Owning gold had a cachet for investors. Typically, because the kink of precious metals had inflation proof qualities, many investors have built core portfolios around gold. In an inflation-rampant economy, though, that strategy of wealth-building is quickly unraveling. Consistent interest rate hikes by central bankers around the globe, gives savvy investors an opportunity to rotate away from gold, and into greener pastures: Silver!

Cold Hard Facts

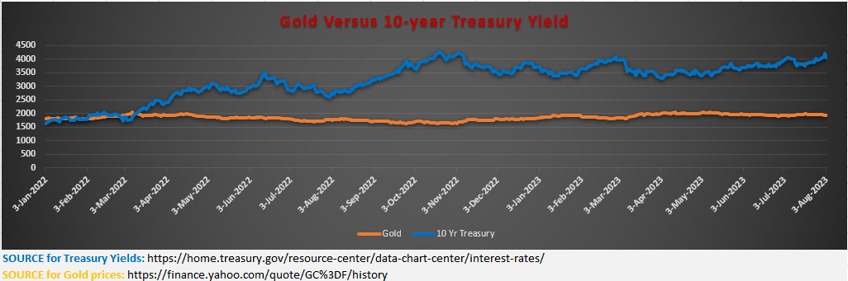

If betting on a losing horse is “your thing”, then sure, you can buy gold and overweight your portfolio with the King of all precious metals. Many gold investors have taken to holding gold bullion, and even gold coins, as part of their portfolio construction. The reason they did so was because of the sensitivity of gold to real interest rates. Since no cash flows occur from holding gold, there’s an inverse correlation with real interest rates.

If safer, cash-generating assets, such as U.S. Treasuries, offer a higher yield (as they do now, in a high-interest rate environment), the appeal for non-cash generating assets, like Gold, however, drops. In an inflationary economy, like we currently have, strong economic signals give the U.S. Fed a reason to further hike interest rates. Analysts believe that recent robust labor data has provided the Central banker the justification (or “excuse”!) to raise interest rates yet again – and that spells gloom for gold prices!

As the Fed began aggressively raising interest rates in its quest to stamp out stubbornly entrenched inflation, it sent gold investors chasing Treasury bonds and other “safe haven” assets. Gold prices either fell, or remained largely static, causing significant underperformance to gold-weighted portfolios. Savvy investors, who pivoted away from the gold trade, fared much better!

