Luntz : “We have put our words on steroids and amped the language up so high that unless we communicate in overdrive and hyperbole, we believe—perhaps correctly—that nobody will hear us.”

_______________________________________________________________________

God the media do love a good panic don't they … but I suppose that's what sells … although one might have hoped for better from the Financial Times. Claims – no assertions – that London is running out of gold seems to have gripped the minds of the commentariat … but let me add a few thoughts :

Dealers in New York are 'standing for delivery' for physical on futures contracts that are normally either rolled month by month or cash-settled on fears that tariffs will be imposed on gold imports to the US.

Yes, about 435 tonnes of gold has moved from London via Switzerland to New York vaults over the last few weeks which is worth about $82 billion. My first thoughts are – OK, to put that into perspective, that's actually about half of an average trading days volume or turnover for the London gold market – interesting, but only maybe.

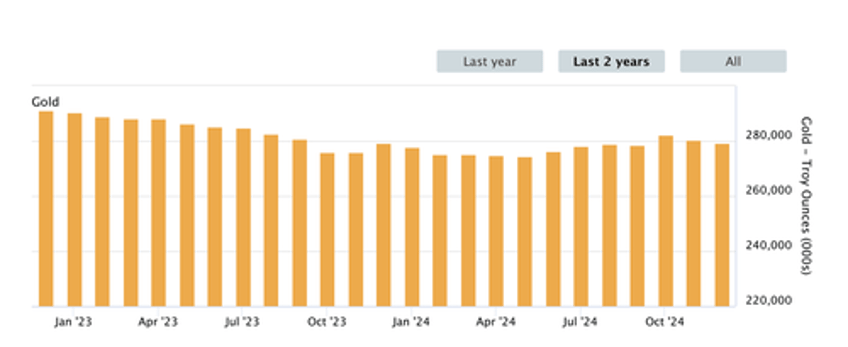

Firstly though, as for shortages … well London is sitting on about 8710 tonnes of gold according to the latest LBMA vault stats and the drawdown has not exactly moved the dial (see below). Yes, less than half of this is owned by other central banks, but the majority is ready and available.

Second thought – so this is a logistical and conversion problem … fine ounces of gold are needed in one location (New York) > which needs to be converted into another form (in Switzerland) > and then shipped across the pond. Of course there are limitations on the Swiss refineries melting capacity to convert 400 ounce gold bars into the kilobars, as well as limitations on metal handling. Again … big deal. You've been in a car … temporary log-jams happen.

Some refiners I met at the World Money Fair in Berlin last week suggested their kilobar capacity is currently booked out for the next 8 weeks or so to meet that demand.

And if 435 tonnes of kilobars are now in New York then surely the problem is as much about surpluses on one side of the Atlantic, as much as so-called 'shortages' on the other. Taking the 10 year average, the US purchases only about 20 tonnes of physical gold bars each year – so 22 years worth of bullion bars have just washed up on their shores. Likely as not, like last time (covid), these bars will simply be flown home to London (via the Swiss refineries where they are converted back into standard bars) over the next few months. Nice business for some.

And the reality is that over the last 2 months gold miners will have generated about 600 tonnes of fresh new metal … and with premiums on kilobars running high, it follows that much of that production will have been cast into non-standard kilobars to satisfy the US demand, rather than standard market bars.

Yes, the Bank of England may have extended delivery periods just now but there are many other LBMA vaults in London as well as other international locations where metal can flow into the US.

For sure some traders will have been caught out by the move and large profits and indeed losses will have been made – but there is also an unintended side effect. The scale and speed of the drawdown in gold has reduced liquidity in the market temporarily and the cost of borrowing gold has rallied from sub 1% to north of 10%. This has a detrimental impact on gold borrowers which includes bullion dealerships, jewellery groups, gold miners and others who optimize their working capital by borrowing gold rather than owning it outright ... yes, the very infrastructure that interfaces with gold consumers and makes our markets possible is being damaged.

As you may have heard said ”a lie can travel halfway around the world while the truth is still putting on its boots.” So true.

______________________________________

Ross Norman

Metals Daily Ltd