This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

None

Options Trades

None

Comments

On the stock side, no exits is always good news, as it means we didn’t get stopped out of any positions. The performance of Portfolio Armor’s top ten names this year continues to be strong, thanks in part to picking up stocks like Nvidia (NVDA -1.36%↓) earlier this year.

Screen capture via the Portfolio Armor web app as of 8/31/2023

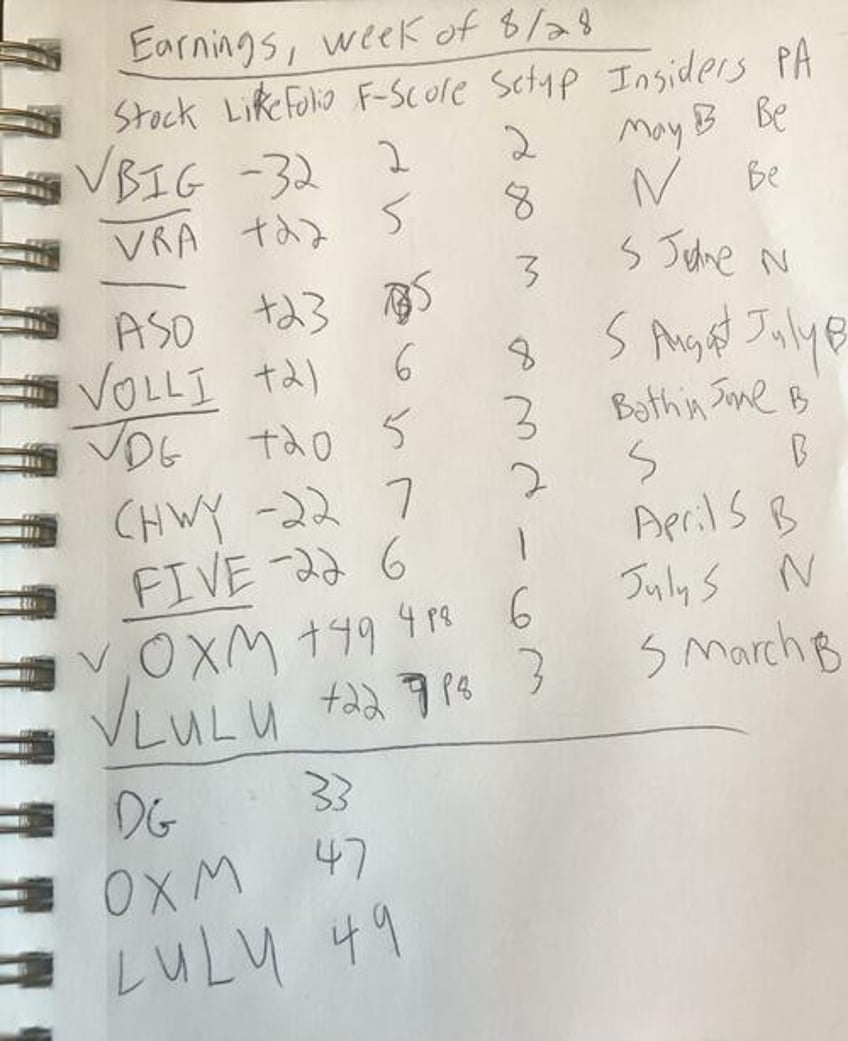

On the options side, here’s a look at my earnings trades notes for this week; the names with checkmarks next to them are ones I placed trades on.

Only one of those trades filled, a bullish bet on Ollie's Bargain Outlet Holdings (OLLI -3.92%↓). Had I used shorter dated options, I could have exited that trade for a gain of about 100%, but I used options expiring in January, so the potential gain from exiting this week would have been closer to 20% and I decided to hold them. The reason for switching to longer dated options in most cases was to avoid some of the randomness surrounding earnings announcements and give trades more time to work, but this is a drawback of them. Let’s look at the other other trades and some lessons we can take from this week and apply going forward.

Big Lots (BIG 3.23%↑) had a huge bounce after earnings (though it gave back nearly all of those gains by the end of the week. Subscriber TJ Eastwood made a good suggestion related to that: to look at RSI (relative strength index) going forward. RSI indicated that BIG was oversold heading into earnings.

Dollar General (DG -5.85%↓) tanked after earnings. TJ Eastwood made another good suggestion prompted by this, which was to be cautious about retail names in the current economic (and lax law enforcement) environment.

Mostly peaceful looting in California 👀 pic.twitter.com/RNUzNKowG1

— HumanDilemma (@HumanDilemma_) August 23, 2023Oxford Industries (OXM 3.05%↑) fell after earnings and then recovered most of its losses.

Lululemon Athletica (LULU 3.84%↑) made strong gains after its earnings beat.

Two Missed Opportunities

VinFast Auto ( VFS -17.44%↓). Not an earnings trade, but a shady, hyped-up Vietnamese electric car company. Options finally started trading on this one on Monday, and on Monday night I drafted a post about betting against it, but it was too expensive to use puts or put spreads on it then. By the time I figured out the right options strategy to use for it on Tuesday, it was already sliding. I know what to do in this situation next time though. VFS ended the week down more than 64%.

Big Lots (BIG 3.23%↑). In hindsight, the play here was to bet against it after it spiked post-earnings. Recall that we made our previous winning bet on it after it spiked ~50% earlier this summer. We exited that one for a 96% gain last week.

Takeaways Going Forward

We’re incorporating RSI, avoiding bearish bets against stocks with RSIs <30 and bullish bets on stocks with RSIs >70.

Giving more weight to bearish social data on retail. Of the three names with negative social data scores this week, two plummeted post-earnings, Chewy ( CHWY 2.59%↑ ) and Five Below (FIVE -1.61%↓).

Being more opportunistic about big post-earnings moves.

Don’t chase trades. We avoided a few losers this week by simply not raising our bids on them.

If you want a heads up when we place our next trade, as always feel free to subscribe to our trading Substack/occasional email list below.

If You Want To Stay In Touch

You follow Portfolio Armor on Twitter here, or become a free subscriber to our Substack using the link below (we're using that for our occasional emails now). You can also contact us via our website. If you want to hedge, consider using our website (our iPhone app is currently not available to new users).