President Biden's second week of military strikes against Iran-backed Houthi anti-ship missile bases and continued attacks on commercial vessels in the Red Sea by the rebels have raised serious concerns about supply bottlenecks jeopardizing global growth.

On Thursday, top container shipper AP Moller-Maersk sent a memo to customers, warning how the global shipping network is fracturing because of the elevated risks in the Red Sea:

"While we hope for a sustainable resolution in the near-future and do all we can to contribute towards it, we do encourage customers to prepare for complications in the area to persist and for there to be significant disruption to the global network."

Major shipping companies like Maersk and Hapag-Lloyd have diverted hundreds of vessels on lengthier and costlier routes around the Cape of Good Hope to avoid Houthi rebels. Shell was the latest company to suspend all Red Sea shipments earlier this week.

Maersk CEO Vincent Clerc told Reuters on the sidelines of the World Economic Forum in Davos on Wednesday that global shipping networks will be disrupted for at least a few months:

"So for us this will mean longer transit times and probably disruptions of the supply chain for a few months at least, hopefully shorter, but it could also be longer because it's so unpredictable how this situation is actually developing."

Earlier this week, Stifel shipping analyst Ben Nolan told clients, "Red Sea issues are getting worse, not better."

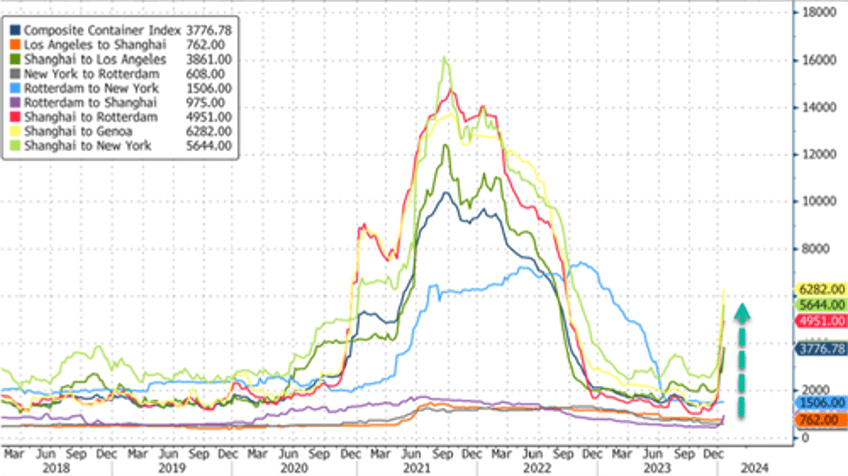

The knock-on effects of Red Sea disruptions have pushed companies to rent more vessels, thus reducing capacity, which has increased shipping rates in recent weeks.

"This week saw a scramble for prompt tonnage," said MB Shipbrokers (formerly Maersk Broker) in a market report on Friday, referring to ships that can be chartered immediately.

"Owners have certainly become more bullish and are pushing for higher-than-last-done levels in all segments and most regions." Charter rates are headed higher, "specifically for short periods of three to six months' duration," said MB Shipbrokers.

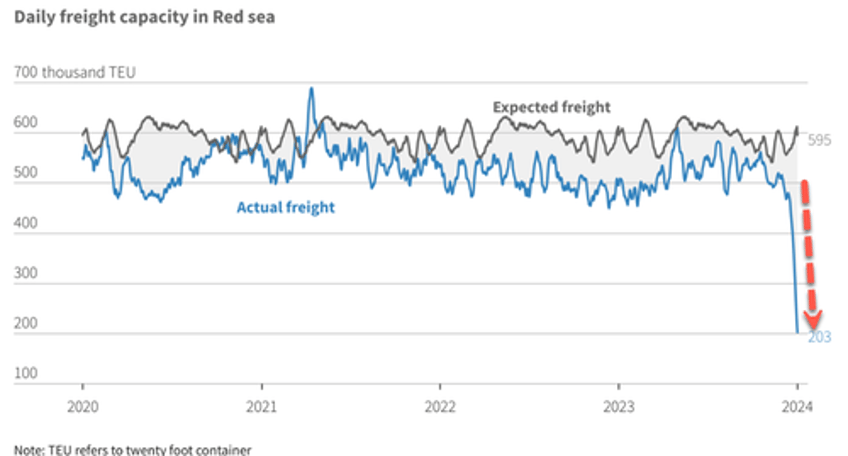

Data from IfW Kiel Institute shows containers being transported through the Red Sea daily are around 200,000 containers, down from 500,000 in November.

The result of the chaos in the Red Sea has been a slide in global trade.