Subscribe on our website www.gmgresearch.com

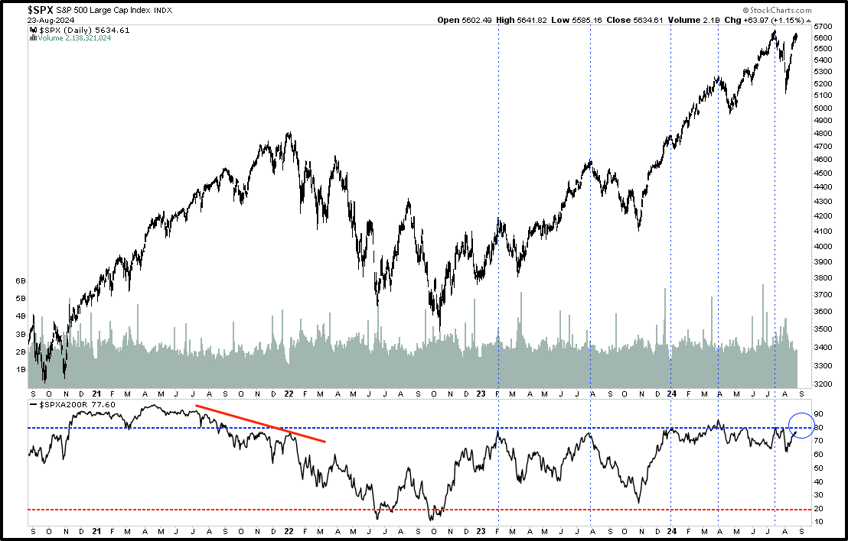

S&P 500: Breadth continues to expand. Equal weight S&P at fresh highs

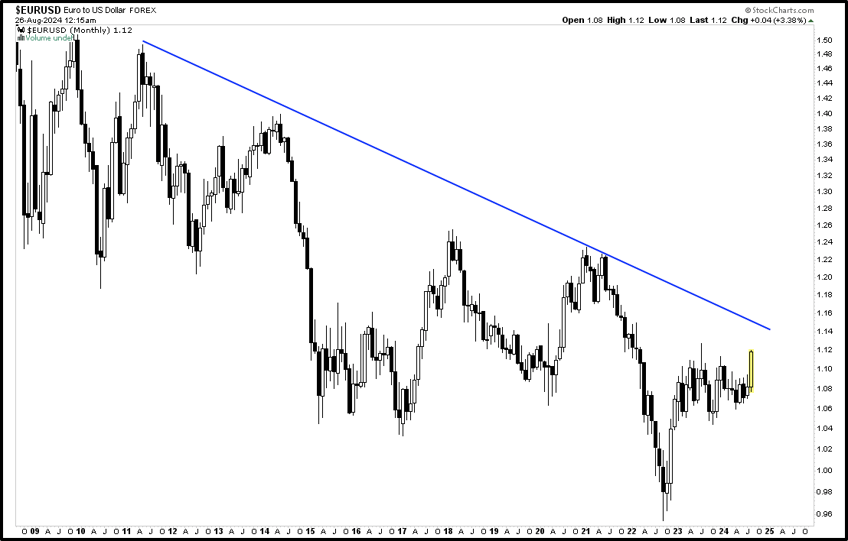

Forex: EURUSD looks bullish to 1.14

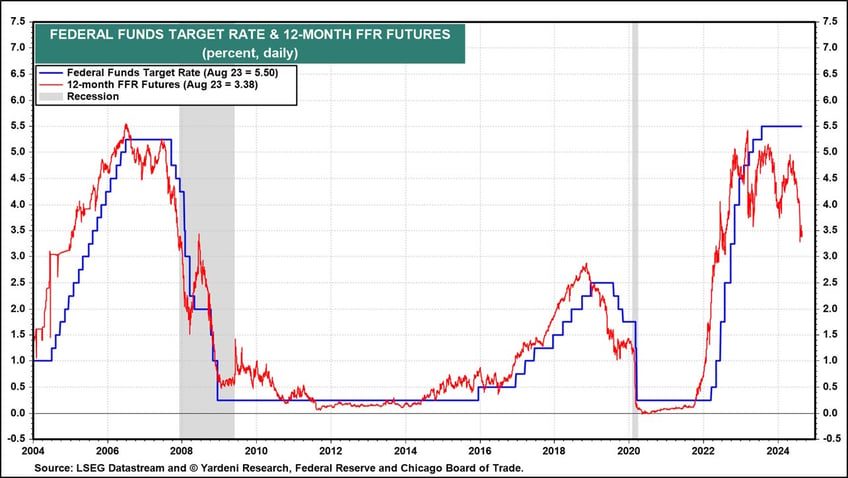

Yields: 2yr rates are giving the fed space for a rate cut or two

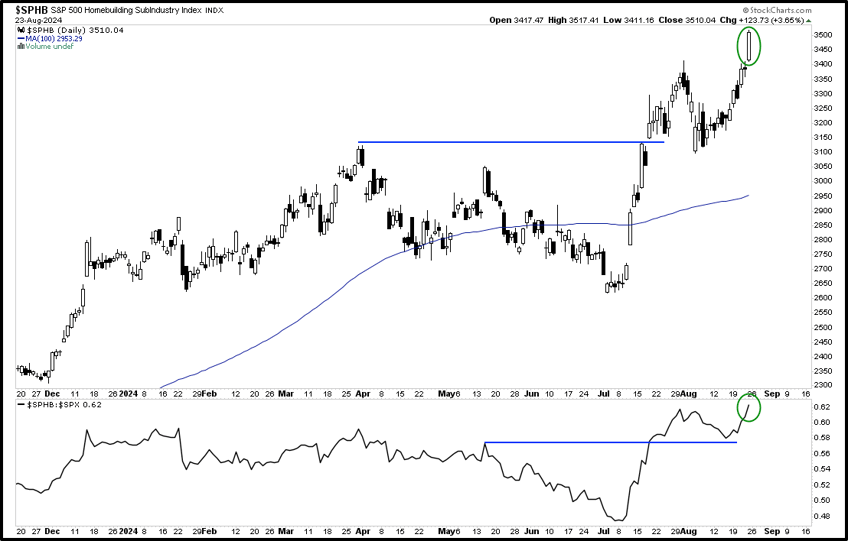

Homebuilders: DR Horton and Lennar have been incredible

