1.) What We Don't Know ...

It's an uncomfortable truth, but it is said we are individually so deeply consistent in our actions that, according to academics at Northwestern University, our actions can be predicted to a 93% level of certainty.

And it's that consistency that powers such fields as technical analysis, banking fraud checks and even generative AI – and then you can even use shifts in behaviour to predict things – like your search engine knowing you are pregnant weeks before you do. One member of the gold market uses predictive analysis to know that you WILL be interested in buying gold, before you actually know it yourself … and then they serve you adverts.

The notion we are so knowable is uncomfortable because we have free-will and we are individualistic, so decisions we make are seen as core to who we are ; but the reality is, our patterns betray us and we are not as original as we think. And as a group, we are even more knowable. Given a certain prompt or stimulus, we will almost always act a particular way. For all our supposed sophistication it appears we humans are actually just pattern-matching monkeys.

Underpinning this behaviour are mental auto-responses which are triggered after accessing our mental libraries for past experiences and then, rather lazily, our brain says … if this … then that … without having to think too hard about it. It's an efficiency thing … or bias if you like.

So what happens when something appears on our radar that is not readily explainable... our libraries do not have an answer … rather like the gold market just now … which defies a rational or obvious explanation ?

For many, we fall victim to apophenia which is a delusion where we see patterns where none exists (such as conspiracies) … not dissimilar to the Monte Carlo Fallacy or the Gamblers Dilemma ; that is to say, as we don't have an automatic fit in our library … say a dollar down/gold up narrative, so we make one up.

And here's the thing … gold is defying most correlations forged over centuries of observed price action. Many so-called “universal truths” that had become axiomatic to our market are now being called into question.

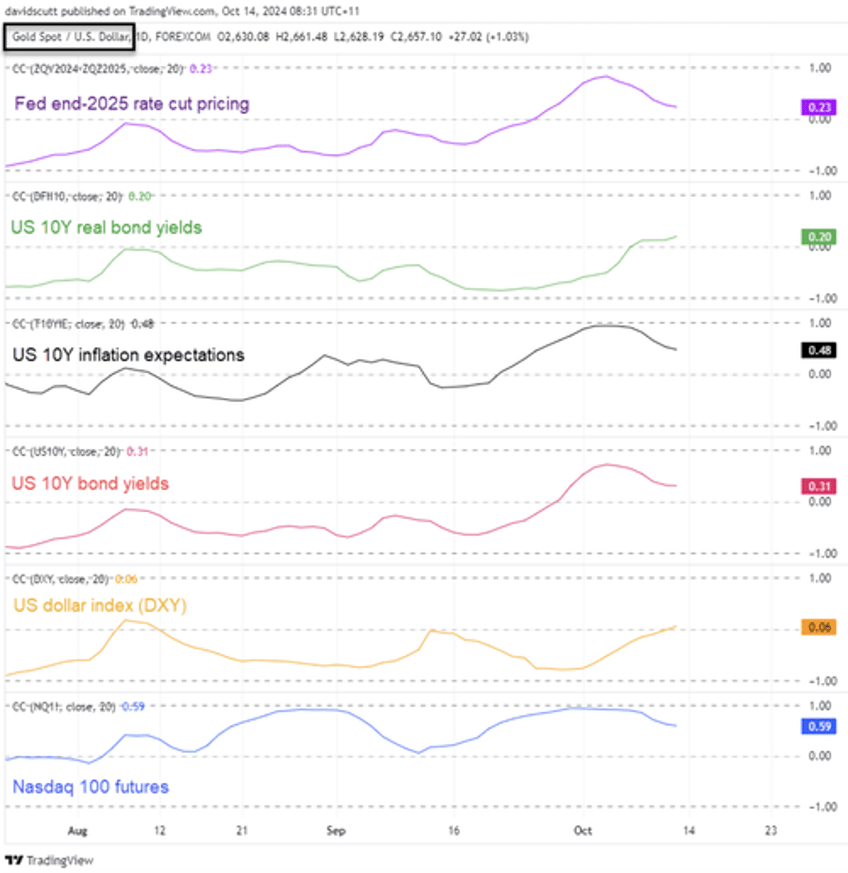

In the table below from David Scutt of Stonex you will see gold's correlation co-efficiency against many assets that it traditionally follows, and from this it is clear gold is walking its own path. Even against the VIX or “fear index” gold has a correlation co-efficiency over the last 6 months of zero – suggesting gold is just not reading the news.

