As of Wednesday afternoon, Milton, a dangerous Category 4 hurricane, is set to make landfall on Florida's Central Gulf Coast near the Tampa region later tonight or early Thursday morning. The storm's path can potentially cause more than $50 billion in damage, with some estimates as high as $175 billion - or about the amount of funds the Biden-Harris team sent to Ukraine since the start of the war.

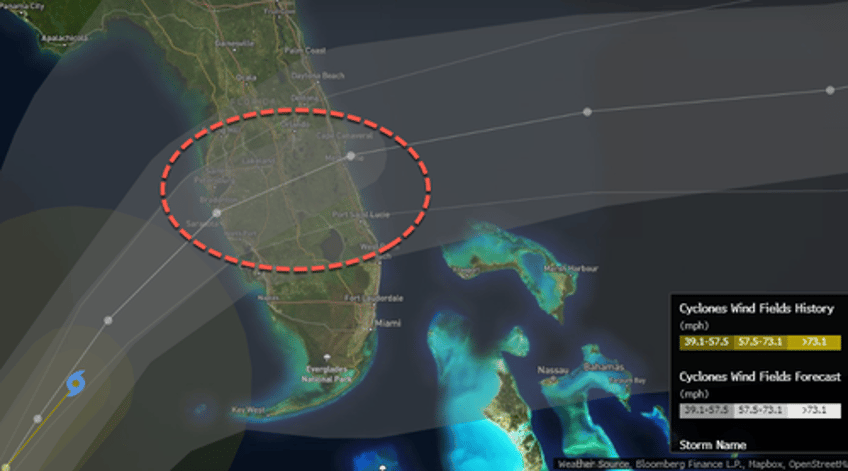

Depending on which research firm is providing the storm damage estimates, this once-in-a-century storm has the potential to generate a catastrophic storm surge of up to 15 feet and winds topping 150 mph. This storm is shaping up to be a very costly event for insurers and the government.

"While too early to make insured loss estimates, a major hurricane impact in one of Florida's most heavily populated regions could result in mid-double-digit billion dollar loss," a team of analysts led by Yaron Kinar from Jefferies wrote in a note to clients.

Kinar said, "A 1-in-100 year event is estimated by some to result in $175 [billion] in losses for landfall in the Tampa region, and $70 [billion] in losses in the [Fort] Myers region."

"Should Milton's path through the more developed Tampa region hold, potential losses could be greater," the analyst noted.

