The core twin hypotheses behind I-System Trend Following and this newsletter are that,

- Market trends are far and away the most potent drivers of investment performance, and that

- Systematic trend following is the most reliable way to capture value from trends.

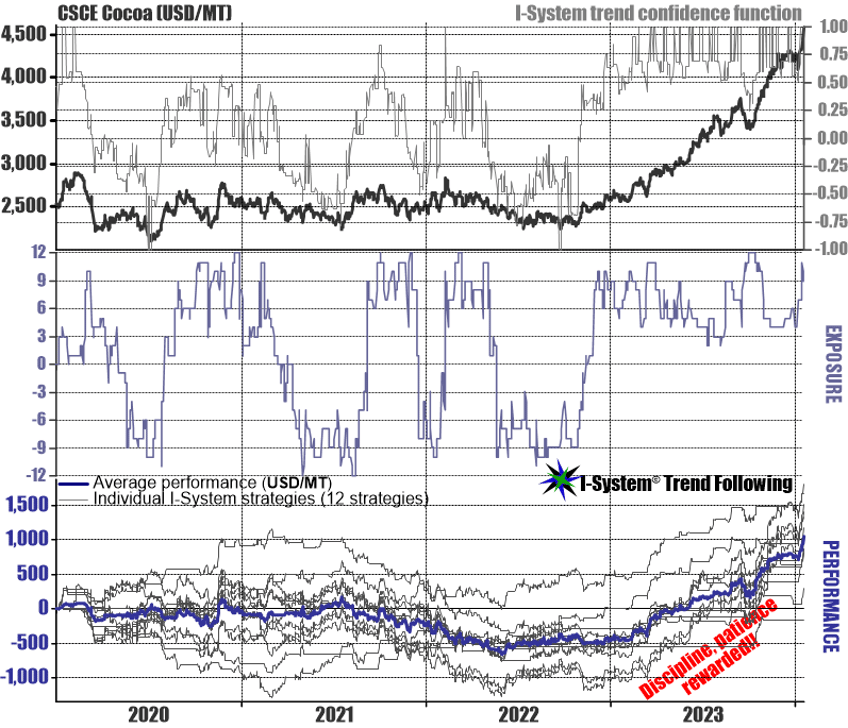

But as I mentioned before, getting the best long-term results out of systematic trend following also requires iron discipline and a great deal of patience, because while markets do move in trends, we've no way to predict when trends might emerge, how long they could last nor how high (or low) they will push the price. The latest example illustrating all this is the Cocoa market, one of the few markets that have trended during the last 12 months. Last Friday, Cocoa reached a new historical high at $4,583/MT. The chart below tells the story:

Top chart shows the price of CSCE Cocoa (USD/metric ton) overlaid with the I-System trend confidence function, fluctuating between -100 (certainty that we are in a downtrend) and 100 (certainty that we're in an uptrend). The middle chart shows the total net exposure of the 12 trading strategies we use to track Cocoa futures, fluctuating between fully short (-12) and fully long (+12). Every change in value along that chart is the result of a buy or sell signal generated by the I-System. Bottom chart shows the results in USD per metric ton of Cocoa: the performance of each of the 12 strategies and their average performance.

If we look at the start point and end point, the trading looks like a success: in just over 4 years, the strategies generated a profit of $1,044 per metric ton on average, or $10,440 per contract traded. However, this windfall only started to accrue from mid-2022. If there is one thing that the above chart should make clear is that it had a real cost in terms of risk, discipline and patience. Trading Cocoa hasn't been great fun during the first 2+ years, and at one point we had about $600 loss per metric ton, or $6,000 per contract. That may seem tolerable, but the fact this loss had been accumulating for more than 2 years makes this challenging from the psychological point of view.

The versatility of trend following

The great advantage of systematic trend following is that once we've mastered the art, we can use it in any market, allowing us to take advantage of the only free lunch available in investment speculation: diversification. Trend following is the same game whether we're trading Gold, Oil, Soybeans, FX pairs, Treasury bonds or Cocoa. I literally don't know anything at all about the supply and demand fundamentals of the Cocoa market. In spite of that I can trade Cocoa futures with the same confidence as any other market and I have done so for many years. Again, in addition to quality strategies, the key is discipline and perseverance.

Incidentally, the above graph also tells us something important about risk management. Our losses extend to a bit over $1,000 per ton at various times (about $10,000 per contract). For illustration, at the price of $2,500/MT each contract is worth $25,000. However, when trading futures, we don't need to pay the full price for the contract, but only the maintenance margin which tends to range between 2% and 10% of the value of the underlying contract. This is how some traders get themselves in trouble and it is also the reason why many investors mistakenly believe that trading futures is very risky. It is very risky, but only if you use too much leverage.

Suppose that the maintenance margin for a contract worth $25,000 is 'only' $2,500. If you had $10,000 in your risk budget you might be tempted to buy 4 contracts (4 * 2,500). But the historical performance in the above example tells us that, regardless of how much leverage we can have (because the margin requirement is low), we should reserve $10,000 risk budget for each contract of Cocoa we plan to trade (more if we only trade 1 contract, less if we trade multiple contracts). This is one of the valid methods of establishing your position limits. The major part of trading discipline is to never exceed your position limits. Instead, you maintain your risk profile and continue to position risk for those windfalls which arrive when they arrive. Until then, the job is to maintain sufficient dry powder to be able to take advantage of it.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports. In addition to Cocoa, we track more than 200 financial and commodity markets, generating daily trend following signals. Feel free to request a one month free trial - no strings attached nor hoops to jump to cancel.