Bitcoin: Continues to be resilient

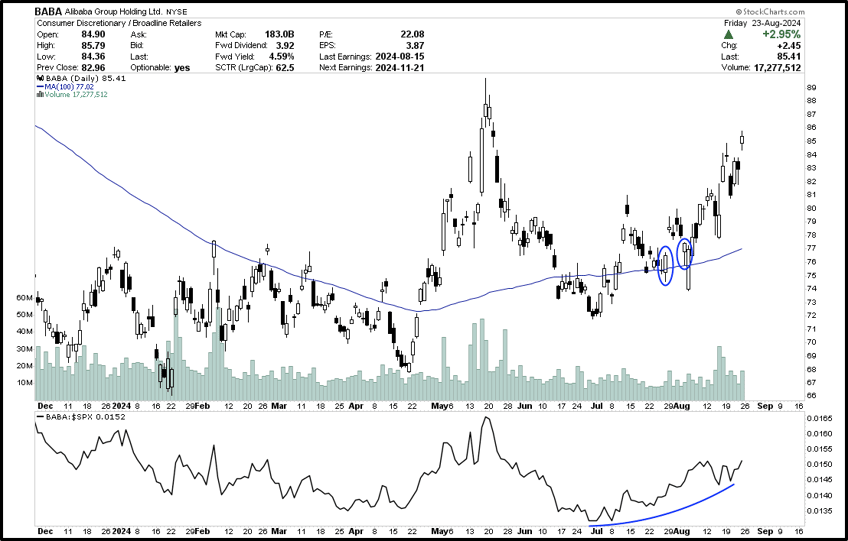

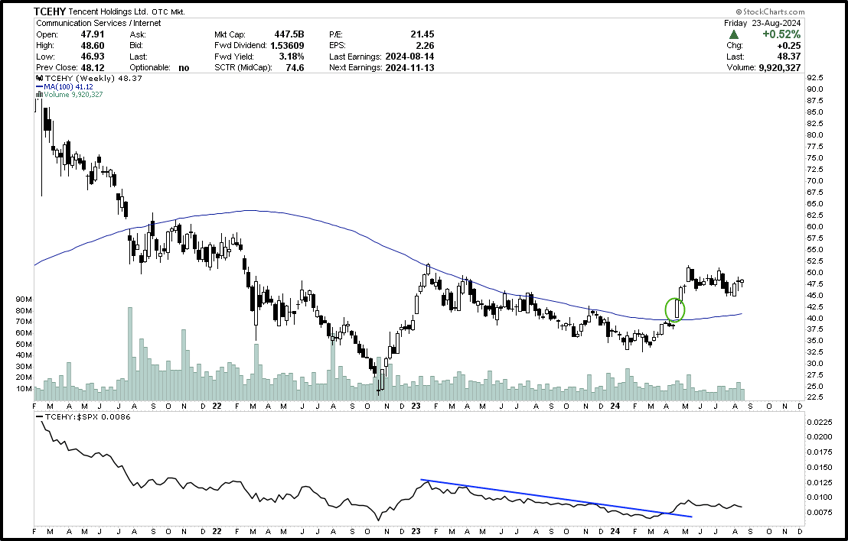

China: Tencent and Alibaba are doing extremely well since we wrote about them

Follow us @GMGResearch

S&P 500: Notice the decline in breadth before the drawdown in 2022. Breadth continues to be expanding right now which is a good sign.

Fed Funds Rate: The fed funds rate follows the 2yr treasury yield.