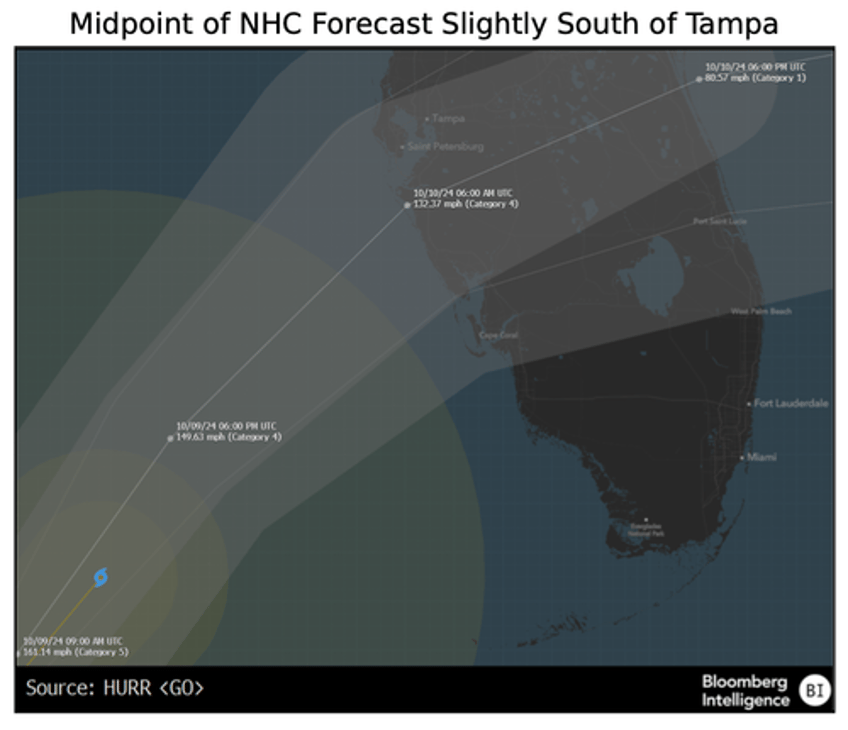

The latest update from the National Hurricane Center forecasts a massive 15-foot surge of water across the Tampa region. The storm's winds will push the wall of water inland, creating the most devastation for building structures and critical infrastructure (as well as loss of life).

In a separate report, analysts at Morningstar DBRS forecast insured losses from Milton in the range of $60-$100 billion if the hurricane directly hits the Tampa metro area. A $100 billion loss would put Milton on par with the 2005 storm called Katrina.

Bloomberg Intelligence analysts Matthew Palazola and Eric Bedell told Terminal users that losses could total around $100 billion.

Hurricane Milton remains on track to generate insurance claims in the tens of billions at least, with economic losses a multiple of that amount. The storm is likely to hit Tampa Bay as a Category 3, which isn't a worst case, but we think still puts a nearly $100 billion industry insured loss in play.

CoreLogic estimates a reconstruction cost of $123 billion for residential properties in Tampa Bay and Sarasota under a Category 3 scenario. In 2020, the Tampa Bay Regional Planning Council ran a simulation of a Category 5 hurricane impact. The council estimated residential "structural losses" across six counties of $287 billion. Still, only a fraction of this would be insured and Milton won't be Category 5 at landfall.

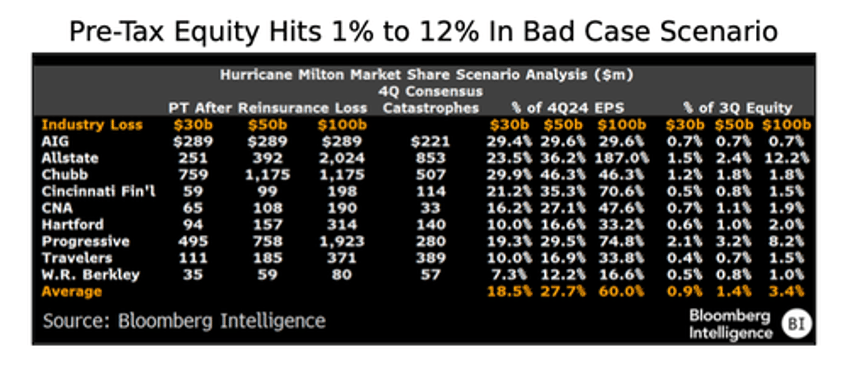

Here's more from the BI analysts on potential storm losses for insurers:

We expect a wider-than-typical gap between economic and insured losses, similar to Hurricane Helene.

Regional Insurers In Most Danger:

