Where do we go from here

Terror in Rue de St. Denis, murder on the periphery

Someone else in someone else’s pocket

Christ knows I don’t know how to stop it

Poppies at the cenotaph, the cynics can’t afford to laugh

I heard in on the telegraph there’s Uzis on a street corner

— Marillion, White Russian

Last year I finally gave in to the pressure and did a 10 Predictions for 2023 post. I’m not a huge fan of these things, but getting out of your comfort zone is never a bad thing. So, let’s look at the scorecard and update things.

Last year’s theme was “Losing My Religion.” Last year was a mess. So many of the themes I wrote about advanced significantly. So many of them caused a lot of folks to lose their religion over old narratives.

What most of them didn’t do, however, was come true. By my count I hit .300 last year — good enough for the Majors but not for the geopolitical prediction business. Predictions #4,6,8 are winners.

The Ukraine War did continue dangerously (#4). De-dollarization (#6) did accelerate as bilateral trade moved away from the US dollar is many areas, while the USDX spent most of the year rising only to collapse in Q4 on ridiculous hopes of eight (8) rate cuts by the Fed in 2024. Oil never dropped below $70 per barrel Brent (#8).

I’d take credit for #9 but the Dow Jones Industrials missed the 40,000 mark by just over 2,000 points. Then again, given that nearly everyone else expected the Dow to collapse into oblivion, I think I should get extra credit for at least calling the shift from bonds into equities for most of the year, to be turbo-charged into the end of Q4 on the perception of a dovish Fed.

Given how much of a mess 2023 was, I guess I’ll have to take that as a challenge to improve. Let’s get started… the problem with that is, of course, where do we start? Where do we go from here?

#1 – The Democrats Will Try to Burn the Country Down to Win the Election

We are in the midst of a Cultural Revolution the likes of which we haven’t seen since the days of Mao in China. Until we wrap our heads around this, take it into our black hearts, and metaphorically start “slitting throats” to invoke H.L. Mencken we will lose what, sadly, has become the most important election of our lifetimes.

Not that elections mean much anymore. Certainly not after “Joe Biden” was selected over Donald Trump in 2020. I said after the 2020 election steal that “Civil War it is, then.”

If we just get rid of Orange Man Bad, everything wrong with America will be gone…

… So, all they have now is the unquenchable envy of Marxism which burns until it consumes everyone in retribution or they are put down like rabid dogs. That’s what is on display in these counting centers.

This is what they did in 2020. Today too many people see them for what they are. The speech environment is less controlled, thanks to some guy named Musk.

Therefore, the only option for them and Davos now is to go big or go home.

They have to win this thing or a few hundred years of colonial oppression and extraction collapses… at least that’s what they are thinking. To stop Trump they will stop at literally nothing. If you don’t believe me, believe the AP’s description of the first week of Biden’s 2024 election campaign, where he’s not even allowed to have a challenger.

It’s all race baiting; dark and twisted. It’s all Goebbels in the media, all day. “MAGA Republicans,” “Nazis,” “Saving Democracy!” Read the quotes from the Millennial operatives building “Biden’s” campaign and tell me they are just cynical hacks.

Is is just me or does anyone else think of “Matt Daaa-mon” from Team America: World Police whenever I see or hear “Joe Biden” anymore?

#2 – It’s False False False False False Flag World.

They are telling you they are going to go balls to the wall with the Race War card this summer. There will be a 'racially-motivated' false flag along with an attack 'by Iran and/or Russia' on our electrical grid.

— Tom Luongo (Head Sneetch) (@TFL1728) January 4, 2024

Both of these things I’m predicting in this tweet have sprung from events from this week… in 2024. “Joah Bii-den’s” campaign kickoff tour as described and the attack on the funeral commemorating the 3rd anniversary of Trump assassinating Gen. Qassem Soleimani in Iran.

