Submitted by QTR's Fringe Finance

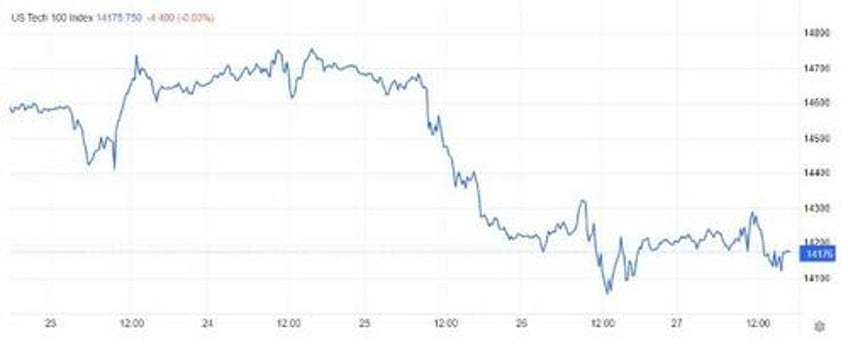

If there's one thing to say about the past week, it's that stocks had considerable difficulty finding a bid. Despite several impressive earnings reports from companies like Meta and Amazon, both of which met or exceeded expectations for the most part, the NASDAQ sold off each day it opened higher.

For me, this comes as no surprise. I've been writing over the last year that I expect a massive re-rating of tech stock valuations, particularly since the Federal Reserve began aggressively hiking rates. I thought valuations were already inflated before the Covid-19 pandemic flooded the system with trillions in liquidity, further inflating these valuations. This is one reason I recently penned an article titled: The Stock Market Sits On The Edge Of The End Of The World

Just last week, a conversation with my good friend Larry Lepard introduced me to a bullish scenario I hadn't yet considered. I have been steadfast in my belief that the market needs to decline significantly before it can rise again, and that this process will likely take years. However, Larry and I discussed on my latest podcast an alternative view—that the market could actually move higher from here. Although I find it unlikely, it's a perspective worth considering.

Last week I also released more than 30 pages from Larry outlining his take on the macroeconomy, gold, bitcoin and the state of the U.S. dollar. You can read Part 1 of his letter, which talks about the U.S. fiscal doom loop, here and Part 2 of his letter, which describes 7 reasons why the Fed must print trillions again, here.

📍 Also, for those who are not yet subscribers, you can take 50% off a subscription for life by using the coupon below: Get 50% off forever

As we look to the week ahead, it's hard to deny that market sentiment is souring. When even robust earnings reports can't buoy the NASDAQ, and we teeter on the brink of geopolitical tensions while facing dwindling strategic petroleum reserves, optimism becomes scarce.

Even the staunchest CNBC fan would find it difficult to argue that stocks should go higher from here in the short to mid term.

The questions that remain for me are many fold:

How low will bonds go?

How high will yields rise?

Can the U.S. dollar hold up?

Is bitcoin better than gold? Where are both going?

Will the Fed maintain control of the bond market?

When will the real estate sector crash?

Just how much pain are we in for?

As I noted on my podcast, I believe we are on the cusp of a major credit crisis and an impending market crash. It's mathematically inevitable, in my view, with rates at 5% and having gotten there faster than anytime in recent history.

Last week, in addition to speaking with Larry Lepard, I published two excerpts from his 30-page letter on the state of the global economy and market.

As I wrote a couple weeks ago, the old adage used to be that the stock market takes the stairs up and the elevator down. Now, with the increased liquidity, the market has taken a rocket ship up—meaning that when the elevator comes down, it won't be an orderly ride down 5 floors on Central Park West. It'll be like when that Red Bull guy did the 71,500 foot jump from the stratosphere.

And so a new week beckons, bringing with it more questions than answers.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.