Contents:

- WHY THIS IS HEAVEN

- THREE RULES FOR NOW

- SIGNAL TO NOISE

- LOOK AT THESE CHARTS

WHY THIS IS HEAVEN FOR US AND SHOULD BE FOR YOU AS WELL

Authored by GoldFix ZH Edit

Bottom line: This time of year, for a very brief window the market is like a 1 year old learning to walk. You can tell when it is about to fall before it even knows it will1

… and you can act accordingly.

THREE RULES FOR NOW

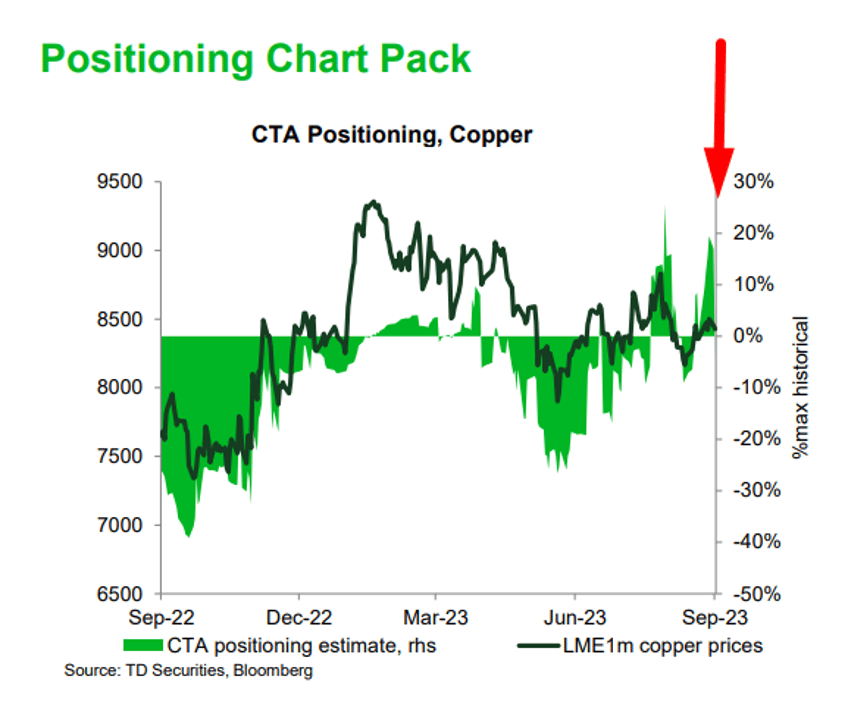

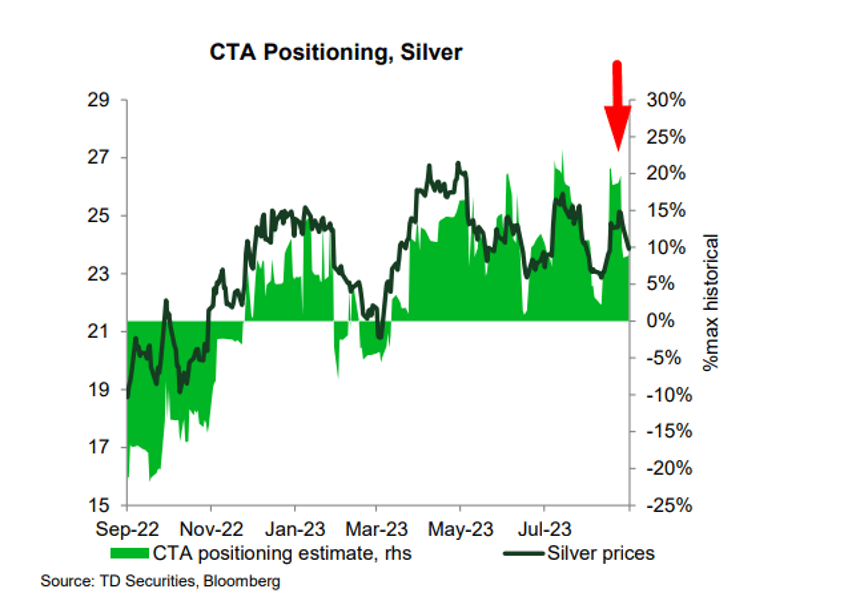

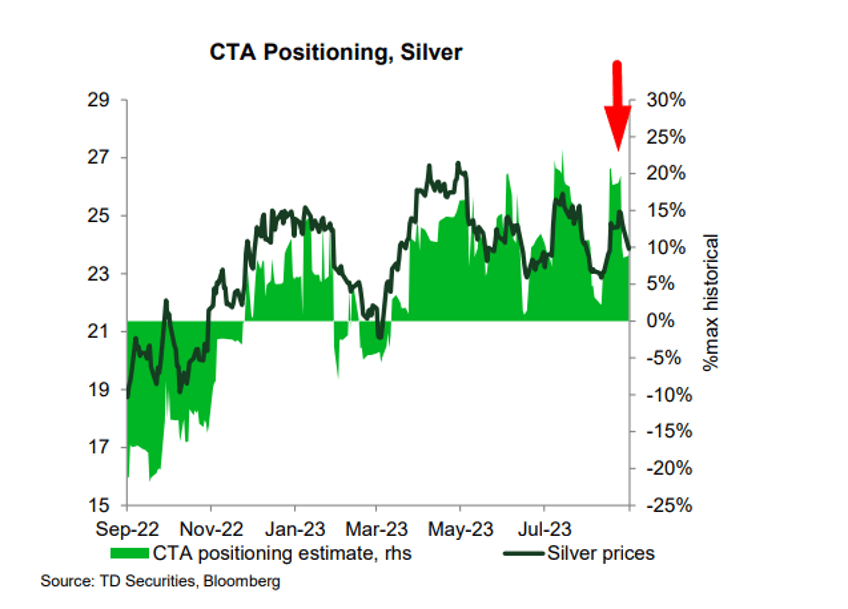

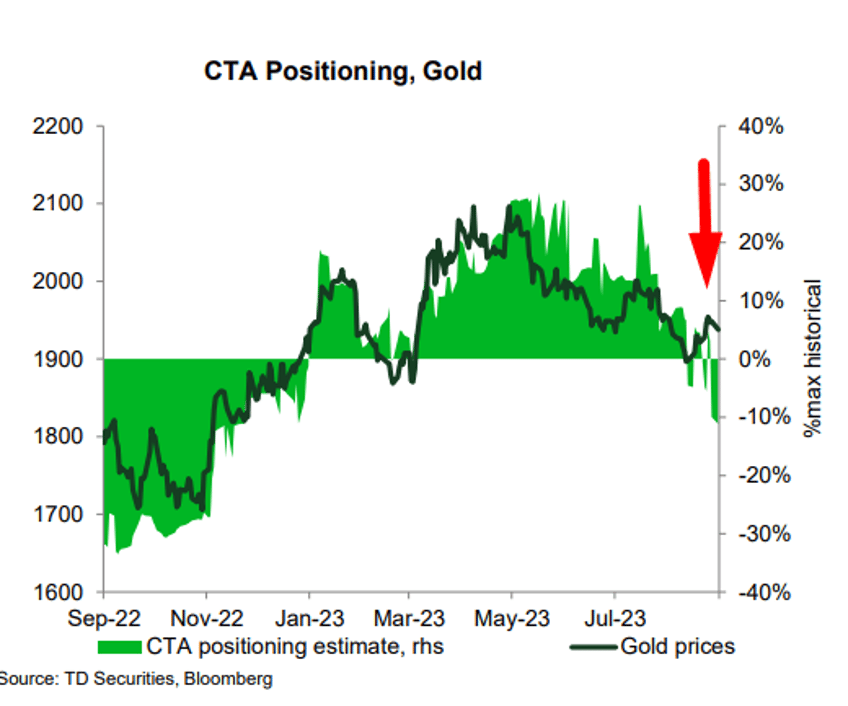

Three things have to first be accepted to use this information. First thing we all have to understand is: CTAs act like a singularity in their investment choices. They are the complete retail market aggregated.2

The second thing is.. during certain times of the year, CTAs tend to dominate/influence market movement because other players are trading less. This is just one reason ZeroHedge gives them so much attention. The third thing is.. They do not have staying power, and thus will cut their losses before the big boys do. They are not stupid, they are just disciplined to a fault.

