Is Silver Still Money, Or Has It Now Fully Become An Industrial Commodity...

Submitted by GoldFix;

Perhaps it’s not surprising that there’s so much disagreement about how much silver is actually worth, given that there’s a large debate as to whether silver is still a monetary metal, or if it’s just a pure industrial commodity at this point.

Which is a reasonable question, as silver obviously has a long history as money in (and outside of) the US, as well as growing industrial demand. And while we’ve seen an increase in the usage of gold as a monetary reserve, especially since Russia was kicked out of the SWIFT system and sanctioned in 2022, the situation in silver is a bit more complicated.

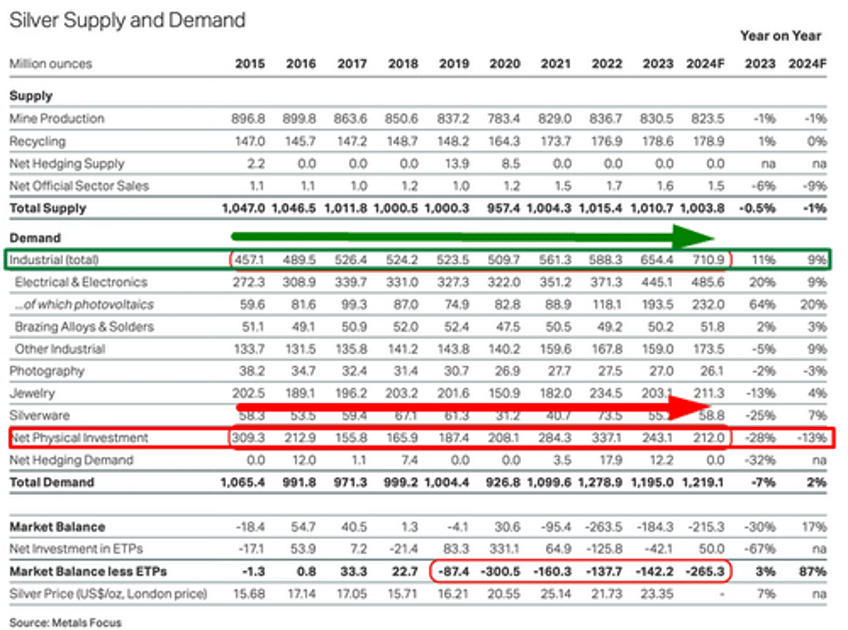

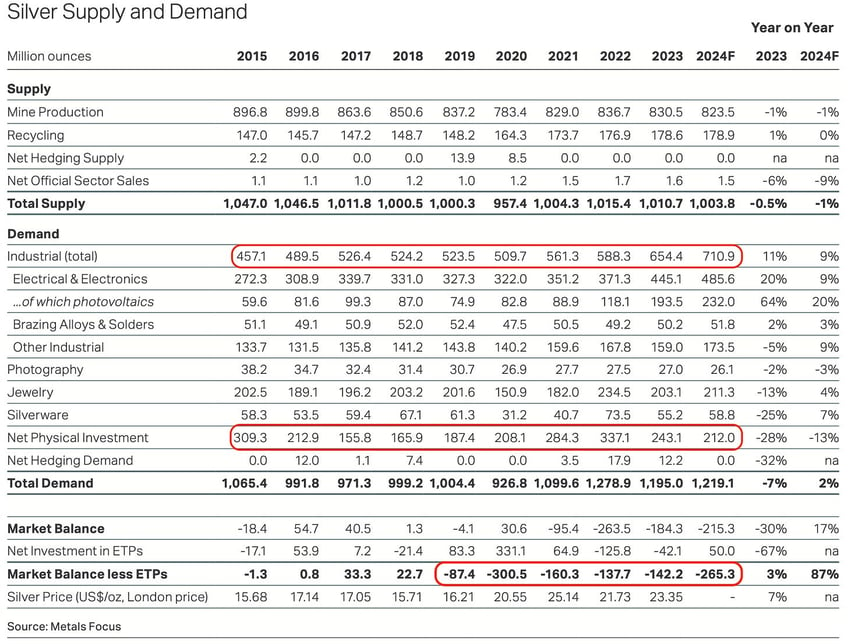

According to data from The Silver Institute, when accounting for physical investment and ETF demand, the silver market has already been in a deficit for the past five years, with one of the larger deficits in history forecast for 2024.

