Submitted by QTR's Fringe Finance

There’s a lot to discuss as it relates to the market and potential portfolio positioning heading into the new year, given the Trump administration's historic win this month.

Generally, my long-held sentiment that high interest rates and positive real rates are eventually going to cause an economic calamity still stands. I do feel as though a crash is still on its way; the only question is how euphoric the market becomes in the interim and how much time and liquidity that euphoria buys. Whoever may have a shotgun-sized hole blown into their balance sheet right now isn’t disclosing it.

As such, heading into the new year, I still believe that gold miners present a great opportunity, and I will likely be investing accordingly. I think the recent dip in the VanEck Gold Miners ETF (GDX) over the last couple of days – a result of a stronger dollar and the illusion that this strength is going to somehow stave off the inevitable quantitative easing down the road – is a buying opportunity.

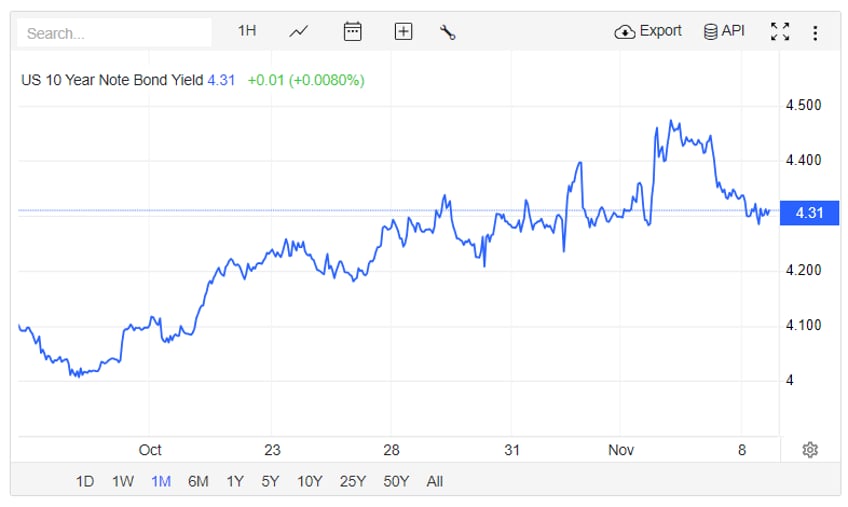

It’s been interesting to watch 10-year bond yields almost do nothing but move higher since the Fed rate hike.

The bond market is signaling that the inflation problem isn’t under control and that there may be fewer cuts, spaced more sporadically, than many people think.

As long as yields stay historically high, with real rates positive, an economic calamity seems certain - the only questions are where and when it will hit. Right now, commercial real estate seems a leading candidate as a potential black swan. But who knows, the black swan could appear somewhere in tech stocks, cryptocurrency, or in a sector no one is watching – that’s why they’re called black swans.

Regarding gold...(READ THIS FULL ARTICLE HERE).