(Written by Bert Dohmen, contains excerpts from our latest February 23rd Wellington Letter, titled “The Great Unwind”)

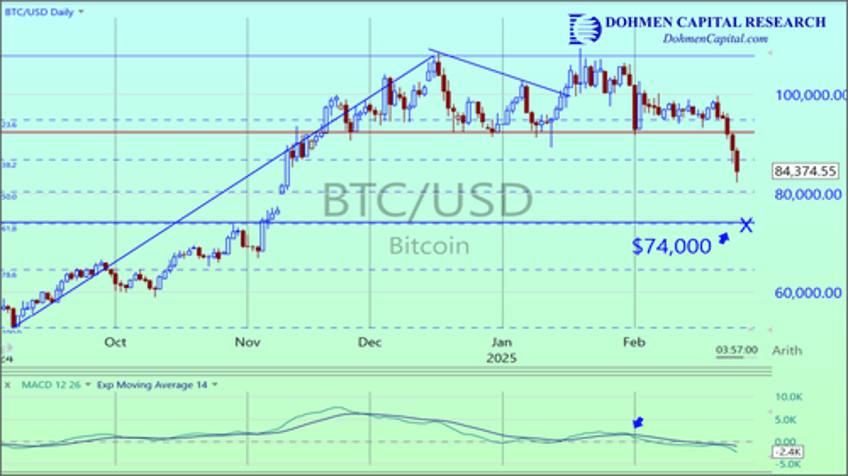

We have often written that Bitcoin has a good correlation with the stock market. Over the past few weeks, we’ve been showing subscribers to our research services evidence that suggests that the stock market is making a top. Now we see that Bitcoin is leading the stock market on the way down.

After setting a record high over $109,000 on January 20, Bitcoin has plunged nearly 24% through Wednesday’s low (February 26), now trading below $84,000. That’s a bear market!

The daily chart of Bitcoin below broke important first support on Tuesday, February 25. It then continued lower the following day (red horizontal line). We should see a bounce off support in the $80,000 price area.

Thereafter, it may have to fall to the $74,000 area before a sustainable bounce, which is the 61.8% Fibonacci retracement of the prior rise from last September to December 2024 (blue horizontal line, “X”).

The MACD (bottom, red arrow) has been on a strong “sell” signal since late January and has continued to fall. Of course, there will be some bargain hunting at various lows, causing short-term bounces, but the excessive leverage suggests big dumping is likely when margin calls go out.

Investors in cryptos must ask, is Bitcoin and other cryptos actual “assets?” Are they a medium of exchange? Are they a true currency, legalized and recognized by major countries as “money?” Can you go to a supermarket and buy groceries with it? How about buying a simple thing, such as a beer at a bar?

No to all the above. Bitcoin, along with other cryptos, is just a computer entry. This is why we consider Bitcoin to be the biggest speculative asset.

Even the name is false, calling it a “coin.” There is no actual coin, just an image of one.

If you use $1 million of good money to buy Bitcoins, all you get is a digital key, which is supposed to be the number that confirms the “asset” is yours. What a deal for the seller.

We have asked Bitcoin fans, what happens if your digital wallet, where you store your Bitcoin, gets hacked? Where is the complaint department, or tech support? This has now happened numerous times since cryptocurrencies were created, resulting in losses of billions of dollars. What is your recourse?

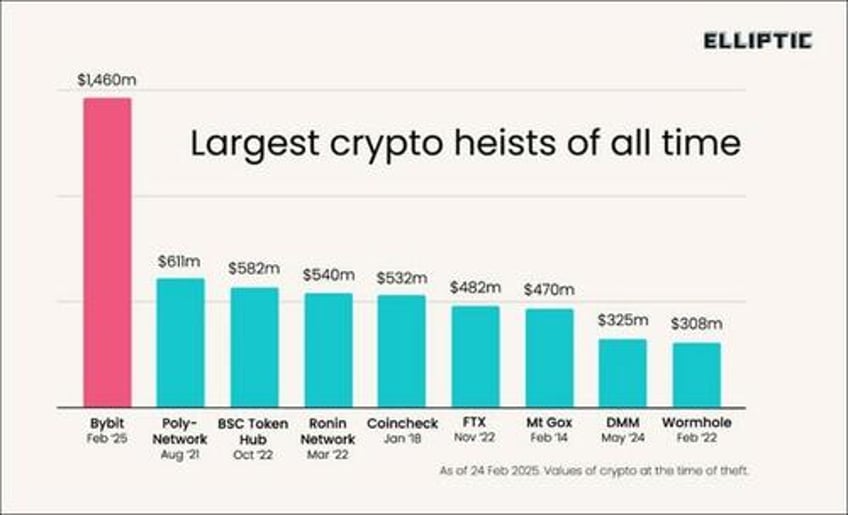

In fact, the largest crypto heist in history just happened on Friday, February 21, with over $1.5 billion stolen from a major Dubai-based cryptocurrency exchange, Bybit. The hack was reportedly committed by a North Korean cybercrime group called Lazarus.