Every neocon douchebag in an off-the-rack (pant)suit will remind us day and night for the next few months about how much Iran hates us. They will now also use the US pulling the Gerald Ford carrier group — long overdue for maintenance FYI — out of the Persian Gulf as a talking point. First to show how weak we’ve become by not standing up to Iran and Shi’ite terrorists.

Second, they will use that to concoct a fantasy of an empowered Iran sending agents through the border to take out the grid in Texas or Florida.

The best part is that will come from the Republi-tards like Nimrata Haley scoring political points with the Fox News set because “Joah Bii-den” opened up the border. This sets up #3.

The main point is that it will be nothing but false flag operations all summer long. These people need a casus belli to rouse the US out of its anti-war slumber for the war that will end the American experiment once and for all.

The goal is always to save themselves, and a US fighting a war on every front is, to them, the best path to do that.

#3 – Neither Trump Nor Biden Will be President in 2025.

The handwriting is already on the wall. It has been written in blood and drool. None of “Bii-den’s” moves to save himself politically will work. The US electorate is too far gone for that. The only thing that gets his or the Democrats’ approval rating out of the cellar is a war, and only a Just War thanks to #2, if it comes to pass.

But, even as I laid out, “Joah Bii-den” and the Dems will get the blame for any attack on US civilians by ‘terrorists’ let into the country.

So, in that scenario, getting rid of Donald Trump is the priority. Trump is clearly primed to go into the White House again, this time armed with a much better sense of what power he actually wields as President.

I’m no Trumptard, far from it. But just Trump’s desire for revenge and his sense of patriotism alone should be enough for him to blow up a whole lot in his second 100-days.

And that is why they have to stop him from either winning or, if he wins, ever taking office.

I’m not making a prediction on how the election turns out. But it is obvious that a lot of bad people are auditioning to be Trump’s Veep. Wall St. has made it obvious that it should be Nimrata. The Gods forbid happening! But it’s the most likely scenario if she makes it out of the early states with even some false momentum.

Vivek Ramaswamay is as authentic as Hillary Clinton’s chocolate chip cookies but he’s saying all the right things, and may even mean a couple of them.

Ron DeSantis isn’t ready for prime time and has too much work to do in Florida to prepare for the Civil War anyway.

The less said about the rest, the better. If somehow Trump is inaugurated a year from now, he will be saddled with more poison pills than your local CVS.

On the Democrats’ side of the aisle, Gavin Gruesome is clearly being groomed (all puns intended) for the job. Michelle Obama hates the US so much she’d love to finish the job her ‘husband’ started but only if she could be handed the job like “Joah Biii-den” was.

Big Mike doesn’t do kissin’ white babies.

And current Veep Kamala Harris may just have something to say about all of this yet. The problem is will anyone be able to understand it.

None of these people can beat Trump even if some of my failed predictions from 2023 come true and they embrace them in 2024, namely #5, “The US will Leave Syria,” to try and shift away from deeply unpopular positions.

Getting our troops out of Syria would fit into the “Iran attacks US civilians” plot I outlined above. It would fuel the Neocon/Nimrata schtick about empowering Iran by running from the Houthis. It will remind everyone of “Joah Bii-Den’s” disgraceful withdrawal from Afghanistan and give her foreign policy cred to be Trump’s VP pick.

