Credit card debt carries a hefty bill in America, and falling behind on payments can be extremely costly for cardholders.

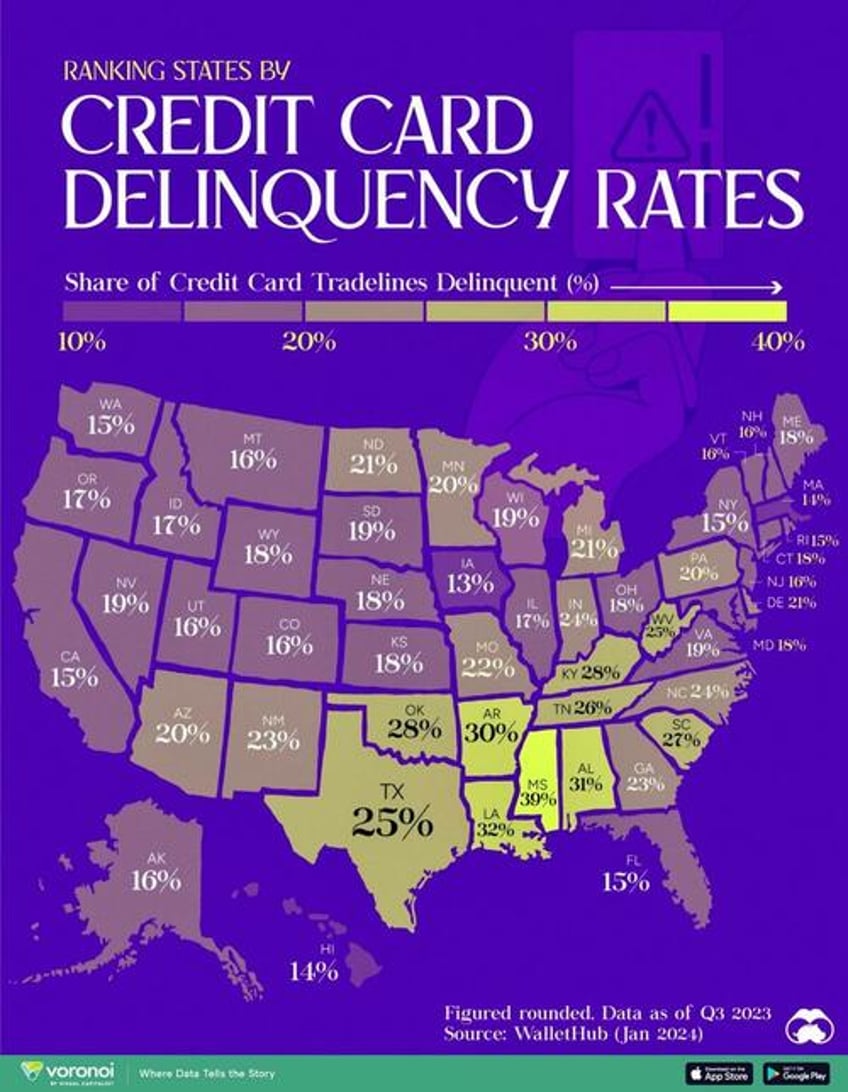

This graphic, via Visual Capitalist's Marcus Lu, shows credit card delinquency rates across 50 U.S. states, as of Q3 2023. This data comes from a WalletHub study published in January 2024.

Which States Have the Lowest and Highest Delinquency Rates?

Credit card delinquency is when a cardholder falls behind on required monthly payments. Credit agencies are often notified after two months of delinquent payments.

WalletHub examined proprietary user data on the average number of delinquent credit card tradelines—also known as credit accounts—across states. Here they are from lowest to highest:

| Rank | State | Share of Credit Card Tradelines Delinquent (%) |

|---|---|---|

| 1 | Iowa | 12.9 |

| 2 | Massachusetts | 13.9 |

| 3 | Hawaii | 13.9 |

| 4 | Rhode Island | 14.7 |

| 5 | Washington | 14.7 |

| 6 | Florida | 14.8 |

| 7 | New York | 14.9 |

| 8 | California | 15.1 |

| 9 | New Hampshire | 15.5 |

| 10 | Alaska | 15.6 |

| 11 | New Jersey | 15.6 |

| 12 | Colorado | 15.7 |

| 13 | Utah | 15.8 |

| 14 | Vermont | 16.1 |

| 15 | Montana | 16.1 |

| 16 | Illinois | 16.5 |

| 17 | Oregon | 16.6 |

| 18 | Idaho | 17.0 |

| 19 | Ohio | 17.5 |

| 20 | Connecticut | 17.8 |

| 21 | Maine | 18.0 |

| 22 | Nebraska | 18.1 |

| 23 | Wyoming | 18.1 |

| 24 | Maryland | 18.4 |

| 25 | Kansas | 18.4 |

| 26 | Wisconsin | 18.5 |

| 27 | Virginia | 18.7 |

| 28 | Nevada | 19.1 |

| 29 | South Dakota | 19.3 |

| 30 | Arizona | 19.8 |

| 31 | Minnesota | 19.8 |

| 32 | Pennsylvania | 20.2 |

| 33 | Michigan | 20.9 |

| 34 | North Dakota | 21.3 |

| 35 | Delaware | 21.4 |

| 36 | Missouri | 22.4 |

| 37 | New Mexico | 22.6 |

| 38 | Georgia | 23.1 |

| 39 | North Carolina | 24.0 |

| 40 | Indiana | 24.3 |

| 41 | Texas | 24.7 |

| 42 | West Virginia | 25.2 |

| 43 | Tennessee | 26.2 |

| 44 | South Carolina | 26.9 |

| 45 | Kentucky | 27.6 |

| 46 | Oklahoma | 28.2 |

| 47 | Arkansas | 30.1 |

| 48 | Alabama | 30.5 |

| 49 | Louisiana | 31.7 |

| 50 | Mississippi | 39.1 |

No state had credit delinquency rates of less than 10%, with Iowa coming the closest at 12.9%.

That puts Iowa ahead of wealthier states like Massachusetts (13.9%), Washington (14.7%), and New Hampshire (15.5%).

At the bottom end was Mississippi, which had 39% credit delinquency rates to end 2023. That’s well ahead of the next-lowest states Louisiana (31.7%) and Alabama (30.5%).

It’s notable that the American South had higher rates of delinquency almost across the board. The five states with the highest rates of credit card delinquency are all located in the southeastern region of the country, and Texas had a higher delinquency rate (25%) than other majorly populated states like Florida (14.8%) and New York (14.9%).