Mali Seizes 3 Tons of Gold from Barrick Amid Ownership Dispute

[EDIT- Events like the following could become more frequent in other nations. These are the equivalent of mining strikes in the short term, and manifest as an increased cost of production in the long term for gold miners.Mining strikes in the 1970s, particularly in South Africa contributed to gold price spikes then.- VBL]

The Seizure and Shutdown

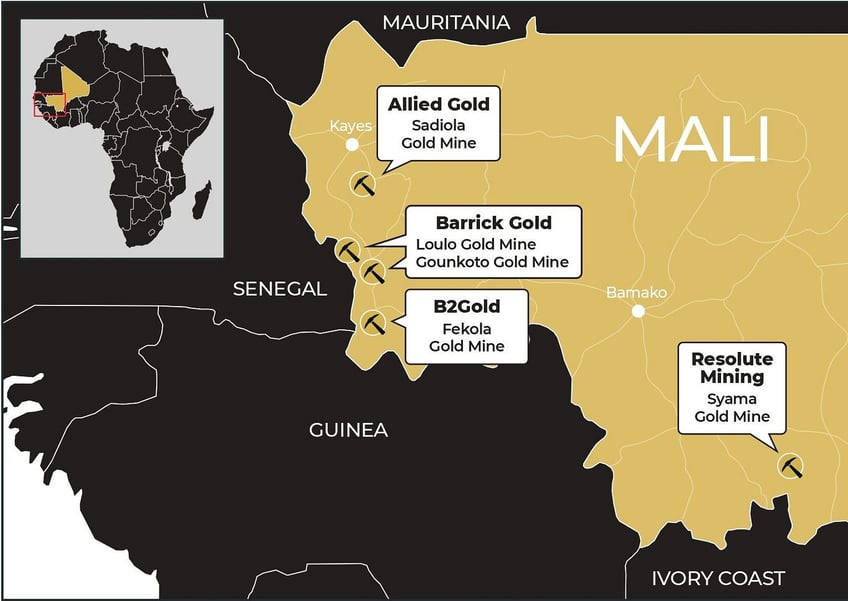

This week, according to Reuters on January 14th, Malian authorities seized three tons of gold from Barrick’s Loulo-Gounkoto mine, valued at $245 million. The seizure follows the government’s push to renegotiate mining contracts under new laws, claiming a larger stake in operations. In response, Barrick temporarily shut down the mine, which produced 547,000 ounces of gold in 2023—14% of its global output.

The Conflict’s Roots

Since the mine opened in 2005, Mali has held a 20% stake, with the remaining 80% owned by Rangold Resources, which Barrick acquired for $6.5 billion in 2018. Mali’s new military government, established after coups in 2020 and 2021, argues the company owes $500 million in back taxes and demands greater control under updated mining codes.

Escalation and Arrests

Tensions have intensified. In December, Malian authorities detained four senior Barrick executives, with CEO Mark Bristow facing allegations of money laundering. Meanwhile, Barrick has offered $370 million to resolve the tax dispute and seeks arbitration.

Broader Implications

This is not an isolated case. Mali has pressured other mining firms, detaining executives and demanding higher payments. Recent settlements include Resolute Mining’s $160 million tax resolution and deals struck by Allied Gold Corp. and B2Gold Corp.

Economic Impact

Barrick’s operations contribute 10% to Mali’s GDP, underscoring the mine’s critical role in the country’s economy. However, the ongoing standoff risks long-term consequences for both Mali and foreign investors.

What’s Next?

Continues here

Free Posts To Your Mailbox