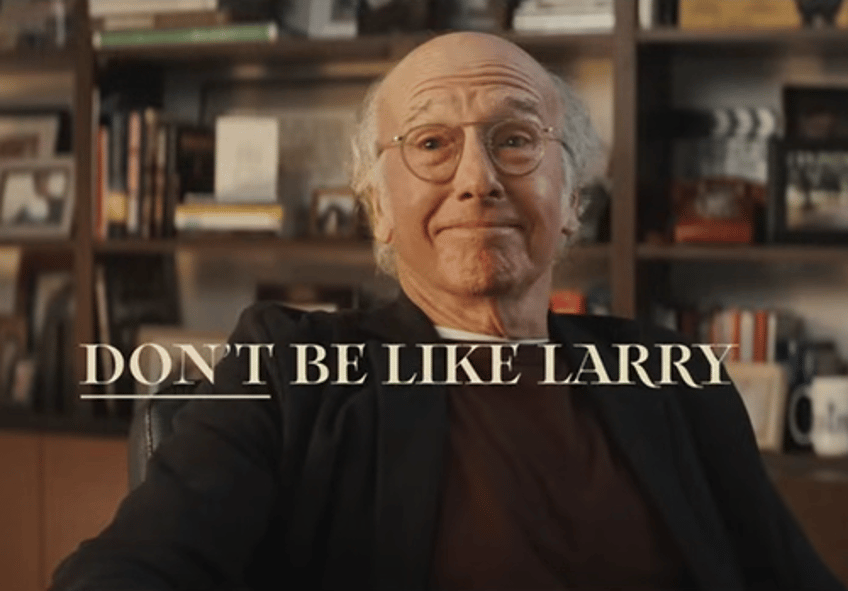

Be Like Larry

We've got an interesting trading update to share with you, but before we get to that, let's take a moment to appreciate how unique Larry David is in profiting from FTX while keeping his integrity intact. As Zero Hedge readers know, FTX founder Sam Bankman-Fried ("SBF") was found guilty on all charges yesterday, and could be sentenced to more than 100 years in prison for that.

Unlike celebrities like Tom Brady and his ex-wife Gisele Bündchen, who shilled for FTX, or journalist Michael Lewis, who portrayed SBF positively in his book, Larry David's reputation hasn't been tarnished by his association with FTX.

The only costume that's better 48 hours after Halloween as it was the day of.#SamBankmanFried #SBF #FTX #MichaelLewis pic.twitter.com/tHSGgr7xae

— Icetoad.eth 🛡️ || 🇺🇦 🇵🇸 🇮🇱 ☮️🕊️ (@ETHtoad) November 3, 2023

As Autism Capital pointed out, Larry David got paid to scoff at the idea of putting your money in FTX.

Larry David got paid $10M to literally tell people not to invest in FTX on national television. He did pretty, pretty, good. 😂 pic.twitter.com/6pszH5MkDE

— Autism Capital 🧩 (@AutismCapital) November 3, 2023

That $10 million figure is speculation, as far as we can tell, but what Autism Capital is referring to is the Super Bowl ad for FTX, in which David replies "Eh, I don't think so" when presented with the idea of using FTX to "get into crypto".

However much David got paid for appearing in that FTX ad, reportedly, he made sure to be paid in cash, rather than in FTX's in-house cryptocurrency, FTT. Smart.

An Interesting Trading Update

In our last post (How Not To Get Beaten By BUD), we mentioned a composite score we developed that would have kept us out of a bad trade against Bud Light parent Anheuser-Busch InBev ($BUD).

How Not To Get Beaten By $BUD

— Portfolio Armor (@PortfolioArmor) November 1, 2023

They killed the Bud Light brand, but they can still sink shorts.https://t.co/0ewPGDdQda

That approach also put us into a couple of nice trades yesterday: a bullish one on Block (SQ 0.00%↑), and a bearish one against Weight Watchers (WW 0.00%↑).

How Our Composite Score Works

We start with these nine metrics...

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

Short Interest.

And for each one, we assign a numerical value indicating whether it's very bullish (2), bullish (1), neutral (0), bearish (-1), or very bearish (-2) for the stock. And then we add them all up and get a composite score.

How That Worked For Block

Block had a bullish composite score of 3 ahead of earnings.

So we placed a bullish options trade on it yesterday. As we type this, SQ is up 18% in the pre-market; if that price action holds during market hours, we'll exit our options trade on SQ for a gain of about 111%.

How That Worked For Weight Watchers

Weight Watchers had a composite score of -6 ahead of earnings.

Based on that, we placed a bearish options bet against WW before it released earnings yesterday. WW dropped about 9% after hours yesterday. If that price action holds during market hours today, we'll exit our options trade against WW for a gain of about 92%.

If you want to get a heads up when we place our next trade, feel free to subscribe to our trading Substack/occasional email list below.

If You Want To Stay In Touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on Twitter here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).