Is an LBMA Short Squeeze Brewing in Silver?

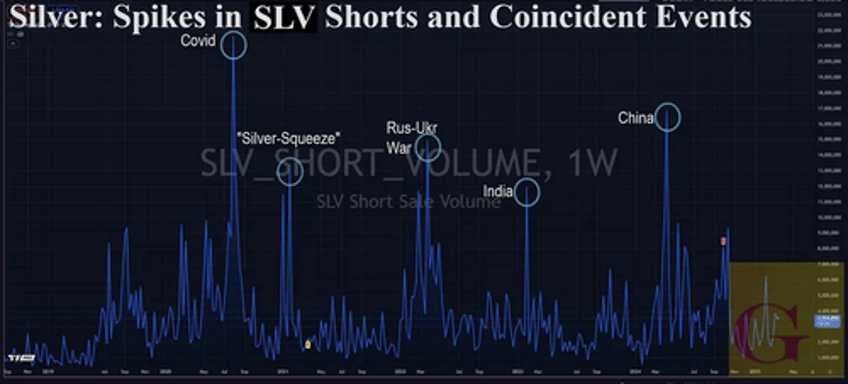

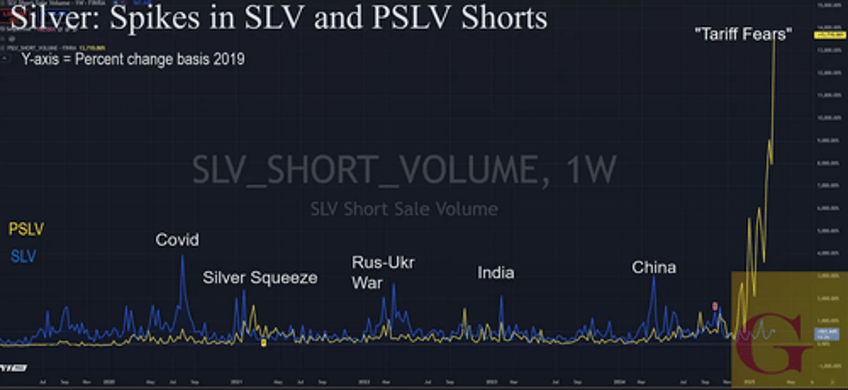

Is an LBMA short squeeze brewing in silver? The answer is yes. Will there actually be a short squeeze? Will it boil over into the public? Probably not. But is there one brewing? Yes.

On March 18th ANZ Bank published their periodic Precious Metals report. This particular one seemed far from routine and made a point of focusing on Silver. It specifically emphasized physical market stress, supply dislocations, and investment demand in its analysis.

In Summary: The Bank argues that silver remains undervalued relative to gold, with the London market experiencing tightening liquidity and the U.S. struggling to secure adequate supply. Investment flows, trade policies, and structural deficits due to LBMA/Comex dislocations will shape silver’s price action, with ANZ raising their target to a USD 34-36/oz trading range in the short term in light of these factors.

ANZ on the LBMA Silver shortage:

“ Furthermore, there are increasing risks of a short-squeeze, as [ LBMA] swap-dealer positions are net short at the highest since 2020. We believe these developments will keep silver vulnerable to a price spike” —ANZ Report

On Silver to accommodate new ETF demand:

The ratio of LBMA silver stocks to silver-backed ETF holdings has fallen to a historical low of 1.

On the potentiality of higher prices curing low prices:

Over 70% of silver is mined as a by-product of other metals, meaning even high silver prices won’t necessarily spur new mine supply.

On Tariffs and their Effect on US supply:

“US domestic silver production meets less than 30% of the country’s total demand. US importers will struggle to adjust [to Tariffs]

Full analysis: Silver Report: Increasing Risks of a Short-Squeeze in London

Trump to Expand Critical Mineral Output Using Wartime Powers

If you are looking for signs of metal stress, look to what President Trump did yesterday. He signed a new EO to pursue mineral independence.

The executive order, issued Thursday, activates the Cold War-era Defense Production Act (DPA). It directs federal agencies to finance, support, and fast-track projects related to processing critical minerals within the U.S. The order treats foreign dependence on these minerals as a national security risk.

BONUS: Want to See Something Really Scary?

h/t @SemperVigilant1

The SLV-short-to-get-metal was essentially invented by Blythe Masters in 2011…

— VBL’s Ghost (@Sorenthek) March 21, 2025

Ask @grok about her and silver… @ArcadiaEconomic @SemperVigilant1 pic.twitter.com/L2k4B7gONi

Continues here