Eli Lilly shares surged 16% in late afternoon trading—marking their largest intraday gain since August 2023—after the pharmaceutical giant announced earlier that its new weight-loss pill met efficacy goals in a late-stage trial, intensifying—if not turbocharging—its rivalry with Ozempic maker Novo Nordisk.

Lilly wrote in a press release that its oral GLP-1 drug, orforglipron, "demonstrated statistically significant efficacy results and a safety profile consistent with injectable GLP-1 medicines in successful Phase 3 trial."

Data showed that participants taking orforglipron lost an average of 16 pounds—or about 7.9% of their body weight—after 40 weeks, outperforming Lilly's prior guidance, which projected weight loss in the 4% to 7% range.

"ACHIEVE-1 is the first of seven Phase 3 studies examining the safety and efficacy of orforglipron across people with diabetes and obesity. We are pleased to see that our latest incretin medicine meets our expectations for safety and tolerability, glucose control and weight loss, and we look forward to additional data readouts later this year," Lilly chair and CEO David Ricks wrote in a statement.

Ricks noted, "As a convenient once-daily pill, orforglipron may provide a new option and, if approved, could be readily manufactured and launched at scale for use by people around the world."

Orforglipron is a more convenient oral treatment alternative to GLP-1 injectables, giving Lilly a potential edge over competitors like Novo.

"The data presents a best-case scenario for a blockbuster launch out of the gate," Jefferies analyst Akash Tewari told clients earlier.

Jared Holz, a healthcare specialist at Mizuho, said Lilly "will remain the preeminent player in this category for a while as its lead over peers, both in Pharma and Biotech, widens on the back of this data."

Additional analyst commentary from Goldman's Asad Haider, Nick Jennings, and others...

Eli Lilly (LLY) this morning reported Phase 3 orforglipron (oral small molecule GLP-1 pill) data in type 2 diabetes (T2D) from the Phase 3 ACHIEVE-1 trial. Topline weight loss of 7.9% (6.3% pbo adjusted) at the highest (36mg dose) and safety (topline discontinuation rate 8% at the highest dose) trends toward our bull case scenario, with A1C reduction inline with our expectations. As the first of seven global Phase 3 trials for oral obesity pull orforglipron, this was a key hurdle for the company to scale.

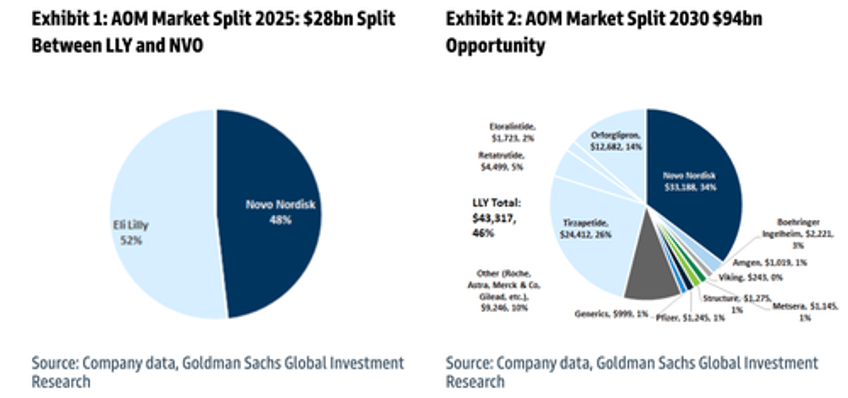

Our conversations over the past week have suggested that many investors have been sidelined ahead of these data given the binary nature of this trial in the backdrop of a tricky broader market/Pharma tape, with concerns about the negative stock reactions seen recently in Novo Nordisk and AMGN on the back of obesity updates that disappointed relative to expectations. To that end, we believe these data serve as an important clearing event for LLY shares. Recall our Buy rating on LLY is based on our view that the company will maintain its pole position as the leader in the anti-obesity market that is set to triple in size from~$28bn today to ~$95bn by 2030, even on our flatter TAM projections (see: Resizing Obesity). Our forecasts for LLY's AOM franchise in 2026-28 period sit 10.3%- 8.9% above consensus. We are bullish on the commercial potential of orforglipron and project risk-adjusted peak sales (obesity + diabetes) of $23.5bn by 2035 (vs. consensus's $16.8bn) on the back of a global launch starting in 2026, and a steep ramp.

So what happened to Goldman's James Quigley—a Novo super-bull? Wonder if he's still bullish…

When To Buy The Dip? Goldman's Meeting With Novo Nordisk Execs Offers Clues https://t.co/JNh3ezeqSC

— zerohedge (@zerohedge) February 20, 2025

The GLP-1 space is morphing from injectables developed by Lilly and Novo to a convenient pill form. Lilly has the early lead.

It appears the market has crowned Lilly as the king of GLP-1s (for now) after a fierce multi-year battle with Novo.