Submitted by QTR's Fringe Finance

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter on September 29, 2023, with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Mark was kind enough to allow me to share his thoughts from his September 2023 investor letter (edited slightly for length and grammar by QTR). This letter also contains positions his fund has on, both long and short.

Mark on the “Everything Bubble”

Our shorts worked well this month and my bearish outlook remains unchanged. I apologize if this letter seems somewhat repetitive of the last few, but the U.S. economy changes course like an aircraft carrier not a speedboat, and thus while I’ve updated all the data points my message remains the same:

There’s no way an “everything bubble” built on over a decade of 0% interest rates and trillions of dollars of worldwide “quantitative easing” can not implode when confronted with 5%+ rates and $95 billion/month in U.S. quantitative tightening plus tighter money from the ECB, BOJ and other central banks.

Contrary to the belief of equity bulls, bubbles don’t unwind gently, and once they burst and the economy takes a dive it takes a long time before lower inflation and lower rates help stock prices. When the 2000 bubble burst and the Nasdaq was down 83% through its 2002 low and the S&P 500 was down 50%, the rates of CPI inflation were just 3.4% in 2000, 2.8% in 2001 and 1.6% in 2002, and the Fed was cutting rates almost the entire time.

Yes, a nasty recession has been delayed due to a combination of “interest rate lag effects,” leftover “Covid cash” and “labor hoarding,” but it will soon arrive for the following reasons:

Although the excess savings built up during the Covid pandemic kept a floor under consumer spending, those funds are now fully depleted for most Americans, and consumer credit card delinquencies are now rapidly increasing while personal savings have collapsed.

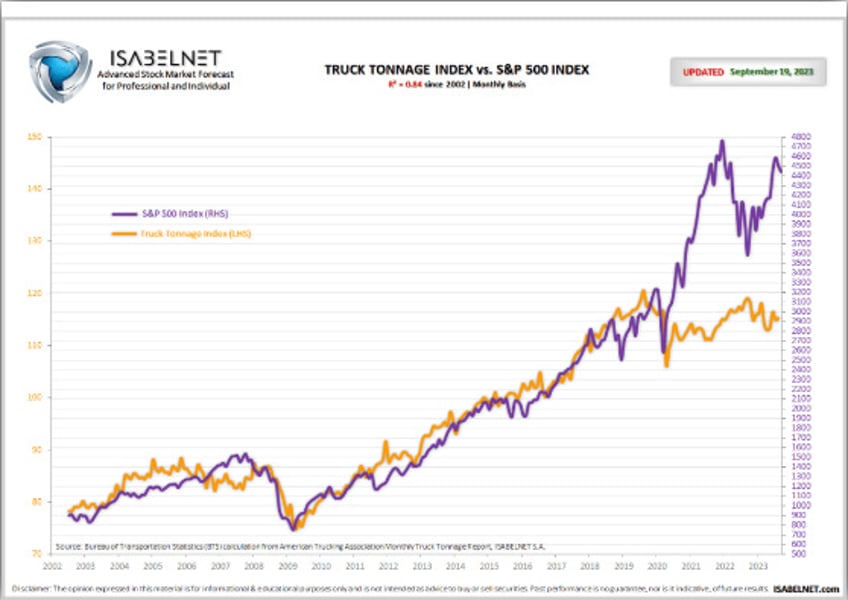

Business lending data, shipping container data, an inverted 2-10 yield curve, bankruptcy filings, declining job openings and other leading indicators say that a nasty recession is imminent.

The cost of servicing the Federal debt is soaring (as is the liquidity-draining rate of its issuance) thereby making extra fiscal stimulus unaffordable.

On October 1 student loan repayments will finally resume (although admittedly, many debtors will undoubtedly utilize the Biden administration’s one-year ”grace period“).

We thus continue to be short a large amount of SPY (as well as Tesla, covered later in this letter), as even if the Fed is “on hold” at around 5.3%, current stock market index valuations are unsustainable, as stocks are still expensive. According to Standard & Poor’s, Q2 2023 annualized run-rate operating earnings for the S&P 500 came in at around $219. A 16x multiple on those earnings (generous for the current environment) would put that index at only around 3500 vs. its September close of 4288, while 15x would put it in the 3200s. And remember, these earnings are pre-recessionary (i.e., they may soon get considerably worse), and just as in bull markets PE multiples usually overshoot to the upside, in bear markets they often overshoot to the downside. Thus, a bottom formed at a lower multiple of lower earnings is not unfathomable.

Meanwhile, although the high current rates of 4.3% core CPI and 3.9% core PCE are slowly trending down, I believe we’re in for a new core “inflation floor” of 3% to 4% as China is forced to stimulate its sluggish economy, Biden continues his war on fossil fuels, the U.S. government continues to rack up massive deficits, and substantial wage increases continue. And even as inflation gradually declines, the Fed does not want to reverse rates too soon and repeat the 1970s.

Mark on His Fund’s Positions

Here then is some commentary on some of our additional positions; please note that we may add to or reduce them at any time…(READ THIS FULL LETTER HERE).