Over the past 3 years, we have often said that with the Biden administration's unprecedented and bizarre belligerence toward the US E&P sector, where even Rabobank notes tongue-in-cheek that the Fed is purposefully selling oil to keep its price low and ensure Biden's reelection...

With a largely-drained US Strategic Petroleum Reserve, if the Fed really are active in oil futures, as some whisper, they need to get busy again soon.

... it will be a miracle if any new refineries are built at all, and as a result of moribund capex spending, the cracking (no pun intended) US refining infrastructure will soon become the gating factor for gasoline production, even more so than access to oil.

Well, we were right: as Bloomberg reports, the increasingly stretched global refining system means fuel-price volatility is set to become more common, top oil executives warned at the APPEC by S&P Global Insights conference in Singapore this week.

The lack of spare crude-processing capacity due to under-investment, and shutdowns happening more frequently with refiners ramping up on better margins and deferring planned work were common themes at the APPEC by S&P Global Insights conference in Singapore this week. That’s left fuels like diesel and gasoline vulnerable to sudden swings when there are unplanned outages.

The dilapidated infrastructure means that there have been unplanned plant shutdowns almost every week or two in Europe, Gunvor global head of research Frederic Lasserre told Bloomberg adding that many refiners have postponed regular maintenance, leaving them open to technical issues that lead to surprise outages.

“The market is overly sensitive to any unexpected supply disruption anywhere,” Lasserre said. “Everyone knows there’s no plan B. We have no stocks, and we have no excess capacity anywhere.”

“Refining capacity is very tight,” Vitol CEO Russell Hardy agreed, noting that a lot of plants closed during Covid-19 and Western markets are lacking sufficient oil products.

The recent spate of unplanned outages and tightness in refining capacity highlight the challenges as the world transitions from fossil fuels to cleaner energy. In the US, gasoline is at the highest seasonal level in more than a decade, with the rise partially due to extreme heat limiting refinery output.

Meanwhile, as noted last week, the price of diesel — the fuel that powers global industry — has outpaced the rise in crude after a slew of refinery outages partly due to excessive heat. Low stockpiles are driving an “incredibly strong” diesel structure, signaling market tightness, said Ben Luckock, co-head of oil trading at Trafigura Group (see "Refiners Are Printing Money As Diesel Crack Soars").

It’s becoming more expensive to fund normal refining projects, Alex Grant, senior vice president for crude, products and liquids at Equinor SA, said in an interview. Existing refineries will operate at the highest rates they can, with refining margins staying high, he said.

The refining system is “crying out” for fresh investment with oil demand still growing, especially in Asia, said Sri Paravaikkarasu, director of market analysis at Phillips 66. Refiners need to cater to it, while also accounting for the green energy transition, she added.

But while the woke western world is suffering under the tyranny of green idiocy which has all but assured record high gasoline prices once the system realizes there is no more refining capacity, one clear winner is emerging far from the "western world."

As Bloomberg reports overnight, run rates at China’s state-owned refineries jumped 1.4% to a new high of 83.12% of capacity, the highest on record since Nov. 2021 when Bloomberg first started tracking the data by OilChem. As a result of the burst in activity, gasoline inventories +2.9% w/w to 13.1m tons in week to Sept. 7, after hitting its lowest since July 2019 in the previous week. while diesel stockpile +1.6% w/w to 16.8m tons.

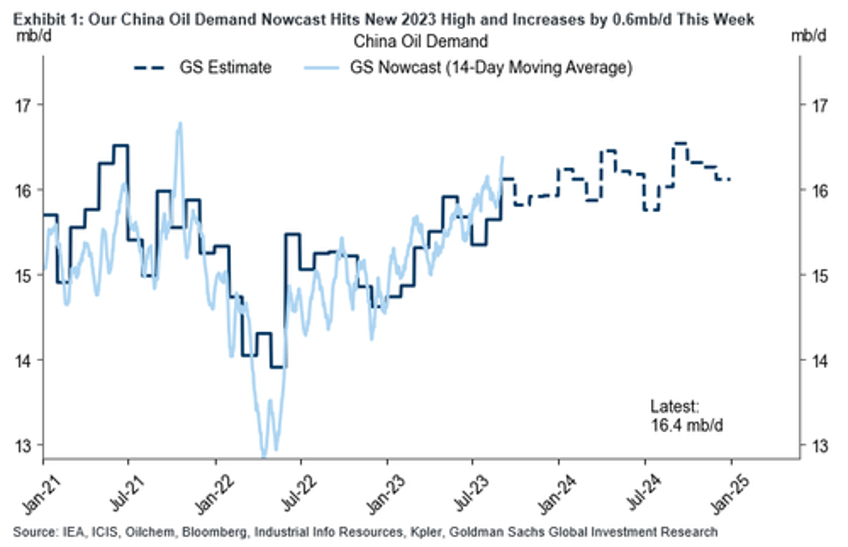

And while China's own economy is suffering despite what Goldman recently calculated was record oil demand...

... the world's 2nd biggest economy is taking advantage of the western refining crisis to steal market share, and indeed transport fuel has become one of China’s fastest growing export sectors as the government increasingly leans on overseas sales to keep its vast oil refineries humming.

Beijing’s generous quotas for gasoline, diesel and jet fuel are allowing refiners to bypass uncertain home demand and profit from stronger world prices for oil products. That’s helping the economy’s otherwise poor export performance since the end of the pandemic; and yes, it comes at a staggering environmental cost.

In other words, by crippling western production - where there was at least some regulatory supervision over environmental standards - the green idiots have pushed the bulk of production to China where anything goes, and the environmental fallout resulting from this transfer is order of magnitude worse than if liberal progressives had not stuck their clueless noses in what they don't understand (which is pretty much everything) yet again.