Published at Theya — the world's simplest bitcoin self-custody solution.

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

Cliff-Notes:

- The National Center for Public Policy Research proposed that Microsoft evaluate bitcoin as an inflation hedge to protect its assets, given U.S. inflation and risks in traditional bonds.

- Bitcoin's significant outperformance compared to corporate bonds highlights its potential as an inflation-resistant asset, even with a minimal allocation, to stabilize Microsoft's $484 billion in assets.

- With Microsoft’s institutional investors like BlackRock favoring bitcoin, and a simple majority required for proposal approval, significant shareholder support could propel this forward in Microsoft's December 10th vote.

Check out today's Theya Research post in video form 👇

Microsoft's latest DEF 14A filing includes a proposal by the National Center for Public Policy Research for the company to evaluate bitcoin as a potential hedge against inflation on its balance sheet. This is a fascinating shift in traditional treasury strategy, especially during inflationary periods where corporations not only need to generate profits but also preserve the purchasing power of those profits.

In the "Bitcoin Diversification Assessment," the proposal emphasizes that the average inflation rate in the U.S. has been 5.03% over the past four years, with a peak of 9.1% in June 2022. Notably, some studies estimate the true inflation rate could be nearly double the CPI’s reported rate, suggesting traditional assets like U.S. government securities and corporate bonds may not be keeping pace with inflation—thus potentially eroding the value of Microsoft's $484 billion in assets (primarily allocated to these securities).

Over a five-year span, bitcoin’s price appreciated by 604%, beating the total return on US corporate bonds by an impressive 600%. Such performance reflects bitcoin’s resilience as an asset capable of maintaining value in periods where traditional assets falter:

Moreover, Microsoft’s heavy allocation to corporate bonds and U.S. Treasuries presents real risks, especially under the Federal Reserve’s rate-hike regime during 2022 and 2023. Despite their reputation as “safe” investments, corporate bonds and Treasuries suffered substantial losses due to duration-related price declines amid rising interest rates, demonstrating that these assets are not risk-free. As the Fed lowers rates, eventually to levels below inflation to reduce the real federal debt burden, these bonds will likely fail as effective hedges against inflation. Without additional diversification into an asset like bitcoin, Microsoft’s balance sheet will continue to be vulnerable in both rising and falling rate environments.

The example used in the proposal is MicroStrategy, a public company that added bitcoin to its balance sheet 4 years ago, which saw its stock outperform Microsoft’s by 313% this year. MicroStrategy, despite its smaller size, leveraged bitcoin’s value appreciation to outperform. Additionally, BlackRock, Microsoft’s second-largest shareholder, offers a bitcoin ETF, reflecting institutional support for bitcoin’s inclusion in diversified portfolios.

MicroStrategy is up 1702% since adopting bitcoin as a treasury reserve asset on August 11th, 2020. Over that same span, the S&P 500 is up 75.5%, and Microsoft is only up 112%. It is inarguable that the feedback loop of bitcoin adoption and shareholder value for large, publicly traded companies is rocket fuel for your company's value:

Microsoft’s Board, however, opposes this proposal, recommending a vote against it. They assert that the company’s Global Treasury and Investment Services team has already evaluated cryptocurrencies, including bitcoin, and that further assessment is unnecessary. The Board highlights that they aim to protect against “significant economic loss from rising interest rates” through stable and predictable assets. If that were the case, what happened when average US corporate bond total returns plummeted 21.9% in the middle of the Fed's rate-hiking regime in 2022?

This is shortsighted. Given bitcoin’s historical outperformance against bonds in inflationary conditions, allocating even just 1% of Microsoft’s assets to bitcoin could hedge against inflation without disrupting liquidity. In ignoring bitcoin’s potential, the Board could inadvertently risk shareholder value by relying on bonds that may fail to match real inflation rates. If Microsoft allocates 1% of its $484 billion in assets, this would amount to $4.84 billion. Microsoft could purchase approximately 70,700 bitcoin at the current price of $68,450.