#4 – Inflation, Interrupted

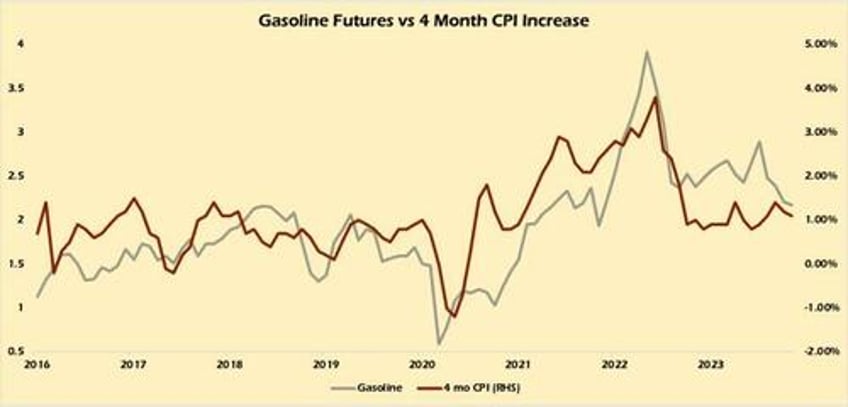

I predicated most of my 2023 predictions on inflation returning in the second half of the year. Inflation didn’t come back because of the concerted effort to keep oil prices below $80 per barrel Brent. That kept wholesale gasoline prices lower for :Joah Bii-Den” to try and score a point with the voters.

Moreover, RINS blending credit prices fell dramatically because of a record US corn harvest. Low natural gas prices used for drying also helped keep pressure on gas prices all year. This dynamic isn’t going to change in the first half of 2024.

Since COVID we’ve been dealing with cost-push inflation and especially of the ‘gasoline-induced’ variety.

Gas futures entered 2024 with all the momentum of EV sales at a Jeb Bush revival.

Please Clap.

And that means low CPI inflation through the first half of 2024. Despite having declared an end to fossil fuels by 2030 or 35 or Juneteenth, the Davos ninnies are having a hard time explaining away why the IEA just revised upward their projection for 2024 global demand for gasoline after a record 2023.

Low gasoline prices are an American phenomenon: equal parts non-market ethanol-blending shenanigans (RINS), the reindexing of Brent to include oversupplied West Texas Intermediate (25% weighting), and dumping more than half of the US Strategic Petroleum Reserve into the market to punish Russia and Saudi Arabia.

The widening Brent/WTI spread, now over $5 per barrel, tells you that global demand is strong despite record US production numbers.

Finally, the “Bii-Den!” administration is refilling the SPR, at far higher prices than they turned down in February of last year. While inflation is on hold, it’s still baked into this economic cake and FOMC Chair Jerome Powell knows it.

So, I expect the CPI to remain exactly where no one wants it for the first half of 2024; just high enough to stay the Fed’s hand on cutting rates but just low enough to keep the pressure on Powell to loosen credit conditions around the world.

#5 – Is It Really a Pivot after More than Two Years?

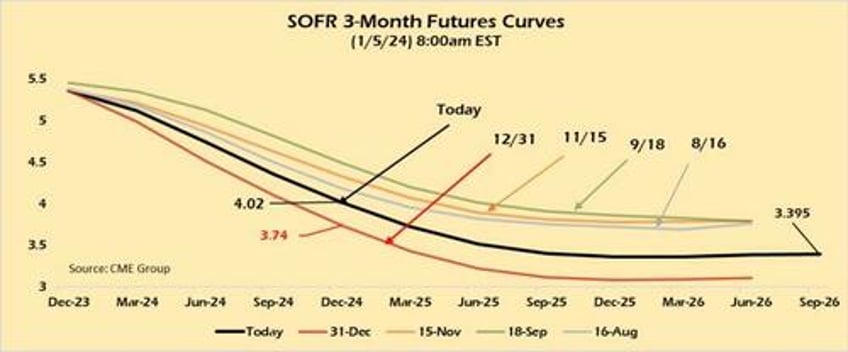

The biggest questions of 2024 surround the Fed. When will they begin cutting rates and how many times? These are questions that have far bigger implications for the dollar worldwide rather than domestically.

We can look now at the financial health of the country more accurately thanks to having a real market for domestic dollar demand, SOFR — The Secured Overnight Financing Rate. Anyone using dollars now has to think about what the Fed wants directly rather than what City of London wants with its hand up the Fed’s ass.

It’s an important distinction for this cycle.

