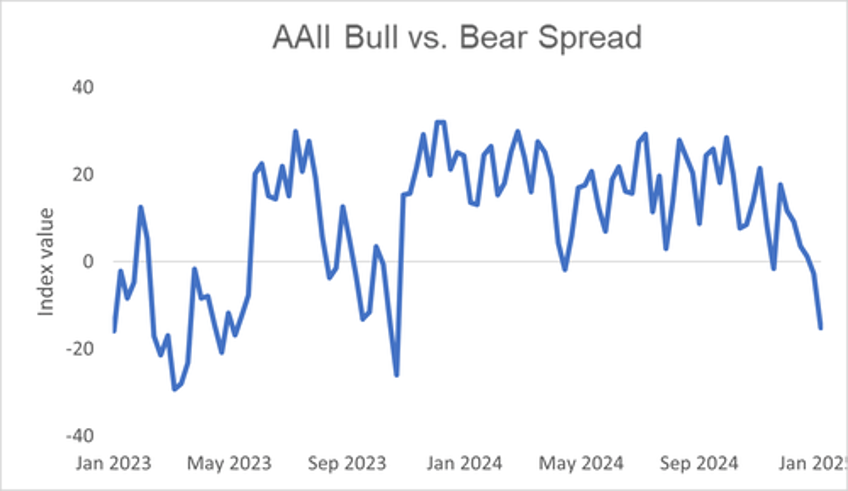

So, both charts confirm that the investing mood has quickly soured. Now let’s look at the difference in spread between bullish and bearish sentiment…

This chart subtracts the bearish sentiment reading from the bullish number. By looking at the difference, we get a sense of how divergent they’ve become. And by surveying them over the last few years, we get a sense of how the current reading compares.

This past week, the spread between the bulls and bears fell to -15. That’s a stark contrast compared to mid-July when bullish sentiment was above 52% and the spread was 30. Like the prior indicators, this week’s number is the lowest reading we’ve seen going back to the fall of 2023. Yet, when that happened, the S&P 500 Index rallied 17.5% over the following three months. And if we look at the pullback in late April, we see a 7% increase over the following 90 days.

Look, bond yields could still go higher, but it’s likely they’re getting overdone. Like I said, investors are patiently awaiting the Trump team’s tariff plans. They’re still unsure of how the size and whether they’ll ultimately be used. And, if the Federal Reserve changes its rate cut plans, there will likely be economic fallout. But it’s likely that fear about the unknown has gotten ahead of itself. And once the clouds clear, the pessimism will lead to a stock-market rally.

If you'd like to receive more content like this to your inbox daily, click here to sign up.