[Originally published on Alex Krainer's Substack]

On the morning of 12 January 2024, the United States and Britain, with support from Australia, Bahrain, Canada, and the Netherlands, launched a series of missile and airstrikes against some 60 Houthi (Ansar Allah) targets across Yemen in an attempt to put an end to their attacks on ships in the Red Sea. In spite of claiming self-defence, the “freedom and democracy” enforcement squad conducted the attacks unilaterally, without a UN Security Council resolution. In doing so, they’ve exacerbated the risk of an escalation to a wider regional war with unpredictable consequences.

The escalation could have a severe impact on oil prices, dramatically worsening the energy crisis in the West. In fact, this was among many observers’ concerns and on Saturday, 13 January, a producer with Sputnik News reached out to me to comment on the developments. My response wasn’t exactly standard fare commentary, but it was based on my nearly 30 years’ experience in the commodities markets.

To be sure, geopolitical events in West Asia could push oil prices much higher, but we should not assume that they necessarily will. There could be a spike upward in the short term, but whether the upward pressure on prices will be sustained is an open question. This will depend on the way the situation evolves. If tensions escalate, we'll almost certainly see oil prices increase sharply.

First, ignore the hype

In these situations, market analysts and the commentariat tend to generate a blizzard of extraordinary predictions and hype, but we should be cautious with any sensational interpretations of what’s to come: we’ve seen crisis events before.

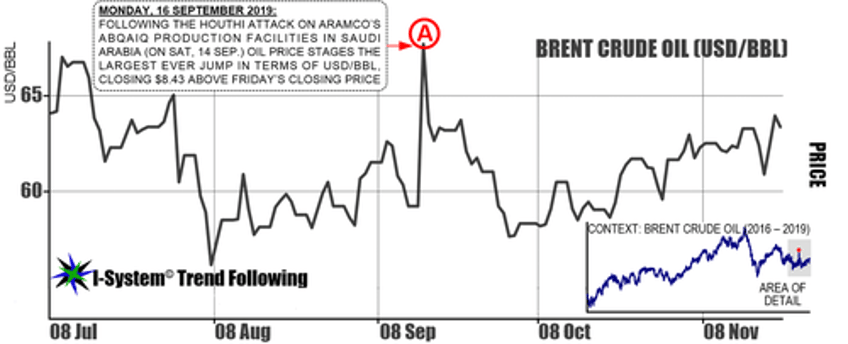

For example, on Saturday, 14 September 2019 a missile attack on Saudi Arabia caused substantial damage to Aramco’s Abqaiq oil production facilities. The following Monday, Brent crude oil experienced the largest-ever one-day price jump, reaching $70.32 during the day and closing at $67.78 - $8.42/bbl above previous Friday’s closing price ($59.25/bbl). This event is marked as (A) in the chart below. Fearing further escalations, many market participants expected that the price would rapidly move toward $100/bbl but this did not happen. Instead, the price quickly dropped back below $60/bbl and continued to fluctuate between the high $50s and low $60s for the rest of the year:

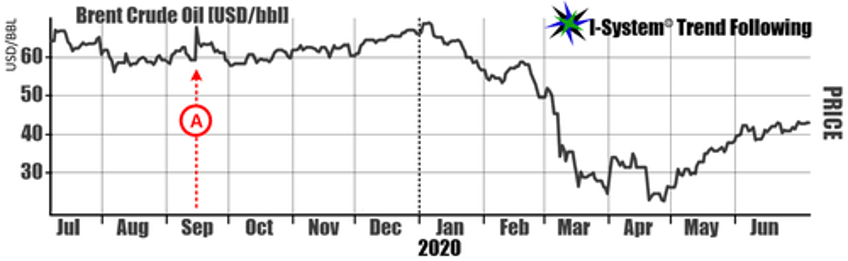

In 2020, entirely different circumstances evolved with the pronouncement of the Covid 19 pandemic, which had a different impact on oil prices altogether:

Seen in this perspective, the September 2019 attack on Aramco facilities appears only as a blip on the historical price chart. For traders who got taken up by the day’s hype, anticipating a rapid ascent toward $100/bbl probably left them with crippling losses.

Prediction is difficult

As Niels Bohr, the nobel laureate in physics and father of the atomic model said, “Prediction is very difficult, especially if it’s about the future.” Bohr had it exactly correct. In addition to geopolitics and the supply and demand economics, oil prices are determined by a very complex confluence of factors that are almost impossible to account for.

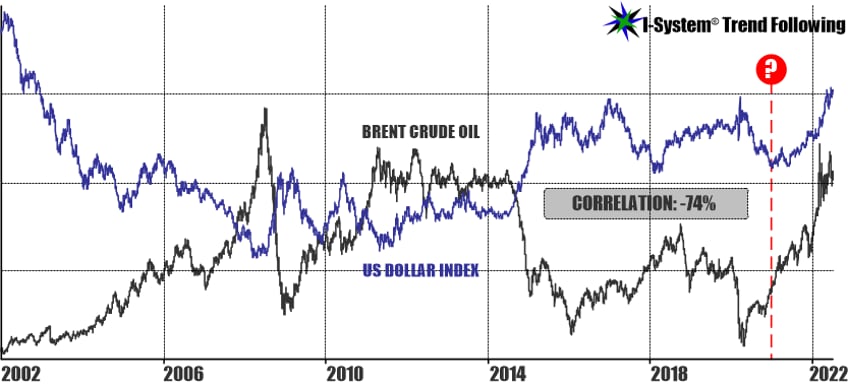

During most of the last 20+ years, the most important single factor influencing oil prices has been the US dollar which has had a very strong inverse correlation to oil prices:

We can see that this correlation has broken down after 2021 (marked “?” in the chart), but it nevertheless tells us an important story: that of all the factors impacting oil prices, the US dollar has been by far the most important one. This implies that elements like US economic performance, employment, inflation, Federal Reserve policy, and interest rates play a much greater role in determining the price of oil than do the discernible supply/demand economics and even geopolitics.

How to navigate the roller coaster?

Whether military escalation in the Middle East will continue to escalate remains to be seen. Furthermore, keep in mind that on Wednesday, 17 January, the grandees gathering at Davos will discuss the “Disease X” pandemic which could be on the cards in the near future. Last time we had a “pandemic,” oil prices collapsed, rather than rallying. In short, there’s no predicting what happens tomorrow, let alone weeks or months from now.

The next question is, how should market participants – investors, traders and hedgers – navigate the roller-coaster, since making predictions is out of the question? My own strong conviction is that the only way to navigate through uncertainty is through systematic trend following. I’ve posted some results of following my own advice, as I illustrated here, supported with charts.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge, no jumping through hoops to cancel. To start your trial subscription, drop us an email at

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. For more information, you can drop me a comment or an email to