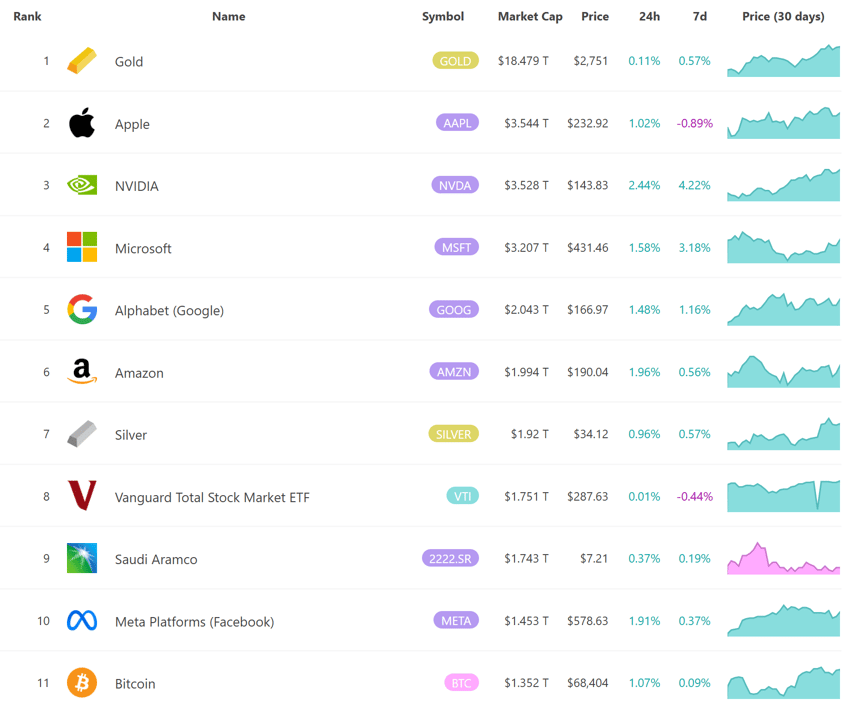

Microsoft, as the world’s fourth-largest asset by market cap at $3.205 trillion, stands just behind NVIDIA, Apple, and Gold. If Microsoft were to allocate even 1% of its $484 billion in total assets to bitcoin, they could acquire approximately 70,700 bitcoin at the current price of $68,450. The potential shareholder returns from such an allocation would be monumental, likely sending shockwaves throughout corporate finance. This move would spark a race for companies worldwide to consider bitcoin for their balance sheets, driving an unprecedented wave of bitcoin adoption:

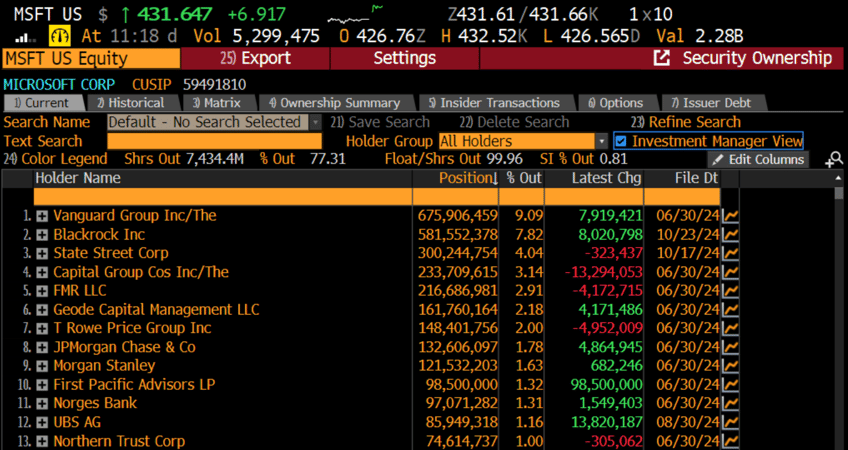

On July 25, 2024, they had 81,346 registered shareholders according to their 2024 Annual Report. Microsoft currently has 7.434 billion shares outstanding. Institutional shareholders make up 71.74% of ownership in Microsoft, with insider and retail investors holding the remaining shares.

The largest institutional Microsoft investors are Vanguard at 9.09%, BlackRock at 7.82%, State Street at 4.04%, Capital Group at 3.14%, Fidelity at 2.91%, and Geode Capital Management at 2.18%. Vanguard is avowedly against bitcoin and doesn't offer ETFs for it, while BlackRock, State Street, Fidelity, and Geode all offering or holding bitcoin and/or the ETFs in one way or another. Additionally, Capital Group is the largest institutional shareholder of MicroStrategy at 9.9% of shares outstanding, so they clearly have an interest in allocating to public companies that have sizeable bitcoin exposure, and will likely vote in favor.

That means 20.09% of MSFT shareholders have a very high likelihood of voting in favor of Microsoft investing in bitcoin. Since only a simple majority is required for this measure to be passed, only 30% of MSFT shareholders comprised of both retail and institutions have to vote yes in addition to these most-likely players, and the motion proposal will be passed:

Though every cycle brings unique conditions, this cycle promises exponential reacceleration in both bitcoin adoption and price growth, positioning early corporate adopters for outsized returns.

Call your Microsoft shareholder friends, big and small, and get out the vote. The deadline for receiving an email copy of the MSFT voting materials is November 26th, and the vote will take place on December 10th.

It will be the second-most important vote for Q4 of this year, behind only the US election in 11 days. Share them this post and other reading materials about bitcoin corporate treasury adoption, and the massive upside potential and limited risk associated with a 1% allocation to a corporate balance sheet.

Together, we can orange pill the world's 3rd-largest public company.

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.