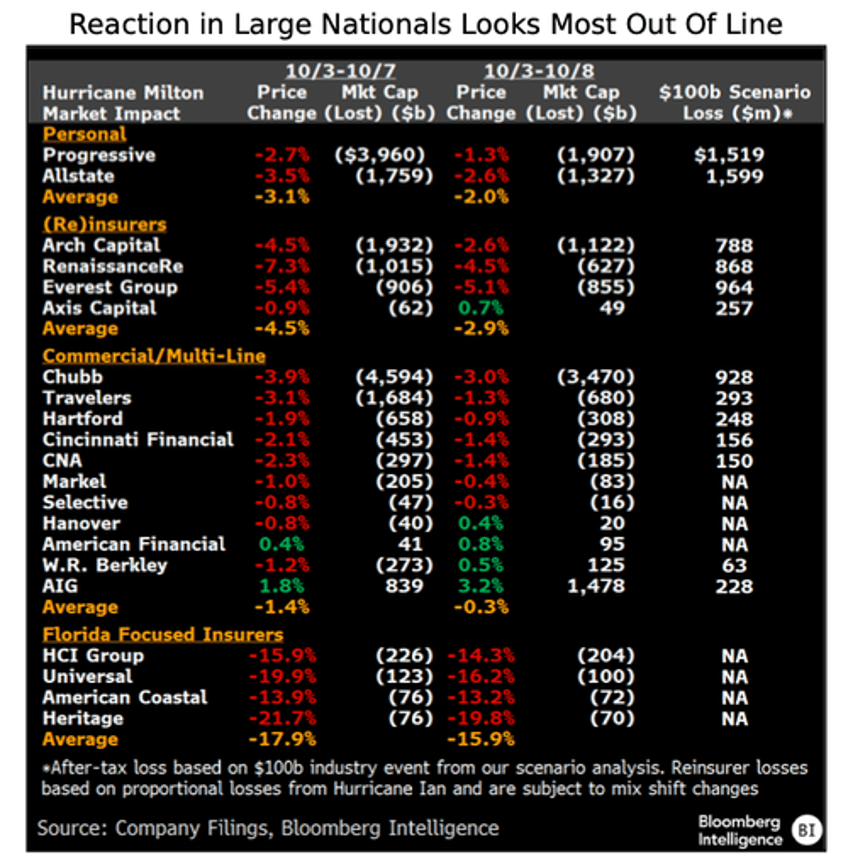

Florida's state-run Citizens, mutual State Farm and smaller regional insurers may have the most exposure to Hurricane Milton losses, based on statewide market share. Some of those Florida- focused carriers, such as Heritage and Universal, are public. Among large, public insurers, Allstate and Progressive could see the most claims, holding about 3-4% homeowners market share in the state. Still, according to our scenario analysis, even in a $100 billion event -- which we aren't predicting at this point, but is possible -- the average hit to 2024 annual EPS for BI-covered insurers is 15%. Our analysis uses industry losses of $30-$60 billion, applies those to Florida market share and accounts for reinsurance. Should a carrier not write coastal or high-value business in the state, this analysis could overstate their losses.

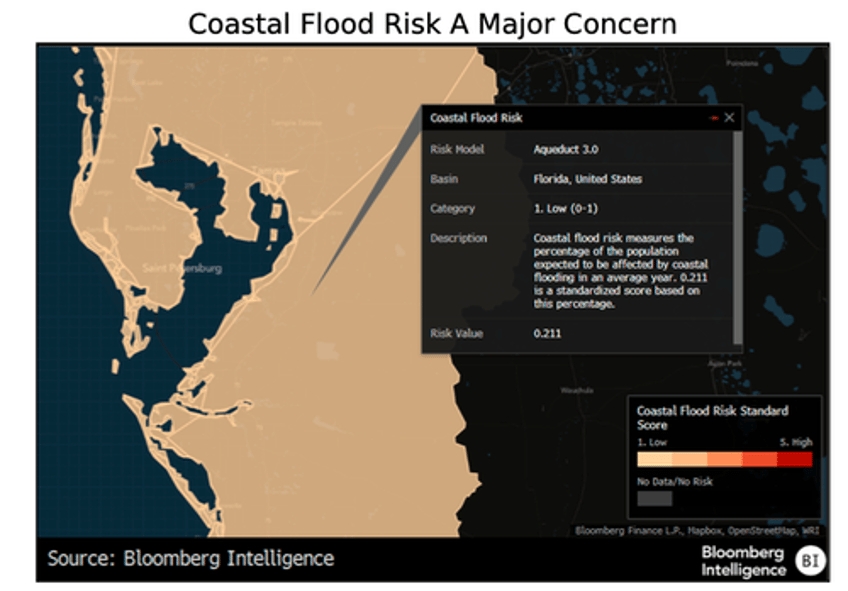

Private Insurers Avoid Flood

Milton's storm surge will likely break records but insurers should avoid most flood claims, as this peril is typically excluded from homeowners policies. Nearly all flood insurance in the US is underwritten by the National Flood Insurance Program (NFIP). The program was started in 1968 due to a lack of affordable private flood insurance and as a form of federal assistance. Take-up rates are still low. FEMA said that in parts of Florida where flood insurance is mandatory for residents with a federally backed mortgage, the penetration rate is only 46%. It's much lower where flood insurance isn't required.