In past cycles, the Fed was never really in control of its monetary policy, but yet it always took the blame for what happened. Austro-libertarians like myself and others applied our general (and I still believe correct) critique of central banking as yet another iteration on why all central planning fails.

But, without the larger context of the system as built, i.e. the eurodollar system, that critique is a shallow one. This is not because the end goal of decentralizing banking and money is wrong, but because there are a few dozens moves to be made before you can actually implement it.

The whole world isn’t just going to gather ’round the campfire, pick up a mistuned acoustic guitar and a joint, and say, “Yeah… man,” before launching into the Ron Paul Song (as good as it is!).

Even Ron argued that we had to do as little harm as possible. That means changing the direction of the country while we keep our promises, pay our bills, and clean our rooms.

Did Ron advocate tearing down 95% of the federal government in a year? No, he said roll back the budget to that of a few years ago, for example. Rein in the spending. Normalize interest rates. End the Empire abroad.

But we couldn’t do that if LIBOR was actually the tail wagging the US banking system dog.

Isn’t rolling the Fed back to being the central bank of the US rather than the world a similar move as the ones listed above? Ending the Eurodollar system will take more than a couple of years. It will take decades to drain if we don’t want to maximize the collateral damage of changing out this system to, you know, everyone.

So, for this year, monetary policy is absolutely political. Whatever Powell does or does not do will be politicized. Everyone will grind their ideological axe because it gets clicks, buys votes, and pays the bills.

The ones dying on the Eurodollar vine will scream, “PIVOT!” The ones finally getting positive real yield on their savings will say, “Don’t you dare!”

One could argue that the first two years of the fight versus the Great Reset and the grand Eurocommie Revival were the easy ones. The easy ground to take. Now it’s crunch time. Now we get to find out not just now strong Powell is internally, but how strong those backing his play actually are.

That’s the real question we’ve all been struggling to answer since I first brought this all up two years ago.

If I’ve been correct about all of this SOFR v. LIBOR stuff, then Powell will hold to his “Higher for Longer” position for as long as he can. We can argue about the definition of “long.”

That means as long as he has the cover of low but annoyingly high inflation (#4 above), then he doesn’t have to do anything in Q1 even if the markets scream otherwise.

Since the beginning of this week, the SOFR Futures market has already priced out one rate cut for 2024.

Will it price out another 1 or 2 by the next FOMC Meeting? Look at how far these curves are moving meeting to meeting and you tell me the market has any clue as to what’s on the horizon.

Last year because I was expecting inflation to return I expected the Fed to pause and then resume rate hikes, pushing to a terminal rate closer to 7% than 5%. Clearly that didn’t work out. But, if I’m right about inflation returning in H2 of this year then that argument still holds serve.

All this said, here are the answers to the questions surrounding the Fed in 2024.

The Goldilocks scenario is this (and it’s the one we should all hope for):

If the Fed can get through the lowflation period thanks to low gasoline prices of H1 2024, then it clears the decks for Powell to continue just doing nothing until the election is no longer in Davos’ grasp. At that point he’s clear to lower rates in the second half of the year, at the July meeting or after Jackson Hole, to give the incoming president, hopefully Trump, clear sailing to clean house with a positive credit environment to continue the reorganization of the economy with a less corrupt Congress.

Now here’s my realistic scenario:

Powell refuses to cut rates by March to help Bii-den! win the election. The Fed becomes one of the main focal points of the Democrats’ campaign. End the Fed and absorb it into the US Treasury. Blame the recession on the Fed. It won’t work. Powell cuts in May or June, once. The FOMC statement at the Halloween meeting will be a harbinger of where election shenanigans are headed. The Usual Suspects will scream “Cuck!” and “Baby Murderer!” with equal ferocity.

The planet keeps spinning.

Part II: Soon

And everyone looks at everyone’s faces

Searching for signs and praying for traces of a conscience in residence

Are we sitting on a barbed wire fence

Racing the clouds home, racing the clouds home…

Marillion, White Russian