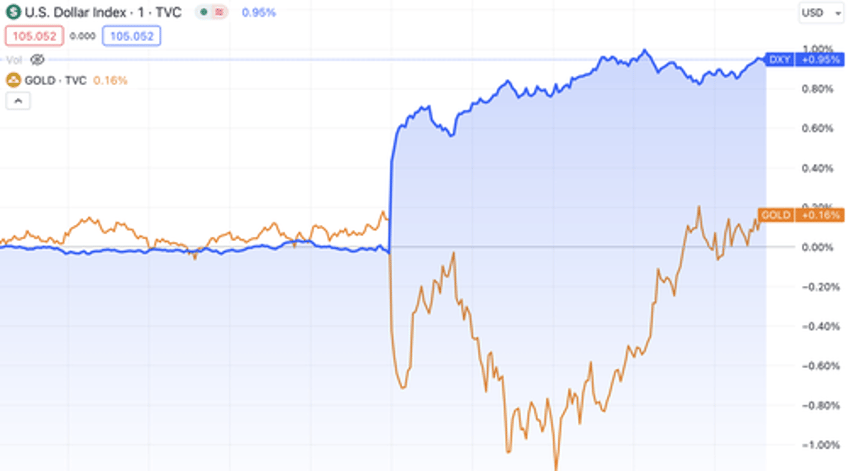

Strong inflation data yesterday afternoon prompted the dollar and 10 year treasury yields to rally, casting strong doubts about a June Fed rate cut ... and in a "normal" market gold would have corrected very sharply lower ... what did it do ?

Well essentially it ignored it.

Interestingly there was a blip lower suggesting someone has not yet the script that says that gold is now in a new paradigm. Get with it.

With US CPI coming in hot, gold dropped $30 and then immediately bounced even as the USD and yields sailed higher ... largely recovering its composure ... the gold buyer is clearly keen to hit the bid on any dips.

They say you best see the character of somebody from how they behaviour under adversity ... and arguably so it is for markets ... well the reading here is that the gold buyer behind this rally has real conviction.

A senior market colleague e-mailed me to say he disagreed with my own conviction that the rally is options based. I don't have a problem with that ... in fact that's the stuff of discourse. But I still take that view and am happy to be proven wrong ... not only have there been a series of cumulatively large bets to the upside ... but the delta hedging that goes with it is also market agnostic. And I am yet to hear a better explanation. See HERE

... and very few things are able to withstand market headwinds as gold is proving. A major sovereign state purchase perhaps might also be relatively oblivious to economic data - as gold is proving - but that would be unusual, especially as loco London vault stocks are unchanged (suggesting they did not want it posted to their home address) and the trades have not been booked through the LBMA benchmark - so an OTC trade.

The main takeaway here is that the rally remains resilient despite the data and the path of least resistance is higher ... hold onto your hats.

_________________________________________________________________________________

Chart below ... gold rapidly recovers its composure after strong inflation data ...

Ross Norman