Insures avoid flood since it's correlated to wind, can result in major losses and most importantly, state regulators are unlikely to let insurers adequately price for the risk as it would push up cost to consumers.

Flood Risk Expensive and Still Underpriced

The NFIP's pricing was and likely still is inadequate. In 2023 the program revamped rates and over 70% of homes saw prices go up. The NFIP's experience highlights why private insurers avoid flood. Hurricane Katrina was a major blow to the program and as of 2022, it was over $20 billion in debt. Congress has capped annual price increases for NFIP policies at 18%. Even with this intervention, flood insurance is expensive. In Florida's Hillsborough County the average cost of home insurance is about $2,500 a year (likely mispriced, given policies from the state-run insurer); adding flood insurance would increase the cost by around $1,100, over 40%.

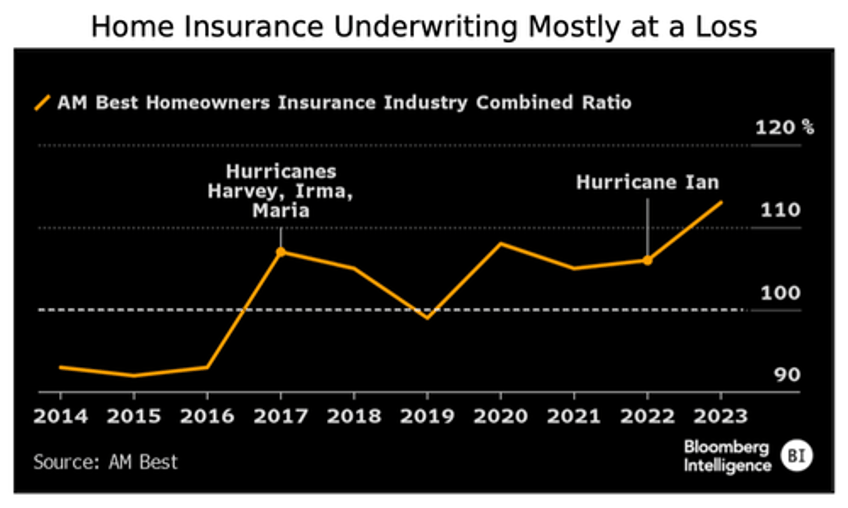

Even with flood exclusions, home insurance underwriting hasn't been profitable over 10 years. On average insurers lost 3 cents for every dollar of premium earned from 2013-23.

Market-Cap Moves Above Potential Losses for Some

Despite a rebound in insurance stocks on Oct. 8, the loss of market capitalization since Oct. 3 is still above potential losses for some, most notably Chubb. Progressive lost nearly $1.9 billion of value, bouncing back from a nearly $4 billion decline. This move is much closer to our assumption of $1.5 billion in after-tax claims for a $100 billion industry loss. The market reaction for Allstate looks in line with that scenario, but if industry claims are closer to $65 billion, the company's reinsurance would absorb more of the impact.

Bermuda (re)insurers such as Arch, Everest and RenaissanceRe likely rebounded on hopes of higher pricing. Axis exited catastrophe reinsurance in 2022, making it likely the least exposed of the group to both losses and reinsurance pricing gains.

