LBMA Webinar Addresses London Gold Availability Concerns

For Debate: Market Functioning or Structural Pressure?

LBMA executives maintain that the gold market is operating as intended, attributing the recent surge in gold and silver moving from London to COMEX in New York to tariff concerns. They argue that delivery issues are logistical rather than indicative of a shortage, framing the situation as a stress event caused in part by market uncertainty surrounding Trump’s trade policies.

However, analysts like Daniel Ghali of TD Bank challenge this narrative, contending that London’s free float of gold is far lower than assumed and that recent U.S. repatriation efforts have exposed a deeper structural issue. The LBMA dismisses this claim, but the contradiction between their stated confidence in ample supply and the market’s persistent logistical strains raises more questions than answered

Key Questions Addressed in the LBMA Webinar

Is the Gold Market Functioning as Expected?

LBMA insists that recent disruptions stem from tariff fears and not from any structural deficit. They point to the economic incentives driving hedgers and traders to move metal from London to New York as a normal market reaction.

What is the Breakdown of Supply Between London and Refiners?

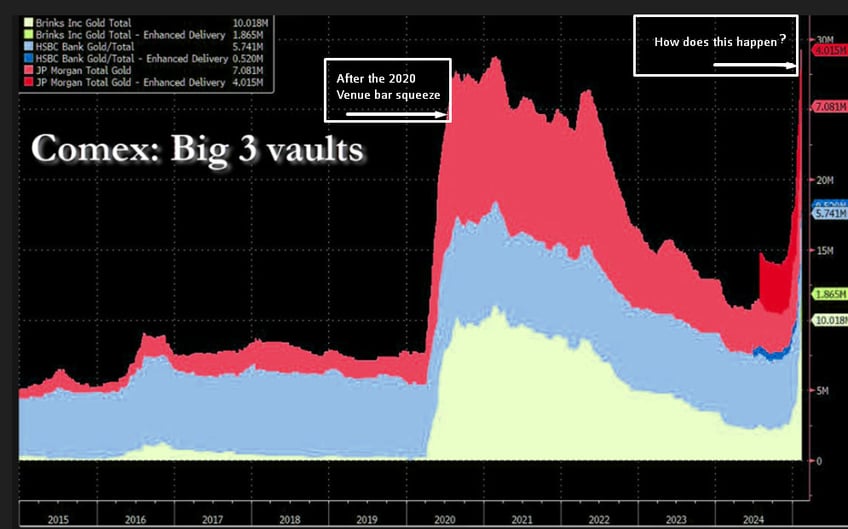

COMEX vault inflows over the past months have been evenly split:

50% sourced from London gold stocks

50% from refiners shifting production from LBMA-standard to COMEX-standard bars

The need for refiners to meet demand, rather than drawing entirely from existing London inventories, presents a potential contradiction. If London has ample gold, why is there a need to remelt bars into COMEX-standard given the reciprocity between exchange standards post the March 2020 (400 to 100) venue problem. This may be above most people's paygrade, but it is not below their ability to understand it if it were clearly explained. This discrepancy, without clairification suggests a degree of scarcity in immediately available supply.

Pic: ZeroHedge

Pic: ZeroHedgeWho is Taking London Metal?

The primary buyers are hedgers with net short positions on COMEX looking to secure physical gold.

LBMA’s Official Position on Metal Availability

LBMA executives deny any shortage of physical gold, stating that delays are logistical rather than a result of constrained supply. However, they also push back against analysts’ free-float calculations, arguing that nearly all vaulted gold is unencumbered and available for trade.

This assertion remains contentious. “Available” is a flexible term—gold may technically be available but not necessarily accessible at the current price or in the necessary form.

What About Silver?

Silver received limited attention in the webinar. LBMA officials dismissed concerns over a potential “silver squeeze,” maintaining that industrial supply remains sufficient. However, they acknowledged that silver logistics are more complex due to decentralized inventories. Their outright dismissal of supply concerns, particularly given the decentralized nature of silver markets and mining shortfall, came across as dismissive in a world where people have access to info they did not used to have. Perhaps instead of complaining about mis-information, leaders can get in front of it and explain things a little better instead of referring to their own business product and participants with derision

Gold’s Relationship to Global Trade

One LBMA official remarked that gold tends to rise when global trade contracts and that current trade levels are shrinking. However, this perspective ignores the role of alternative trade systems, particularly those led by BRICS nations, which have increasingly conducted trade outside of SWIFT. Whether global trade is truly contracting depends on how trade is measured and which networks are included

Final Observations: A Market in Transition

The LBMA’s confidence in gold availability and market function remains open to debate. While they maintain that supply is ample, the necessity of refinery conversions, rising lease rates, and increasing demand for physical repatriation all point to deeper structural pressures revealing antiquated logistics and supply-chain mgt (at best) in a world literally deglobalizing and fragmenting those chains.

Gold, once a globally priced product, has been well on its way to becoming priced regionally for years. The LBMA's incumbency helps it be more patient in reacting to changes, but only to a point.

At the core of the issue is whether London’s gold market can continue operating under its traditional centralized model. Some argue that the LBMA is simply managing someone else's short-term panic, while others believe the ongoing delivery constraints expose a deeper systemic flaw—one that U.S. repatriation has now laid bare.

Regardless of whether the issue is logistical constraints, limited free float, or both, one reality is clear: the outdated response of centralized institutions to rising gold demand stands in stark contrast to today’s decentralized access to gold via blockchain, regional trade networks, and alternative settlement systems. The rise of BRICS, the shift toward multipolar financial structures, and gold’s official return as a Tier 1 asset under Basel III—an event that unfolded within the very institutions that once dismissed gold’s role—signal a fundamental shift.

The world has changed, and gold market custodians must evolve with it. Attempts to re-centralize control over gold flows may be futile (even with recent buildouts of blockchain front ends) in a system that is increasingly bypassing traditional power structures. The LBMA’s challenge is not just about logistics—it’s about adapting to a financial order that no longer revolves solely around London or New York. The logistics and supply chain issues are now symptoms of incumbent supply-chain inflexibility meeting persistent, sometimes disorderly decentralized demand.

Drones versus air craft carriers if you will. More historically, Redcoat soldiers in line formation meeting guerilla warfare tactics for the first time

Perhaps the problem is ideological. London (NY etc) and much of the G7 leadership still believe Gold is an artifact, a collectible that can still be abstracted and financialized to defer delivery ad infinitum. However, about 1/2 the world now thinks otherwise and those types want the Gold for monetary and collateral purposes. Disintegrating trust cannot be papered over so easily anymore.

Continues here

Free Posts To Your Mailbox