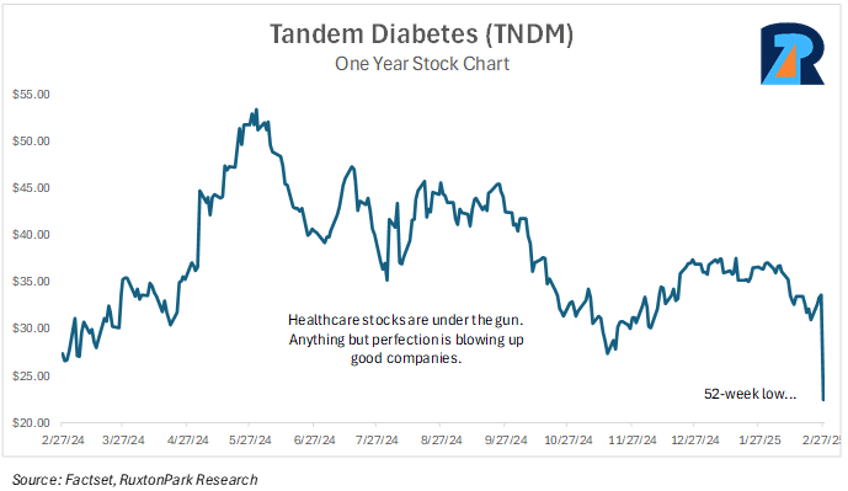

Tandem Diabetes (TNDM:Nasdaq) reported 4Q24 and full year 2024 financial results after the market closed on February 26, 2025. The market hated the print and pushed shares down as much as 34% intraday.

Tandem is the manufacturer of one of the most effective and user-friendly insulin pumps on the market. While shares have been volatile over the years, the company continues to make strides in helping people manage their disease.

The stock reaction seems overdone, but this is what healthcare investors are getting these days. Why? Uncertainty around healthcare funding driven by our new administration. Anything other than perfection is getting sold off hard.

These are markets that often give us great buying opportunities because healthcare is complicated and misunderstood. Yet it represents our most important asset. The rhetoric is always worse than the reality.

Not that Bad

Despite the violent stock reaction, the results were not a disaster. The market doesn’t seem to like the slightly higher operating expenses and conservative 2025 guidance. Again, if its not aligned with expectations, its considered bad.

That said, fourth quarter revenue came in slightly ahead of analyst expectations…$252m vs. $250m.

However, adjusted EBITDA of $2.3m fell far short of the $13.4m expectation. Why the miss? The difference was spread across high quarterly costs of goods sold, SG&A, and R&D. No single expense line item blew up the results.

Financial guidance for 1Q25 and full year 2025 also appeared light but again, not by much. Analysts were expecting $222m in the current quarter and management guided to $219m-$224m. For the year, analysts were expecting $1,011m and management guided to just over a billion. These are not big misses.

Management suggested there were some timing issues that played into the 4Q24 and 1Q25 expectations. Timing issues occur occasionally and provide good buying opportunities when misunderstood. Moreover, management also alluded to conservatism in the 2025 full year outlook.

Strong Balance Sheet

At the end of 2024, Tandem had $438m in cash and marketable securities. Long term debt is balanced at $348m. This means the company has a $90m net-cash position. Additionally, the bulk of the debt is not due until 2029.

Not Cheap but Aligned with Peers

Tandem’s enterprise value (EV) is about $1.4 billion today. This is 47x its 2025 EBITDA estimate of $30m. That is very high considering the broader S&P500 trades around 18x.

However, this is a medical technology company and these businesses command higher valuations. A quick check of five other med tech stocks shows EV/EBITDA multiples ranging from 18x at Medtronic to 65x at Intuitive Surgical.

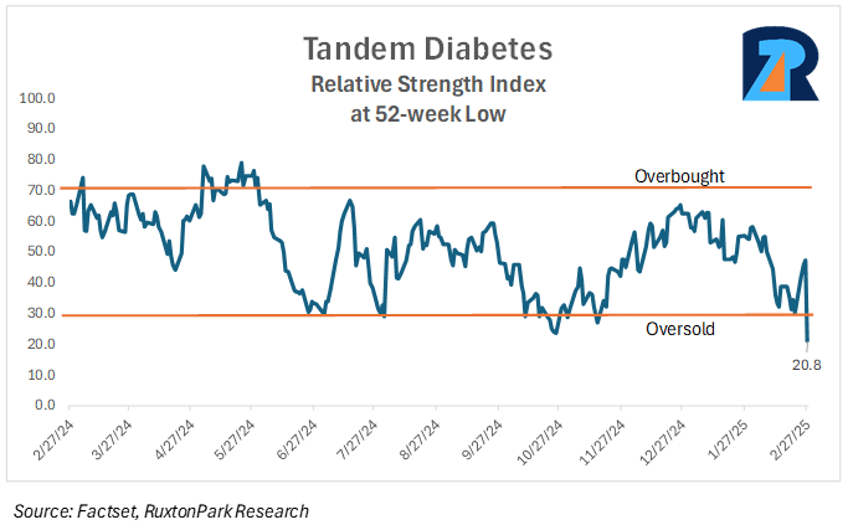

Oversold

Today, Tandem’s RSI (relative strength index) is at 21, the lowest level seen over the prior twelve months.

RSI is a measure that suggests either overbought or oversold conditions. 30 and under is considered oversold while 70 and above is overbought. The current reading suggests the stock may be bottoming to digest the recent quarterly news.

I’ve owned this stock many times over the last decade. In fact, in 2018 TNDM shares paid for almost all my annual family bills. Today, I’m buying it again as the outlook doesn’t look that bad and the market seems to be over-reacting. I bought a little today and will add should subsequent days push the stock down more.

Cheers,

Thomas Carroll

RuxtonPark Research

Important Disclaimer. Nothing in this report or anything written by RuxtonPark Research, Thomas Carroll, or affiliated research should ever be considered individual investment advice. This is purely for information and educational purposes only. Every investment involves risk, and participants should do ample due diligence, seek the counsel of registered investment advisors, and only risk what they can afford to lose.