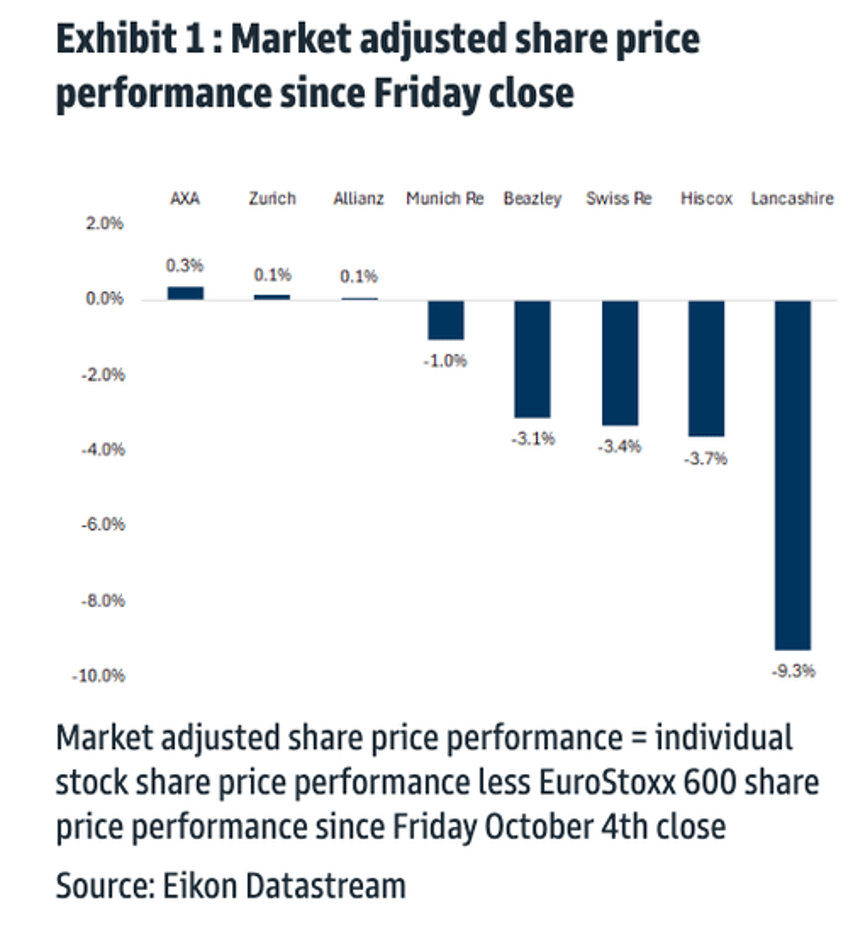

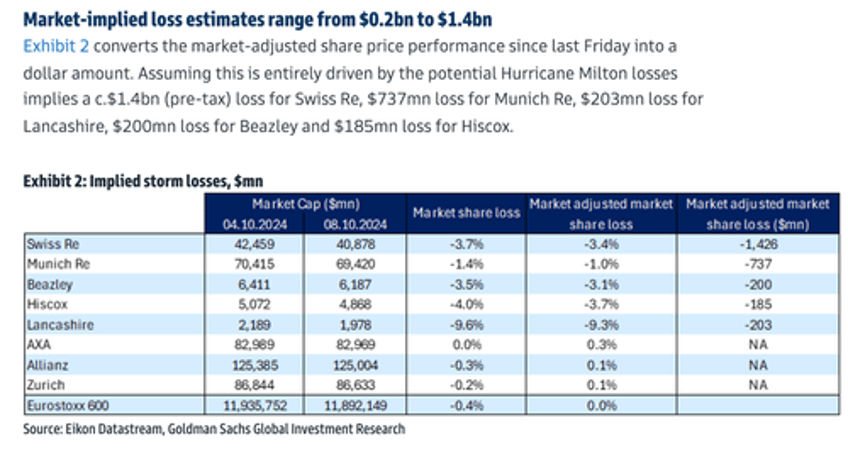

Andrew Baker from Goldman noted that stocks of global reinsurers have faced downward pressure since last Friday's close.

Baker converted market-adjusted share price performance into potential storm losses for each insurer...

Analysts at UK investment bank Peel Hunt noted today that Lloyd's of London published a realistic storm disaster scenario earlier this year that projected a $134 billion loss for the insurance sector. Lloyd's noted that this scenario was about stress testing its ability to withstand future catastrophe risks, such as the one about to play out in Florida.

On a broader view, Ryan Sweet, chief US economist for Oxford Economics, stated that about 3% of the US economy's GDP is within the storm's path, which could create a .14 percentage point drag on fourth-quarter GDP growth.