Homebuilders are at new highs. (Lennar & DR Horton)

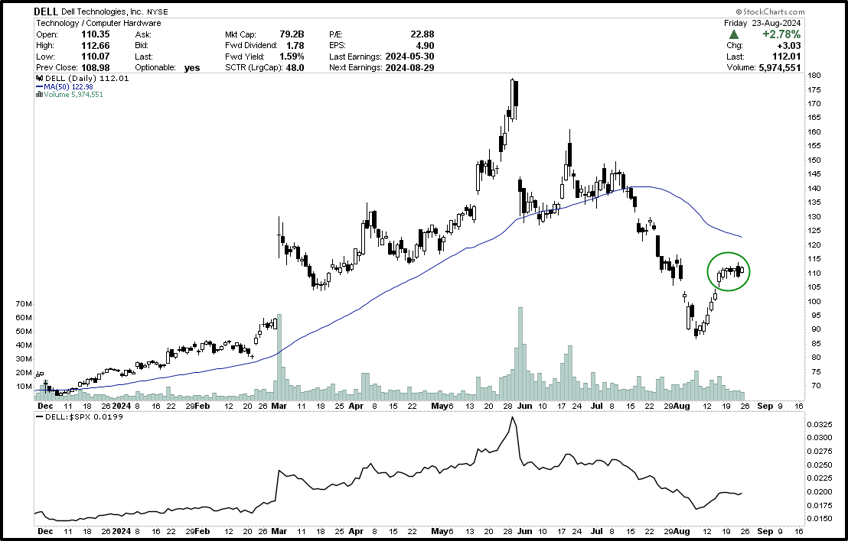

Dell: starting to turn higher here.

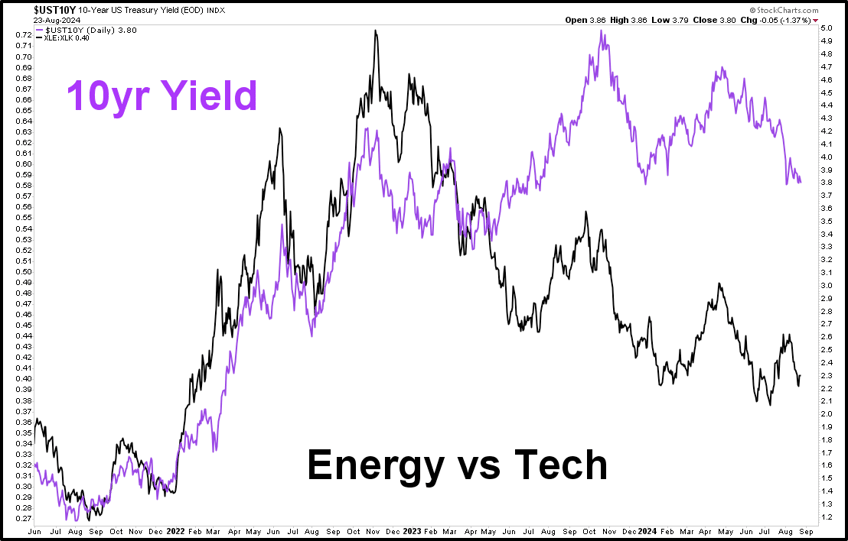

Important chart to always monitor.

1.14 on the EURUSD Pair.

Alibaba has been showing signs of serious strength.

Tencent is the only video game exposure we like.

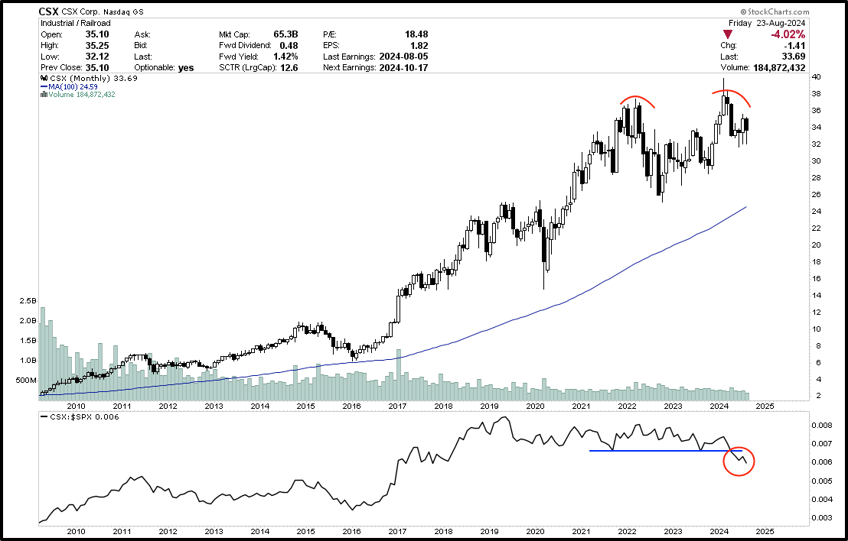

Continue to avoid railroads. We’ve been pounding the table on this. Look at that under-performance.

*REMEMBER* Correlations don’t exist the same way people think they do.

For example, when economic growth expectations are volatile, stocks and bonds will be negatively correlated because if growth slows, it will cause both stock prices and interest rates to decline. In an environments where inflation expectations are volatile stocks and bonds will be positively correlated because interest rates will go up with higher inflation which is detrimental to both bonds and stocks.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.