By Peter Schiff, Schiff Gold

The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more detail on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).

The data below looks at contract delivery where the ownership of physical metal changes hands within CME vaults. It also shows data that details the movement of metal in and out of CME vaults. It is very possible that if there is a run on the dollar, and a flight into gold, this is the data that will show early warning signs.

Gold

In the 5+ years I have been tracking the Comex data, there has never been a month like this. The analysis last month highlighted some of the wild activity that started in December. That activity has carried directly through into January.

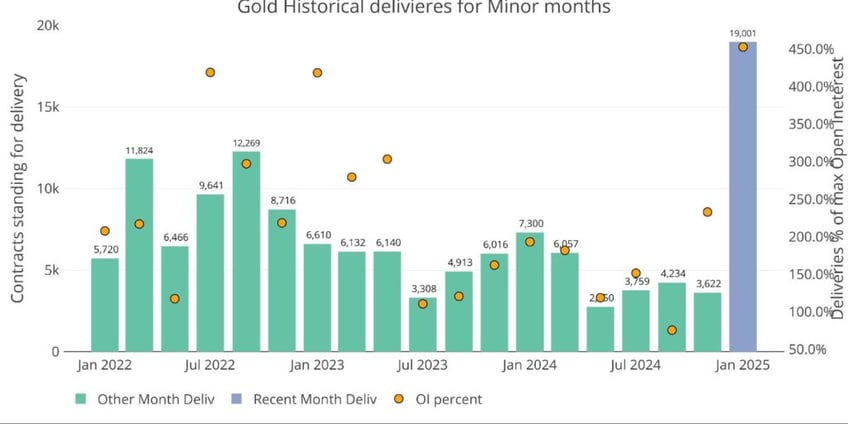

Let’s start with the delivery volume. January is minor month and does not typically see large demand. That changed this month with 19,001 contracts being delivered with 3 days still to go until February contracts start delivery. For context, that 19k volume (or $5.2B) would be about average for a major month, but minor months are typically less than 1/4 the major months.

Figure: 1 Recent like-month delivery volume

So, what drove this massive delivery volume? It was net new contracts coming in throughout the month. These are contracts that open and settle immediately with delivery. The chart below shows how much this deviates from past months. It was not any single day; it was just consistent buying throughout the month.

Another very odd aspect is...(READ THIS FULL ARTICLE, 100% FREE, HERE).