All investment strategies fall in one of these two categories. Which one's better? Surprise: it's trend following.

In his recent podcast, Joris Bastien, founder and CEO of Quantraxia rightly summed up the universe of investment strategies: "... however you look at it, investment strategies - quantitative or not - fall into two broad categories: trend following and mean-reversion." He explains each, in turn.

- Mean-reversion strategies, also called "short volatility" are based on the philosophy that when values diverge away from their historical norms, they subsequently revert to them (to the mean). Such strategies include value investing, pairs-trading [arbitrage], and options selling.

- Trend following is also called "long volatility" or divergence strategy based on the idea that market equilibriums change over time and that this transition can be captured. In this category we have CTAs (commodity trading advisors), and any kind of momentum strategies.

In essence, Bastien articulates the same school of thought that I had embraced already in the 1990s and explains that trend following is, "positively skewed, with many small losses and fewer large wins, with low-to-medium turnover. Trend following strategies exhibit higher volatility; ... the performance of trend following is highly cyclical and will definitely test your patience." I think that Bastien's short podcast provides excellent and very valid food for thought and is well worth its 7 minutes. You can find it at this link.

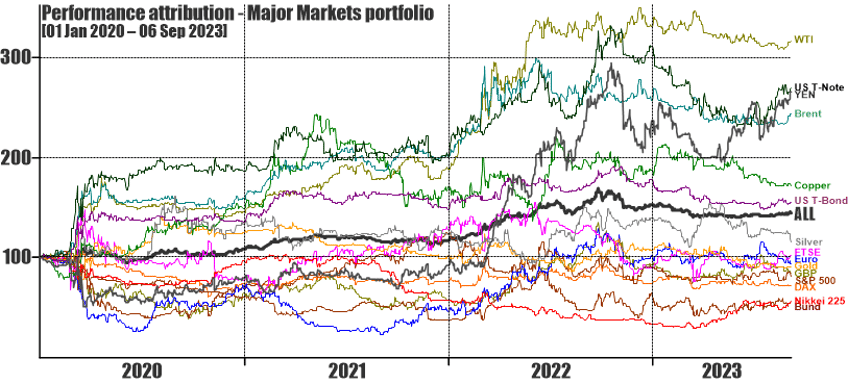

In the past, in explaining my own approach, I said many times that the question is not whether I-System Trend Following works. The question is whether markets move in trends. In Bastien's formulation, are they mean-reverting or do they exhibit shifting equilibriums over time? This report now has a nearly 4-year continuity and in that time, the 15 markets we track have begun to crystallize an answer, discernible in the chart below, showing the performance of 180 strategies in our Major Markets portfolio (12 trading strategies per market, each with the same initial risk budget):

The negative performance of our strategies is more limited and its bottom extent has remained relatively horizontal (our worst losses haven't exceeded 70% of the risk budget in any market over the past 4 years), while its upper extent has an upward-trending bias with gains in four markets exceeding 100% of their risk budget. While we use different trading strategies in each market, they are all based on the same set of trend following algorithms.

Mean-reversion in the markets: it's not even a thing

Of course, this observation doesn't represent a very large sample, nor a very long time interval. Still, the reason why I believe it is nonetheless valid, is that it conveys the result of a large number of strategies and signals generated in real time, not a backtest.

Last year however, researchers at Goldman Sachs analyzed markets for evidence of mean-reversion based on over 140 years' worth of stock market data. Their conclusions validated the trend following approach in a very important way. As cited by Lance Roberts, Goldman’s lead analyst Sam Ro wrote that, “While valuations feature importantly in our toolbox to estimate forward equity returns, we should dispel an oft-repeated myth that equity valuations are mean-reverting."

The report concludes: "We have not found any statistical evidence of mean reversion.” Ro’s analysis found that the mean-reversion significance of the Schiller CAPE metric since 1881 is very low, at just 26%. That conclusion would very much corroborate the findings of Dimson, Marsh and Staunton on momentum investing, which I summarized in my article, "Tesla and the power of momentum investing." If you read it, you'll discover the staggering outperformance of a strategy of simply picking last year's winners and dumping the laggards, tested in 17 global stock markets with data stretching back over 100 years. That's a lot of empirical evidence that most of the time, trend following/momentum works and value investing doesn't.

Sign up for a 1-month free trial of I-System TrendCompass!

One of the best trend following newsletters on the market, I-System TrendCompass delivers consistent, dependable and effective decision support daily, based on I-System trend following strategies covering over 200 key financial and commodities markets with no dilution in quality or focus.

- Cut the information overload

- Get real-time CTA intelligence in seconds per day

- Never miss a major trend move

- Navigate trends profitably, with confidence and peace of mind

One month test-drive is always on us. Sign up for a 1-month FREE trial by e-mailing us at

To learn more, please visit I-System TrendCompass page.