Submitted by QTR's Fringe Finance

I just had a moment thinking about today’s action in the market that inspired me to pen a small note tonight, ahead of tomorrow’s regularly scheduled programming.

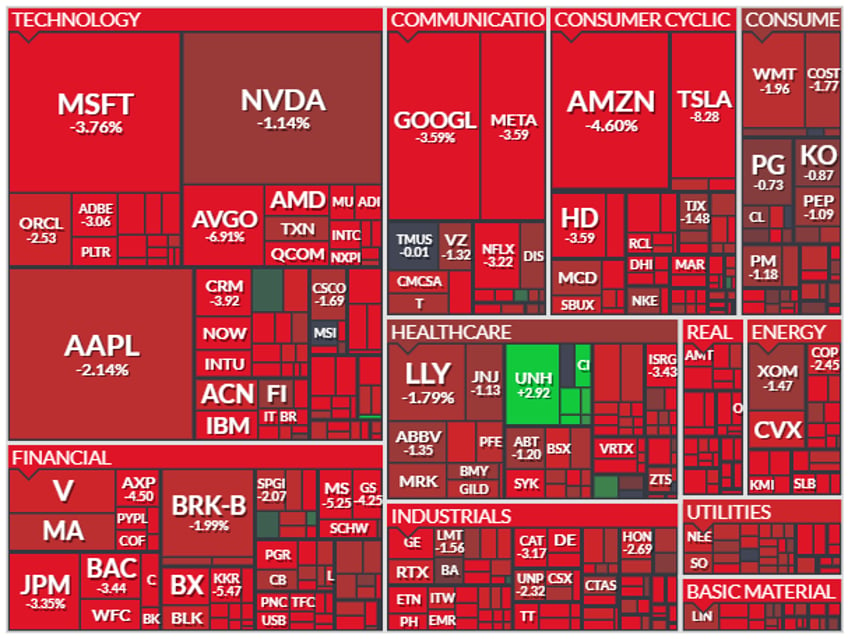

The market sold off in sharp fashion today after the Federal Reserve did exactly what almost everybody on Wall Street thought they would do: cut by 25 basis points.

Interestingly, the “whisper scenario” that started to bubble up to the surface over the last few days was whether the Fed might even wait on cutting, despite more than 95% of the Street unanimously believing a rate cut was set for this month. The last-minute concern came from inflation and producer price index data that all but indicated inflation is under control. In fact, progress on inflation appears to have stalled, while at the same time, the economy continues to slow and the job market follows suit.

Today gave me an immediate flashback to the week before Christmas in December 2018. Those who have been reading my blog for a long time know that I have harped endlessly on the fact that market crashes don’t usually occur until the Fed actually starts cutting rates. From September:

This situation is not unlike the one we have with the stock market and the economy now. In addition to the American consumer being tapped out, I’ve pointed out multiple times that the stock market has a history of finally cracking and giving way after cuts begin. In essence, cuts finally happening could wind up being the biggest "sell the news" event in recent memory.

In countless posts here, I have used 2018 as an example. When the market started to drop precipitously at the end of 2018, just days before Christmas, the Fed sped up rate cuts and blew more air back into a bubble that would continue up until today.

Remember just a few months ago when I was making fun of Jeremy Siegel for requesting an emergency 75 basis point cut during the yen carry trade chaos?

Well, the market is more than 15% higher than those lows right now and, despite today’s “chaos,” is still just a couple of percent off its all-time highs. The market is going to return nearly 30% this year unless all hell really breaks loose in the next 12 days.

Today stood out because, over the last week, including in an interview with Chris DeMuth that I’ll be releasing in a couple hours, the idea of leverage has haunted me.

Perhaps it was Interactive Brokers founder Thomas Peterffy talking about the alarming amount of margin outstanding that he saw, or perhaps it was crypto’s recent skyrocket higher—as I pointed out in this piece just days ago—that alerted me to the idea of leverage. Day after day, I’ve watched Bitcoin skyrocket higher, fully aware that people are likely utilizing monster leverage to...(READ THIS FULL ARTICLE, 100% FREE, HERE).