The Silver Lining: A viable alternative for stressed-out God bugs

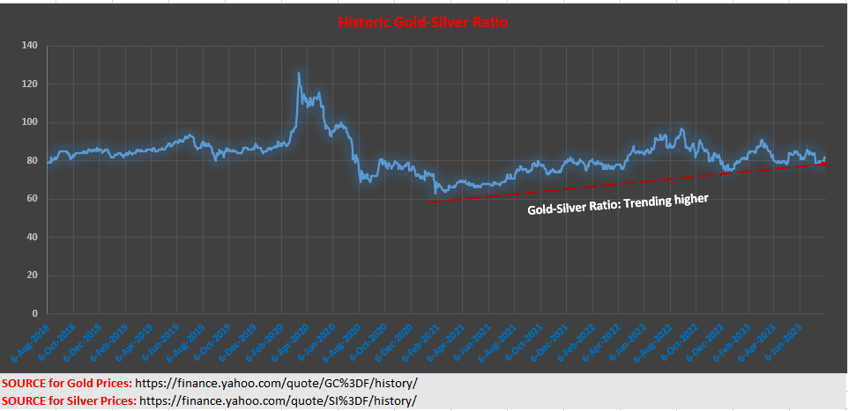

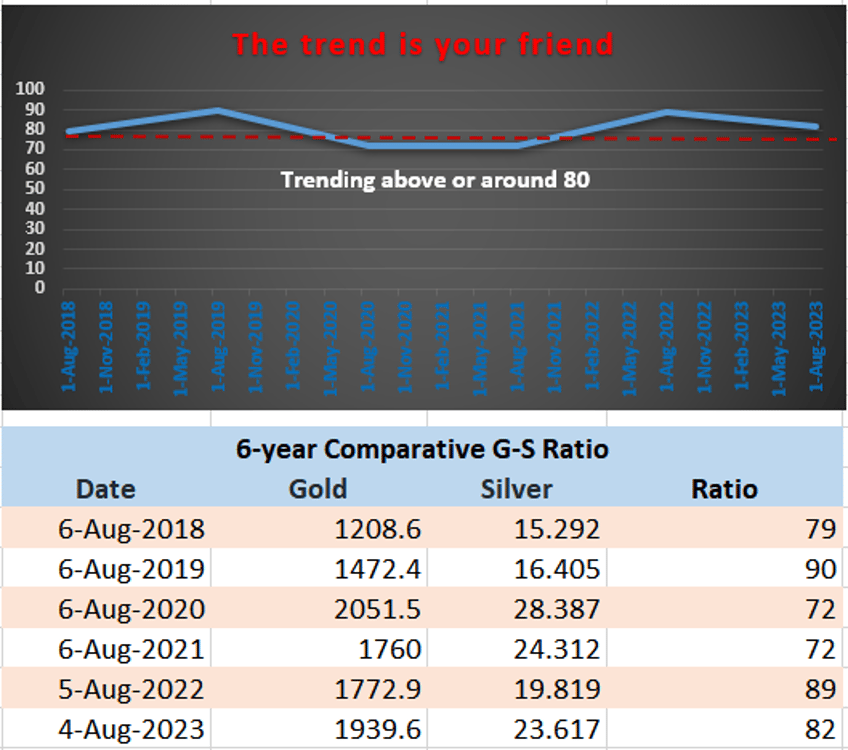

So, if gold loses its luster in inflationary, high-interest environments, then what’s an alternative strategy to super-charge precious metal portfolios? The answer is Silver, and the secret to profiting from gold’s lack of shine lies in a critical metric known as the Gold-to-Silver Ratio.

The Gold-to-silver ratio serves as a vital tool for savvy investors seeking to diversify their precious metal holdings and maximize returns. This ratio gauges the number of silver ounces required to purchase a single ounce of gold at any given moment. An interplay of supply and demand for both metals, as well as various other economic factors, influence fluctuations in the ratio.

For investors, the ratio offers valuable insights into when to transition between gold and silver, depending on their relative worth and potential. A higher ratio indicates the undervaluation of silver, compared to gold; while a lower ratio suggests that gold is undervalued in relation to silver. Consequently, the ratio empowers investors to spot opportunities to buy low and sell high.

To illustrate, an 80:1 ratio signifies that it takes 80 ounces of silver to buy one ounce of gold, implying silver is relatively inexpensive compared to gold. This situation might be an opportune moment to acquire silver while considering selling gold. Conversely, a 40:1 ratio means that it takes 40 ounces of silver to purchase one ounce of gold, implying gold is relatively cheaper than silver. In such a scenario, investing in gold and potentially divesting silver might be a prudent move.

By The Numbers: Betting for the long run

Let's use the information discussed earlier to demonstrate how a favorable Gold-to-silver ratio can be beneficial for a decision to buy silver. We'll compare two different ratios: 80:1 and 40:1.

Gold-to-Silver Ratio: 80:1

In this scenario, it takes 80 ounces of silver to buy one ounce of gold. This implies that silver is relatively cheap, compared to gold. If an investor has 80 ounces of gold and decides to trade it for silver at this ratio, they would receive:

Silver = 80 ounces (Gold) * 80 = 6,400 ounces

So, by trading 80 ounces of gold for silver, the investor would end up with 6,400 ounces of silver.

Gold-to-Silver Ratio: 40:1

At this ratio, it takes 40 ounces of silver to buy one ounce of gold. Now, gold is relatively more expensive compared to silver. If the investor decides to trade their 6,400 ounces of silver back to gold at this ratio, they would receive:

Gold = 6,400 ounces (Silver) / 40 = 160 ounces

By making this trade, the investor effectively increased their gold holdings from 80 ounces to 160 ounces by taking advantage of the favorable Gold-to-silver ratio.

In summary, a favorable Gold-to-silver ratio can be advantageous for buying silver because it allows investors to acquire more silver for the same amount of gold. When the ratio is higher, silver is relatively cheaper, making it a potential opportune time to exchange gold for silver. Later, if the ratio decreases and silver becomes more valuable relative to gold, the investor can convert their silver back to gold, potentially increasing their gold holdings.

How gold bugs are losing their shirts!

Inflation has been a persistent risk for central bankers globally, and they’re doing all they can to fight it. As a result, it appears that the Fed is likely to continue to raise interest rates in the coming quarter. When that happens, there’ll be no respite for investors overweight in gold. The Gold-to-Silver ratio will continue to tilt against them.

A closer look at the above long-term trend reveals a secret that many gold bulls might be overlooking: That the gold bull run might be over!

At an 80:1 G-S ratio, and persistently trending in that region, it’s time they (gold investors) realize that the smart money is rotating out of bullion. But where is it heading? The answer: While gold loses its luster, Silver has taken on the mantra as the go-to precious metal for savvy investors. It’s time to rotate out from Gold, and into Silver!