You can also see in this chart that while net investment demand has risen since COVID, it hasn’t ‘surged’ like we’re in a monetary crisis. And aside from 2022, it’s remained lower than the 309 million ounces reported back in 2015.

So while there’s a yearly deficit, it’s been driven more by growing industrial demand (solar panels in particular) rather than a big spike in monetary demand.

Does this mean that silver’s now purely an industrial commodity?

Well…not exactly.

Perhaps the short answer is that it’s still both, and will likely remain so.

The debate around whether silver is money or a commodity often assumes it’s a ‘one or the other’ matter. But that’s not been the case. And probably won’t be the case going forward either.

In an increasingly electronic world, that’s consuming larger amounts of silver because of its incredible conductivity properties, unless we’re heading towards a period of a declining standard of living (granted, not an impossibility), industry is going to continue to consume silver.

A November 2023 report by Oxford Economics forecasting the industrial demand for silver over the next decade concluded that:

“Between 2023 and 2033, we forecast the global output of end users of industrial silver will increase by 46% in real terms.

This reflects predictions of particularly rapid growth in the output of the electrical and electronics applications industry, which is forecast to grow by 55% over the decade.”

Of course investors concerned about a recession wonder what impact that would have on silver demand. And while that is a valid concern, remember that approximately 70% of silver is mined as a by-product of other metals like copper, zinc, lead, and gold. And if a recession leads to lower demand for metals like copper, and production is decreased, the silver supply also decreases.

Additionally, if there is a recession, do you expect governments to provide fiscal stimulus? If so, how likely is it that green energy subsidies will be part of those packages?

Even without a recession, governments are going to have a hard time meeting the silver requirements for the global green agenda.

But if we do have a recession, at least if the Inflation Reduction Act stands as any sort of template, it might be wise to at least price in some non-zero probability of any future stimulus packages including more silver consumption boosting green subsidies.

Yet in either case, outside of silver rising to a price that sounds silly to say out loud, industrial demand could conceivably go lower, but it’s not going away.

And neither is silver’s monetary demand.

There are people who have been saving silver as money for decades. And who will likely continue to do so as long as they’re alive. Probably even regardless of what the price does.

You may or may not think they’re right. But they are using it as money.

I also know many silver investors who use it for transactions, and prefer settling invoices in physical silver. And one friend who’s a regular silver buyer has been taking advantage of the low premiums and dealer buyback prices over the past year, and buying silver from physical sellers at a much lower price than retail.

Is that happening on a widespread level?

No.

But it’s also not insignificant relative to the overall silver supply.

Additionally, at the end of September, when Russia released its Draft Federal Budget, there was a note mentioning that silver (in addition to gold, platinum, and palladium) was going to be acquired in the State Fund.

"The plan is to acquire refined gold, silver, platinum, and palladium to increase the share of highly liquid assets in the State Fund."

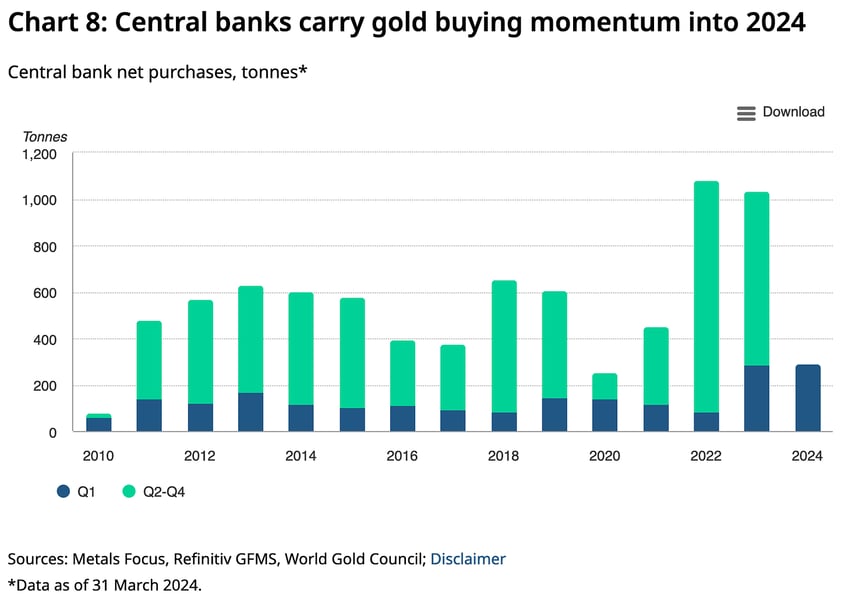

It’s a significant development, as while Central banks have set gold buying records over the past 2 years, this is the first government or central bank level institution to mention silver.

