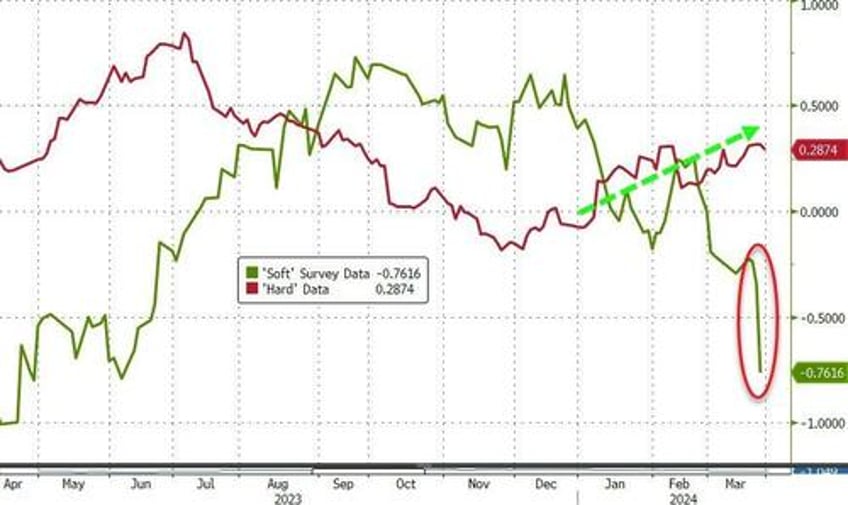

'Hard' data has been soaring since the start of the year - as 'soft' data collapses - so all eyes are on this morning's Manufacturing PMIs (surveys) for an end to that trend.

Source: Bloomberg

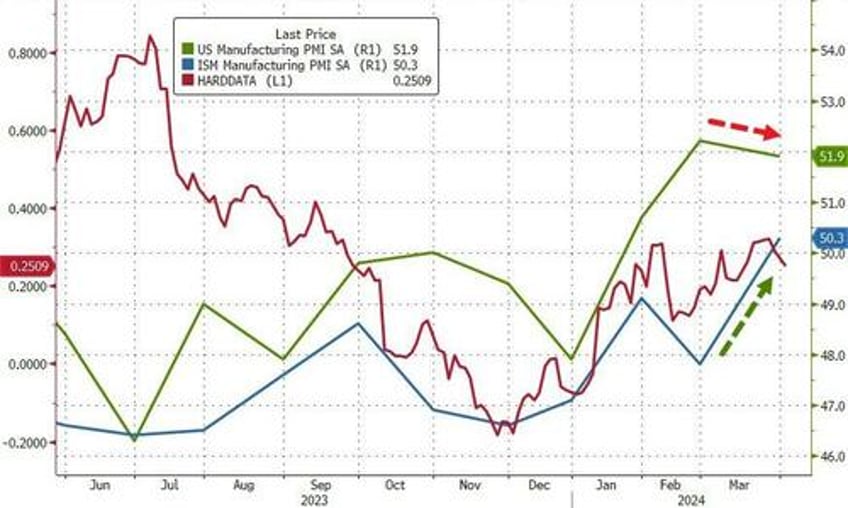

But, of course, there is normally something for everyone in this data as last month saw ISM's data tumble while S&P Global's soared. Both were expected to improve marginally in March final data today.

ISM's Manufacturing PMI surprised to the upside, rising from 47.8 to 50.3, better than the 48.4 expected (breaking a 15-month streak below 50).

But, S&P Global's US Manufacturing PMI disappointed, falling from its 'flash' print of 52.5 to 51.9 - also down from the final print of 52.2 in February (with prices .

Source: Bloomberg

However, a common theme from both surveys was that of soaring prices!!

S&P Global noted that higher oil and raw material costs, plus increased transportation rates, reportedly added to cost burdens at the end of the first quarter... and the impact of rising labor costs was mentioned as a factor pushing up selling prices at a number of manufacturers.

Employment remains in contraction for the sixth straight month and Prices Paid surged to its highest since July 2022...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“The final reading of the S&P Global Manufacturing PMI signaled a further encouraging improvement in business conditions in March, adding to signs that the US economy looks to have expanded at a solid pace again in the first quarter.

“A key development in recent months has been the broadening-out of the upturn from services to manufacturing, with reviving demand for goods driving the fastest increase in factory production since May 2022. Jobs growth has also picked up as firms boost capacity to meet demand. Rising capex spending has likewise buoyed orders for machinery and equipment, in a further sign of firms gaining confidence in the outlook.

But the 'improvement' comes at a cost:

“The upturn is, however, being accompanied by some strengthening of pricing power. Average selling prices charged by producers rose at the fastest rate for 11 months in March as factories passed higher costs on to customers, with the rate of inflation running well above the average recorded prior to the pandemic.

Most notable was an especially steep rise in prices charged for consumer goods, which rose at a pace not seen for 16 months, underscoring the likely bumpy path in bringing inflation down to the Fed's 2% target.”

So slower growth and much faster inflation - that does not sound like a recipe for rate-cuts... in fact quite the opposite.