New home sales rose in January for a second consecutive month.

Sales of recently built, previously unoccupied homes in the U.S. rose by 1.5 percent in January to an annual rate of 661,000, up from 651,000 in the prior month, the Commerce Department said Monday.

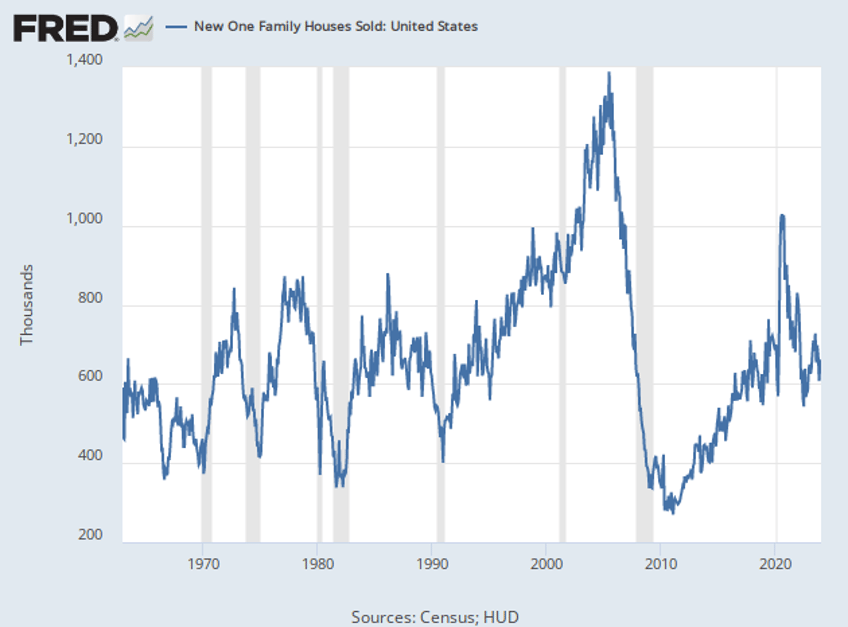

New home sales are close to where they were in the immediate prepandemic period and well above the average for the prior decade. That average, however, reflects the long period of depressed new home sales that followed the bursting of the housing bubble.

At their peak, new homes were purchased at an annual rate of 1.389 million in June of 2005. At the lowest point in records going back six decades, the new home sales rate fell to 270,000.

Since 1963, the average annual rate of sales is 656,000, according to Commerce Department Data.

Wall Street had been expecting an even bigger increase. Economists had forecast an annual rate of 680,000 homes in January.

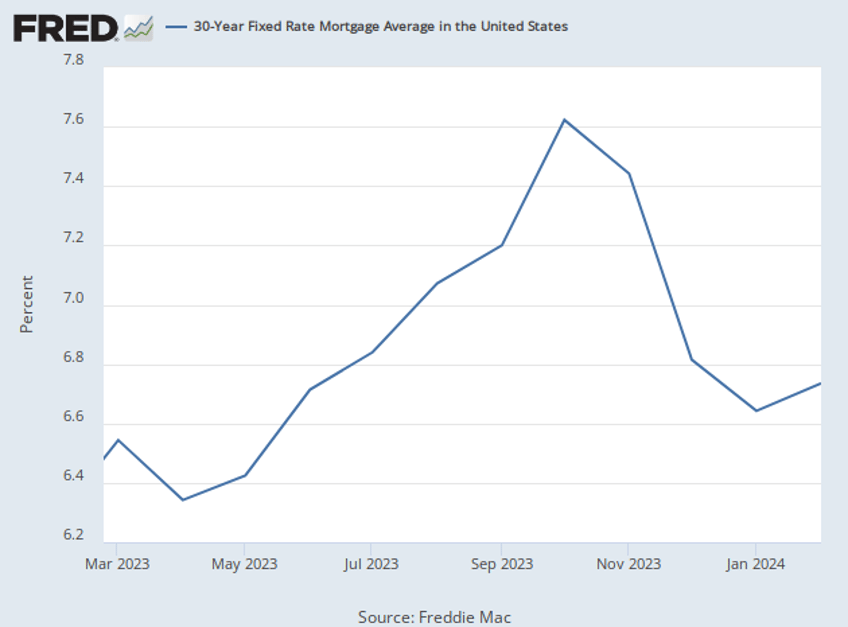

The average 30-year fixed rate on home loans fell in November and December from a peak of nearly 8 percent down to around 6.6 percent to 6.7 percent. In January, the average rate was 6.64 percent.

The Commerce Department adjusts the figure to smooth out seasonality. It reflects how many houses would be sold if the most recent month’s pace were kept up for a year.