The amount of crypto stolen from Bybit last Friday is more than double the previous record crypto heist from August 2021 when Ploy Network saw roughly $611 million stolen. See the great chart below of the most notorious crypto hacks over the past few years (via elliptic.co):

In last Sunday's Wellington Letter we explained that while investing in stocks of course has risks, investing in cryptos has many amplified risks. When your digital “coins” are stolen, is there a “customer service” department you can call? Who stands behind it? Is it “Satoshi,” the legendary alleged inventor of bitcoin who has never been seen or heard from?

What if the US, or any other government, makes Bitcoin illegal because it competes with the legal local currency? The US has such a law. Only the US Treasury is allowed to create the currency. It could be invoked at any time against cryptos.

Investing is difficult enough. With the cryptos, all you have is hope that none of the above will become a problem. But hope is a very poor tool in investing.

The crypto system relies on “blind trust” that everything will be legitimate and will preserve wealth. In today’s world, that is a risky bet.

With gold or safe T-Bills, you have something of value recognized all over the world. You eliminate the potential problems of the cryptos.

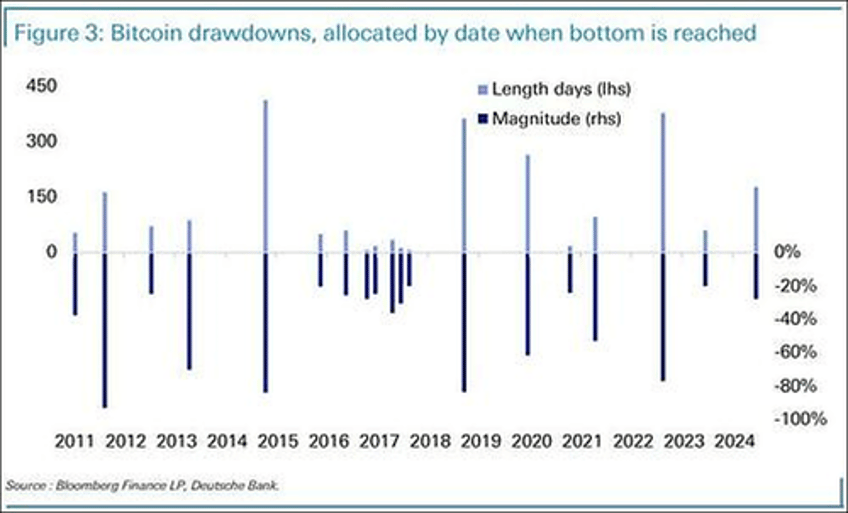

Look at the volatility of Bitcoin. Below is a chart from Bloomberg:

- “Drawdowns Within Rallies: Despite sustained uptrends, significant drawdowns (19 episodes since 2011) are common, averaging a 44% decline over 123 days.

- Post-2018, these drawdowns have deepened (-50% vs. -41%) and lengthened (194 vs. 82 days on average).”

Imagine, the “average” correction has been 44%. About 4 declines since 2011 have been around 80%.

While the media hides those facts, the sellers of Bitcoin tell you it is a good investment and only tell you about the big gains. This is SUCKER BAIT!

We remind anyone buying cryptos that Bitcoin has no intrinsic value. But an investor would pay roughly $100,000 in real dollars (last week) for one Bitcoin. In just a few days he would have lost over 17%.

Real money could be used to buy a nice Mercedes, or a down payment for a house. The Bitcoin digital key buys him NOTHING unless he sells his Bitcoin to someone else.

But he has to wonder, if something happens to the crypto exchange (as we saw with Bybit last week), or to his digital wallet, where does he go? Is there a complaint department or tech support?

This is why anyone investing in cryptocurrencies needs to be aware not only of the potential rewards, but the huge amount of risk that comes with them. Successful investors always consider the risk first, before thinking of potential gains.

CONCLUSION: Remember what we said at the start; the action in Bitcoin has a good correlation with the moves in the market. Therefore, if the Bitcoin bear market continues on, stock market investors should be very cautious in the days and weeks ahead.

In our February 23rdWellington Letter, we provide our current research and forecasts on the stock market selloff and why a potential short bear market could develop. We give our insights on the specific sectors and stocks that are most vulnerable to a big plunge in the current market environment. We also give our latest analysis on gold and how gold will trade if there is a big selloff in equities.

If you enjoy reading research and insights like this, we encourage you to read our latest award-winning Wellington Letter, titled “The Great Unwind” (published February 23rd) and get 1 FREE MONTH by signing up today after buying 1 month.

New members gain instant access to our latest issue along with all our most recent issues over the past 60 days! Claim our special savings for ZeroHedge readers today: Buy 1 Month Get 1 Free.

Wishing you successful investing,

Bert Dohmen, Founder

Dohmen Capital Research

Editor, The Wellington Letter