Is It Time to Revalue America’s Gold Reserves?

Gold prices have surged past record highs, central banks are buying aggressively, and yet the U.S. still values its massive gold reserves at a 50-year-old price. While gold trades near $3,000 per ounce, the government continues to list its 261.5 million troy ounces at just $42.22 per ounce—putting the official value at only $11 billion instead of its true market worth of over $770 billion.

Why Revalue Gold Now?

Revaluing gold wouldn’t mean selling it off—it would simply reflect its real market worth. An update could immediately strengthen the national balance sheet by adding over $700 billion in assets, improving fiscal positioning without raising taxes or printing more money. It could also ease debt concerns, giving the Treasury more financial flexibility and reducing the need for excessive borrowing.

Beyond that, an updated valuation would increase market confidence, reinforcing the strength of U.S. reserves, stabilizing the dollar, and helping mitigate long-term inflation risks.

Why Hasn’t It Happened Yet?

Despite the clear benefits, the U.S. has not revalued its gold reserves in over 50 years. Bureaucratic inertia plays a role, as congressional approval is required, and it has never been a legislative priority. Some policymakers worry that a sudden revaluation could create market instability, raising concerns about the dollar and fueling inflation fears.

The Federal Reserve complicates the issue further, as it holds gold certificates at the outdated $42 per ounce price—any adjustment could force a major shift in the Fed’s accounting and financial management. Politically, updating gold’s value could also draw attention to the declining purchasing power of the dollar, a reality that some would rather avoid.

What Happens If We Do Nothing?

By keeping gold valued at its outdated price, the U.S. leaves a critical asset underutilized while global competitors continue to build their reserves at full market value. Instead of leveraging real assets, policymakers remain dependent on debt and monetary expansion, further weakening long-term fiscal stability.

Meanwhile, central banks worldwide are diversifying away from the U.S. dollar, strengthening their own positions while America clings to an outdated valuation. Without action, the U.S. risks falling behind in the global financial landscape.

Fort Knox: The Side Story

Fort Knox holds 147.3 million ounces—about half of America’s total reserves. But this debate isn’t about where the gold sits; it’s about what it’s worth. Even Elon Musk has questioned whether all of America’s gold is truly accounted for, pushing for an audit. If an audit confirms the reserves, it could boost confidence in U.S. financial stability. If it doesn’t, the implications could be far-reaching.

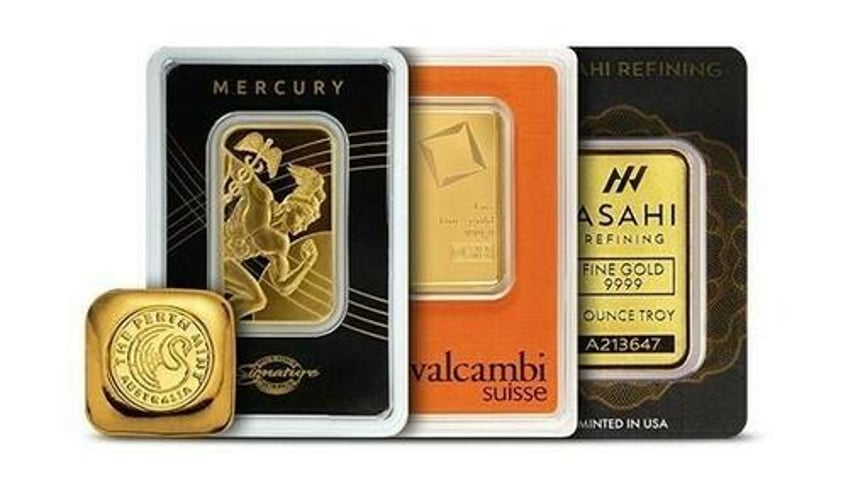

Protect Your Own Reserves

While Washington drags its feet, you don’t have to. JM Bullion’s Gold Starter Pack gives you direct ownership of .9999 pure gold—a hedge against government missteps and fiat failures.

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, offers investors an accessible entry into the gold market. Each pack includes a curated selection of .9999 pure gold products, providing a tangible asset to diversify and strengthen your investment portfolio.

Don't wait for economic shifts to dictate your financial security. Invest in the Gold Starter Pack today and take control of your wealth with the enduring value of gold.