The economy may already be in a recession.

The sudden and unexpected jump in unemployment in July meant that joblessness in the U.S. crossed a key threshold that has usually meant the economy is in a recession.

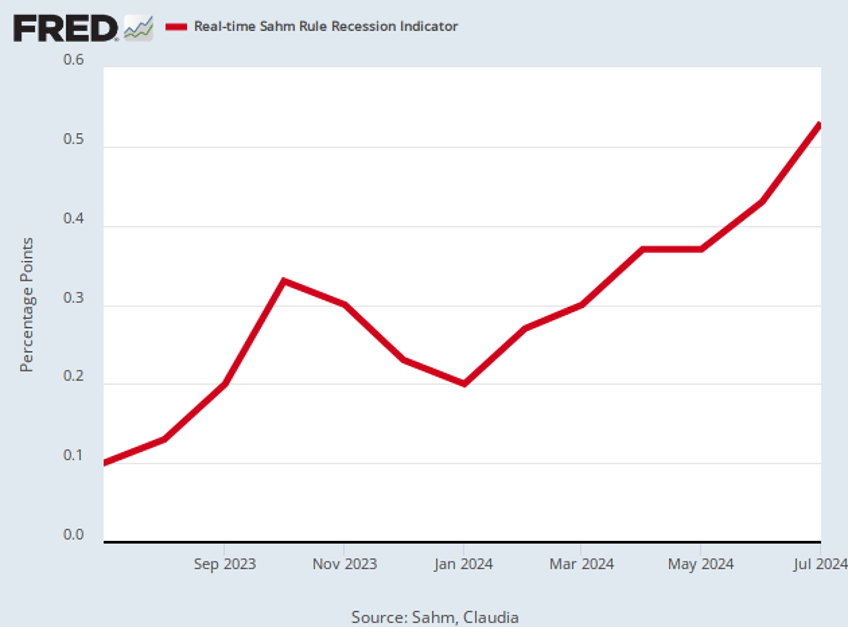

The unemployment rate climbed to 4.3 percent in July, the Department of Labor said Friday. That puts the three-month moving average of the unemployment rate 0.53 percent above the lowest three-month average over the previous 12 months, triggering the so-called “Sahm Rule” recession indicator.

The Sahm Rule is named for former Fed economist Claudia Sahm who first formulated it after studying the relationship between rapid rising in unemployment and recessions. Sahm found that when the three-month average of the unemployment reaches 0.5 points above the lowest three-month average over the preceding year, a recession has typically begun.

In her work, Sahm recommends that the government begin sending economic support payments to households once the threshold is crossed.

Sahm on Friday told the Wall Street Journal that she does not think the economy is in recession. Post-pandemic changes in the labor supply, including a surge in immigration, may have diminished the usefulness of the Sahm Rule, Sahm said. Other economists have said that the very low level of unemployment—even after the July jump—may mean that even a sharp increase does not indicate a slump serious enough to be considered a recession.

On Bloomberg Radio, Sahm agreed that the Sahm Rule had been triggered and said that while the economy was not yet in a recession, “we’re not headed in a good direction.”

Fed chairman Jerome Powell on Wednesday said that while recessions have typically followed a triggering of the Sahm rule, a recession was not guaranteeed.

“It’s not like an economic rule, where it’s telling you something must happen,” he said.

The increase in the unemployment rate and the triggering of the recession indicator will likely make it harder for Kamala Harris to sell American voters on the idea that the economy is doing better than they think.