Carson Block of Muddy Waters Capital, known for shorting companies, is pushing deeper into the commodity space as the 'Next AI Trade' theme sparks huge interest in copper, uranium, and other critical metals for powering up America into the digital age.

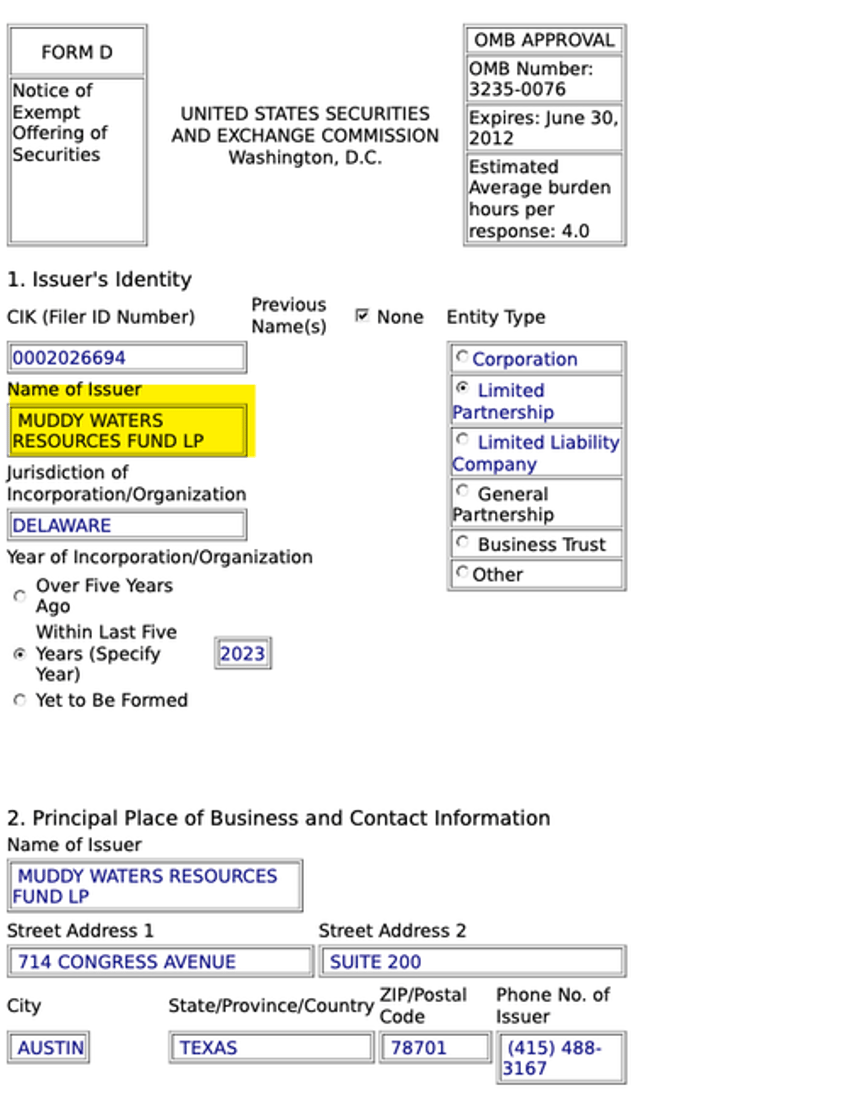

Block's fund, named "Muddy Waters Resources Fund," filed a Form D, or "Notice of Exempt Offering of Securities," which is a private placement notice, with the Securities and Exchange Commission on Tuesday.

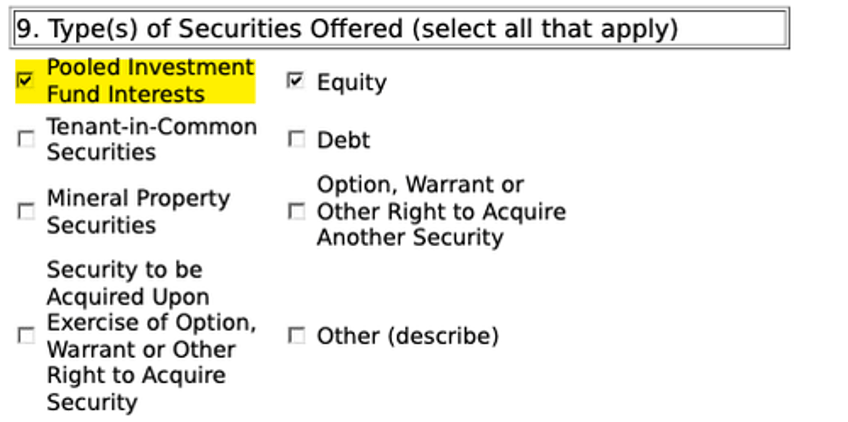

According to the filing, Muddy Waters Resources sold a $1.45 million equity offering in a "pooled investment fund interests."

Block and/or Muddy Waters have not released details about the commodity fund. However, we can only speculate that it might have a thesis related to our 'The Next AI Trade' theme, namely in metals that will thrive with infrastructure, electrification, power grid, and energy.

This new fund is a continued pivot for the Austin, Texas-based hedge fund manager, who just months ago set up a long-only hedge fund that invests in Vietnam. He has also launched an activist campaign against Canadian miner Mayfair Gold Corp.

Bloomberg said a Muddy Waters spokesperson declined to comment about the commodity fund. As of the end of 2023, the firm had about $440 million of regulatory assets - this measure includes leverage.