London’s Gold Market Can’t Satisfy Current U.S. Demand

The LBMA Has a Stock-Out

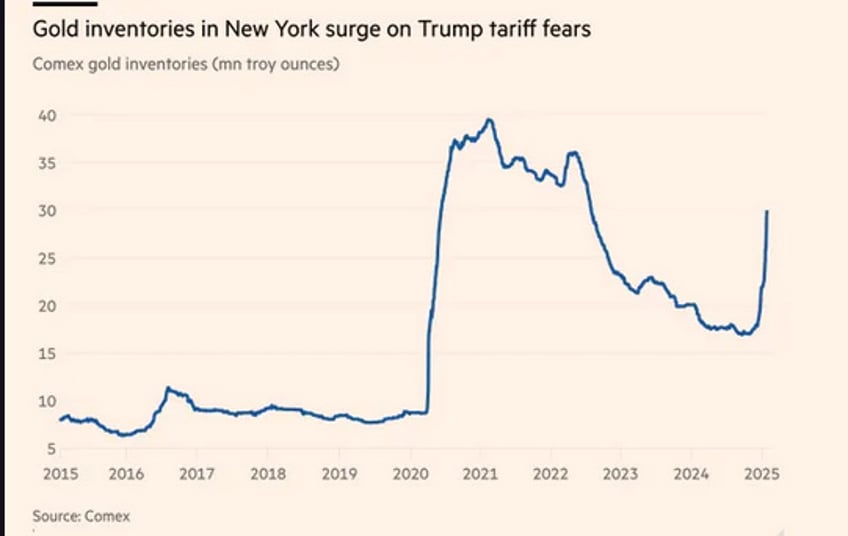

London's bullion market is under strain. A surge in gold shipments to the U.S. has left traders scrambling to borrow from central banks, with wait times at the Bank of England stretching from days to weeks. The gold supply chain, long considered reliable, is now exposed to cracks that weren’t apparent before.

The free float—gold available for immediate OTC trading—has declined after the wave of shipments to New York. Despite the logistics claims, many have said that this is just a good old fashioned stock-out

The Just-in-Time Model Breaks Down

For decades, bullion banks operated on the assumption that gold was always available. The system worked because gold isn’t consumed—it’s recycled, leased, and traded. When supply disruptions occurred, banks could borrow metal, cover their needs, and replace it later. That model is now failing.

A new kind of buyer has entered the market: one that doesn’t see gold as a financial instrument but as money itself. Countries like China and Russia have spent years accumulating gold, prioritizing it over U.S. bonds. Their strategy has chipped away at the available leasing pool, leaving Western banks exposed.

The Musical Chairs of Gold Supply

Bullion banks relied on a game of musical chairs, borrowing gold to meet short-term needs. But when enough chairs are removed—when buyers refuse to lease their holdings—banks are forced to compete for an ever-dwindling supply. That’s what’s happening now.

Central banks have been net buyers of gold, not just in emerging markets but in the West as well. Eastern European countries like Poland and Lithuania have ramped up purchases, further tightening supply. The once-abundant leasing market is drying up.

London's Golden Milkshake Gets Drained:

There's a billion ounces available.London's Warehouses for argument sake. There's a billion ounces there, but there's only 300 million ounces available. The other 700 million ounces are owned by people who have no interest in leasing it. because they see what's happening. You already have China, right? You have a big straw sucking the gold and silver out of Europe. It comes out of London, it goes into Switzerland, it gets earmarked and it goes to China. Now you have a new straw coming to the US for whatever reason you want it to be. For tariffs, but I believe it's just a straight up repatriation of gold for Tier 1 purposes and the tariffs are a catallyst reason, if not a good cover for it all. We now have two straws draining the LBMA, the golden milkshake in London is just being drained by China and the US. Source:

Gold Shipments to the U.S. Accelerate the Crisis

With London’s supply already strained, large shipments of gold to the U.S. are adding pressure. Whether the movement is driven by tariff concerns or broader repatriation efforts, the effect is the same: gold that was once part of London’s available float is being pulled out of circulation.

Source: FT

China has long siphoned gold from European markets, refining it in Switzerland before shipping it east. Now, the U.S. is drawing from the same source, creating a dual drain on London’s reserves. As more gold moves across the Atlantic, London’s role as the center of the global gold trade is being tested.

What Happens Next?

If bullion banks can’t secure enough gold through leasing, the next step is central bank intervention. The G7 central banks may be forced to lease their gold to keep the system functioning. Mines may divert gold before it even reaches public markets. More countries may follow China’s lead, buying gold directly rather than allowing it to flow through exchanges.

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished.”

This is a policy shift reflecting Mercantile tendencies, where nations prioritize securing physical gold over participating in a globalized trading system. The bullion banks, long dominant in gold markets, are losing their grip as governments take direct control of supply and the pool of lease-able gold shrinks while World trust is broken making Gold's newly reinstated Tier 1 status more important for trade than ever

More Detailed Video Version:

THE LBMA IS BROKEN

— VBL’s Ghost (@Sorenthek) January 30, 2025

(We didn't need them anyway)

Key Moments

0:00- Intro/ Mkts

4:45- London Gold Deficit

6:10- RTRS/ FT Coverage

7:23- LBMA Supply Chain

16:18- BNP Gets Bullish Gold

21:12- Trump Dresses Down Powell Again

24:15- Gold, Silver Charts pic.twitter.com/pg6VBhO8ZE

Related Stories out Today

- FT Reports: Gold Shipments to U.S. Strain London’s Bullion Market

- NEWS: RTRS Reports LBMA Scramble for Gold is Real

- Breaking: The LBMA Doesn’t Have the Gold

- Silver EFPs and Trump-Tariff Risk

Free Posts To Your Mailbox