SIGNAL TO NOISE

During very light volume parts of the year, (like now) if CTAs are active they transmit pure movement/alpha to markets.Taken together this is an informational home run for us. Why?

Because when there is less volume, and there are less sophisticated “smart” players distorting the market it makes flows more predictable if the CTAs get active like they are currently. Taken together that means a much better signal to noise ratio. Less fake outs, less concerns about outside forces screwing up timing etc.

With those facts in mind.. here we go.

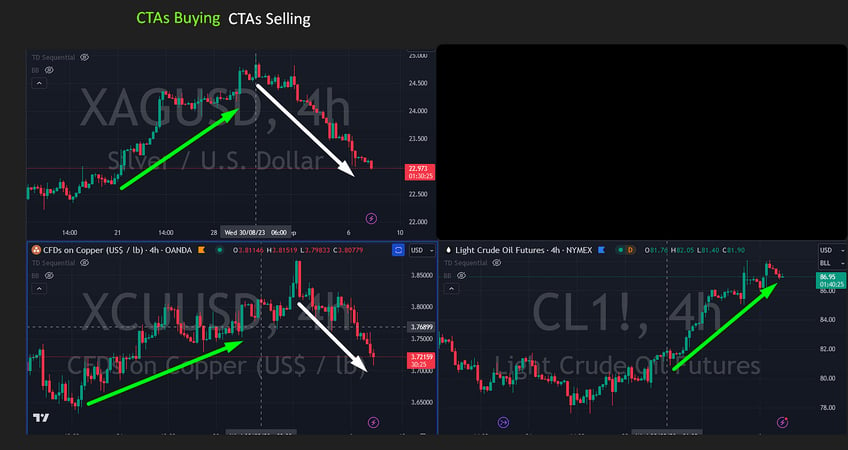

Look at These Charts Chronologically

There is obvious overlap.. but that is because what we are describing takes time to manifest completely.

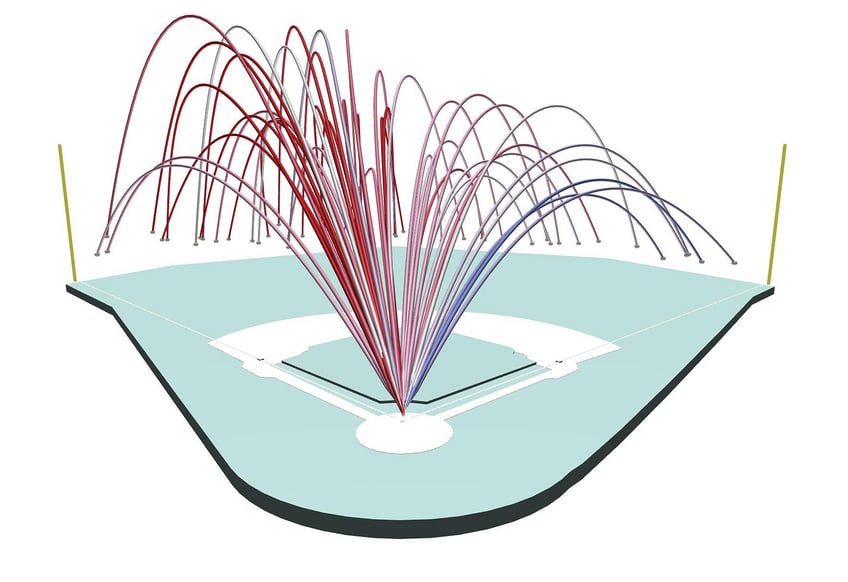

First, here is what happened in aggregate…

Now we look step by step…

1- CTAs piled into Silver and Copper longs betting on a Fed end to rate hikes while China was hopefully recovering. Shanghai traders piled in as well.

2- They short Gold because.. and we’re not kidding you.. they are told to hedge the Silver precious aspect based on the comment: If we recover, Silver will outperform Gold, if we do not, you want to hedge your silver a little.

3- CTAS are told Oil is going up. They start exiting Silver longs almost exactly as they start piling into Oil Longs because some are trading on margin!

Now we look step by step…

Continues here ...