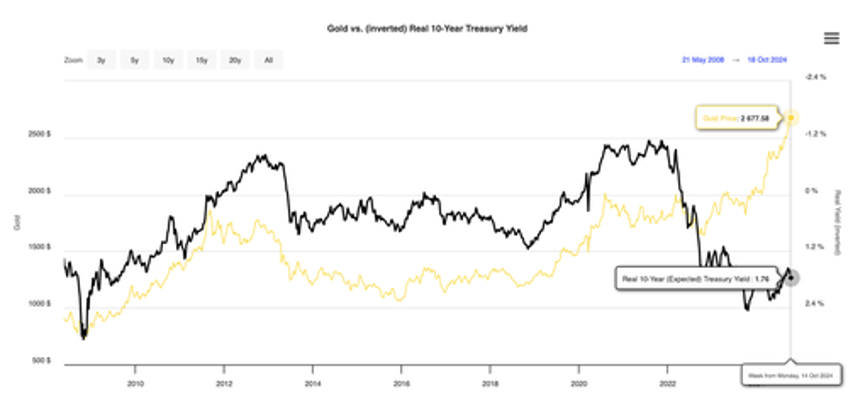

Meanwhile there is the inconvenient truth from the bond market ; with a reliable multi-decades inverse correlation, you could ask a 10 year US treasury bill what the gold price should be and it would tell you about half the current price (see below).

Something fundamental has changed.

2.) What We Do Know ...

But let me first try to define the scale of the anomaly...

Since 1st March 2024 (a date the rally can be linked to) gold miners have produced about 2125 metric tonnes of fresh new metal, plus the refiners have added about an additional 720 tonnes from scrap – making a total supply of 2845 metric tonnes of gold.

Yet, over the 7 month period we can only readily account for where roughly half of that metal went.

Institutional investors (via the ETF) have acquired just 194 tonnes net, Central Banks have reported 136 tonnes net, India has imported 420 tonnes, while Shanghai withdrawals (seen as a proxy for domestic demand) has absorbed 730 tonnes (so that's investment demand and jewellery demand in the 2 leading markets) – meanwhile other key markets such as Germany have seen marginal buying, at best.

For sure there has been an increase in spec positions on CME (483 tonnes of fresh longs) but a massive shortfall remains...

_______________________________________________________________________________________________

So for supply of about 2850 tonnes we can readily account for about 1480 tonnes of buying from gold's key markets – and yet the gold price has gained 34% …

_______________________________________________________________________________________________

So what we do know is : The price action is strong, it is highly resilient, it is heedless of traditional drivers, it moves in an unconventional way (few periods of consolidation, let alone profit-taking), it has massive conviction and it is largely opaque. And there really aren't many buyers who could fill all of those conditions.

Possible Culprit …

Upfront … I am not keen on speculation or conspiracies … it's not just the sceptic in me, you get that way having heard so many dystopian stories … that have never happened.

Anyway.

For sure gold has seen strong derivatives buying on SHFE and likely within the OTC markets – and the Chinese have form. Known players have thrown everything (but the kitchen sink) at other (base) metals and the maxim that “size matters” has never held more true.

Effectively, if sufficiently large options positions are opened, then you can engender a self-fulfilling event. As banks sell call options to the speculator they cover part of the risk by buying some gold (typically about 10%) on delta hedging, the price moves correspondingly higher which begets more buying and so on as we move towards the strike price.

If much of the buying was directly between counterparts (or OTC) rather than on an exchange, to the outside world one would only observe the spot desk of the options writing bank buying gold relentlessly.

So that might partially explain things.

But if that was the case then likely we would also be seeing a build-up of loco London physical stocks as no metal would have been taken off market … and yet it is largely unchanged over the period.

But how to explain the remorseless nature of the buying ? Quite possibly we are applying a Western-centric view on things such as traditional macro drivers and geopolitical events, while those actually speculators are looking elsewhere and are more concerned with domestic Chinese economic issues. So not only does gold not read the news, nor do the specs.

3.) Suspect #2 ?

But there might also be another explanation.

In a word – “de-dollarisation”. In a polarizing world, the BRICS nations are selling dollar denominated assets and may be buying gold but not reporting it. Central bank gold reporting to the IMF is voluntary.

We are in the realm of speculation here but quite possibly the BRICS nations might back-stop a new currency with a partial gold backing – let's see.

It is very hard to buy very significant amounts of gold without leaving any footprint as there are multiple observable points … government statistics, shipping rates, physical premiums and refining periods, kilobar production scheduling at refineries … helpful colleagues. These could all give an indication of a super large buy order but so far … nothing seen.

For sure, many nations envy the central role that London plays in the global bullion market and they make no secret of it … much like “the exorbitant privilege” the US has with the global reserve currency. So is this part of bigger story with a player wishing to take control of the global gold market … maybe. But that's going out on a limb.

Conclusion

My mental libraries are telling me that gold has shifted onto a whole new paradigm.

The available stats suggest actual global gold demand is deeply and woefully lacklustre reflecting the widespread view amongst traditional buyers that gold prices are well above 'fair value'. But there is a mystery buyer out there who disagrees.

Whether this is a massive Chinese speculative play, a discrete supranational (BRICS ?) gold buying programme or a bid to take a larger role in gold's price discovery process, I really don't know. But what I do know is that gold is trying to tell us something and the final chapter is yet to be written for our collective mental libraries.

__________________________________________________________________

Ross Norman

CEO

MetalsDaily.com

www.MetalsDaily.com