It’s also worthwhile to keep in mind that these types of perception changes often come in stages over time. In the sense that if you had told most investors 5 years ago that gold would start playing an increased role in monetary reserves, most non-gold bugs would have had a hard time believing that.

Yet events progressed (many of which were somewhat inevitable) that changed that Central Bank behavior. And given silver’s equally long track record as money, it’s not impossible to see other countries adopting a similar strategy.

Especially in a world where countries are increasingly taking their kickball and going home with it, amidst the possibility of wider spread military conflicts, silver also does become a potential strategic vulnerability that governments could potentially seek to exploit.

Crises also have a way of generating new investment interest in silver. The collapse of the housing bubble in 2008 created a new wave of investors and savers who were resonating with Ron Paul. And in 2020 there was another new upleveling of the degree of interest in silver during the pandemic shutdown.

So while the silver price didn’t really break out when we were feeling the effects of inflation in 2022 and 2023, I continue to wonder if the next time prices really start rising again, if that doesn’t trigger a new level of awareness among the broader population to start realizing there’s something wrong with the money.

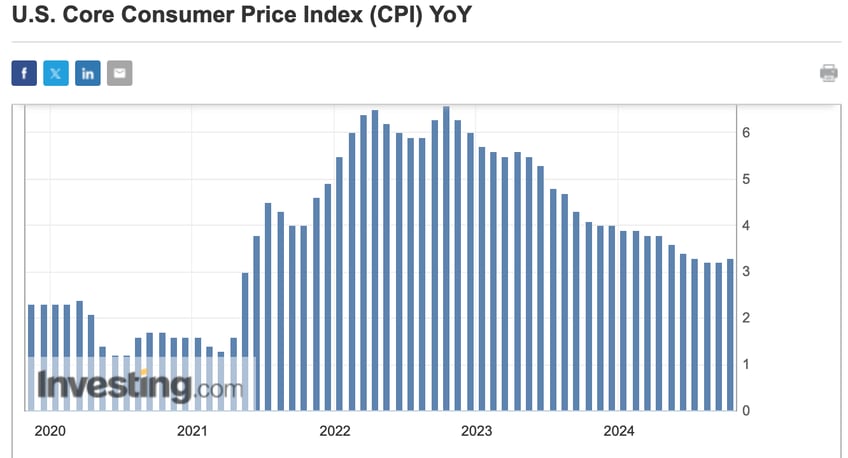

Even the somewhat generous CPI Index is up over 23% since 2020, and the Fed just cut 75 basis points in the past 2 months. Despite Powell saying the economy’s still strong, while year-over-year core CPI has been above 3% for 41 straight months.

It’s not hard to imagine another wave of inflation. And does that lead more people to trade their currency for silver?

We may find out soon enough.

Remember that during silver’s two spikes to the $50 area in 1980 and 2011 there was elevated concern about the stability of the money. And despite a decade and a half of TARPs and BTFPs patching over the imbalances, it’s becoming easier for even the most ardent deniers to see that our financial system in its current formation is living on borrowed time.

In terms of what actually gets people to pick up the phone or click the mouse to buy physical silver, the bank failures in March and April of 2023, and the Nikkei plunging over 12% in a day are the types of events that lead to big surges in physical investment demand.

So if there is a large correction in the stock market, or a funding issue as the reverse repo tank runs low, let alone the type of Lehman moment that seems inevitable on a long enough time-line as governments continue to pile up debt, any of those events would have an impact on physical silver demand.

Lastly, keep in mind that Silver Institute data shows 2023 investment demand of 243 million ounces, at an average price of $23.35. Which comes to a total dollar amount invested of $5.674 billion.

Whereas the World Gold Council reports 63.8 million ounces of gold investment demand in 2023, of which about half was central banks, at an average gold price of $1,940, for a total of $123.788 billion.

Which means that if even a fraction of that gold investment demand does transfer into silver, it has the potential to make a significant impact in the much smaller silver market.

So ultimately, the relevant question is less a matter of whether silver is a monetary or industrial commodity only, but more a case of to what degree it’s a bit of each, and at what rate that calculus will change in the years ahead.

- For daily updates on the gold and silver markets like this one visit Arcadia’s Gold and Silver Daily Substack.