"Powell can do nothing except slow the inevitable. The way to stop Wage-Price spiral, if we get there, is with price-controls on the fiscal side. Those lead to supply shortages…..and that is exactly how banana republics are made."

Topics:

- New Inflation Tools Needed

- Zoltan Can’t Help Now

- Studying Consumer Behavior

- RECENCY BIAS

- LOSS AVERSION

- What Powell Worries About

New Inflation Tools Needed

Authored by GoldFix ZH Edit

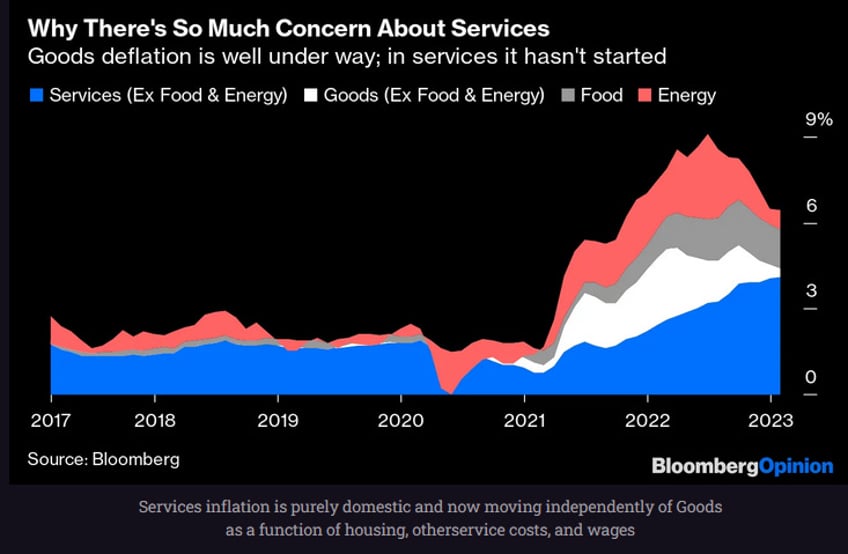

Two things to keep watch over now that inflation has subsided somewhat and unemployment may be rising. Goods inflation as a function of Energy prices is the first. Why? Because the Fed raising rates has little control over this. Last stated in Inflation is not Dead At All

The Fed admits they have no control over the supply side of goods. Their success thus far in getting goods inflation to drop has not been their own doing. The fed got lucky.

As energy prices go up, goods prices will. Necessities will rise taking a bigger cut of paychecks. This is in addition to the limited success thus far the Fed has had in getting services inflation under control

Anyway, Goods inflation has been slightly tamed. But it’s prepared to re-rally soon with oil doing its thing. The second thing to watch is Corporate profits, which are tied to goods inflation.

Corporate profits: If corporate profits have resumed their upward trend, that is very inflationary. It means they are comfortable raising prices again. To put a finer point on it: Normally, corporate profits lead wages and hiring to determine trend inflation. So, if wages are still rising ( they are) and profits are once again upticking (they may be), then something is out of sync cyclically in yet another economic indicator. A self-reinforcing inflationary cycle may be at hand if this is true.

We need to monitor goods prices, and corporate profits closely now that we have a better handle on unemployment.

How to watch for these:

- Oil prices… if they go up you get more goods inflation

- Consumer behavior… is less rational now.. this is the tricky part and our new focus

Zoltan Can’t Help Us Now

Broad sweeping big picture statements we are personally fond of will not do well from here on in. They have gotten us to this point for sure. Unfortunately, the analysis need not be structural anymore. The new structure has been built. The cement has hardened. Everyone can now see the inflationary winds are not going away as Zoltan told us a year ago, especially with union jobs upticking so violently on top of Biden’s fiscal largess.

We all have to look at the numbers going forward. But which numbers? Unfortunately many. Here are two concepts that may start to matter a lot more for Jerome Powell and company in assessing inflation going forward. These two will factor largely in predicting Wage-Price spiral inflation, the thing Powell fears most now.

Studying Consumer Behavior

Specifically, among other things, we want to understand “Recency Bias” and “Loss Aversion” in studying inflation now. Here they are extremely boiled down for GoldFix purposes followed by a textbook definition.

RECENCY BIAS

Recency bias: the price of things Consumers buy most often (recently and repeatedly like food) is what they care about most.

Recency bias is a cognitive bias that favors recent events over historic ones; a memory bias. Recency bias gives "greater importance to the most recent event", such as the final lawyer's closing argument a jury hears before being dismissed to deliberate.

Eggs are more important than vacations according to this rule. Eggs are also inelastic demand-wise. Corporations know this. They raise prices and pass through their own labor costs quickly and frequently as a result. If you are also making more money, they raise it again!

LOSS AVERSION

Loss Aversion: Winning $10 feels good. Losing $10 feels worse

Loss aversion is a psychological and economic conceptwhich refers to how outcomes are interpreted as gains and losses where losses are subject to more sensitivity in people's responses compared to equivalent gains acquired.

This manifests in multiple ways. One way is in consumers buying more of something to avoid the future price hikes, which causes future price hikes for those that did not hoard. It is FOMO for the necessity crowd and leads to price gouging.

Together, these two behavioral concepts described above can make or break Wage Price spiral inflation.

Continues here ...