Although the Biden administration claims that the American consumer is humming on all cylinders, the Federal Reserve's Beige Book in March painted a much different story in the report released on Wednesday. It showed consumers are cutting back on spending and becoming more cost-conscious due to the increasing pressures of elevated inflation.

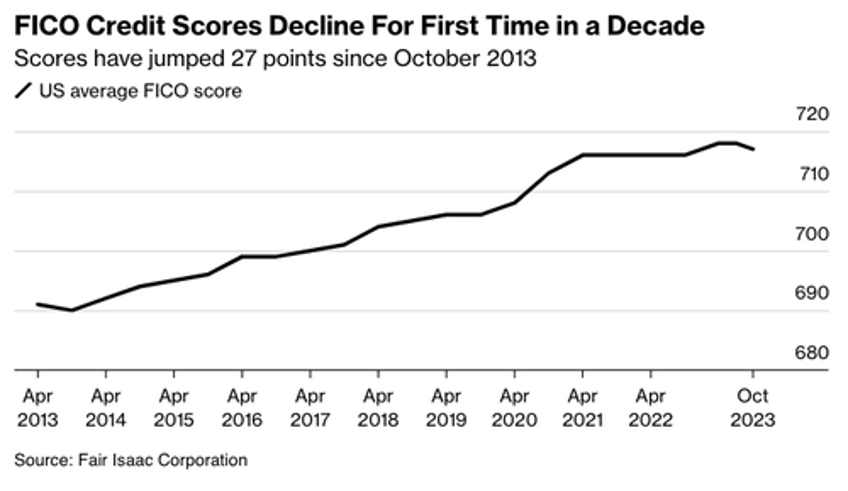

A new report by Fair Isaac Corp., the Montana-based creator of the FICO credit score, shows consumers missing more credit card payments and taking on more debt. This has led to the average consumer credit score reversing for the first time in a decade.

Blomberg first reported that the average FICO credit score for Americans fell by one point in October to 717 from 718 in July. Despite being a minor change, this marks the first decline in a decade.

"It's a notable milestone that we've seen the average score decrease," said Ethan Dornhelm, vice president of scores and predictive analytics at FICO, adding, "This isn't a blinking red light, but it certainly is a yellow light."

According to Bloomberg, the 30-day-or-more delinquency rate increased to 18% of the population - up about 4% since April - and comes in an environment of rising delinquencies for credit cards, auto loans, and mortgages. Credit card utilization also rose higher in October, up to 35% from 34% in April, while the average credit card balance in October jumped 5.9% to $7,306.

A separate report showed how non-revolving credit growth stumbled under high interest rates in early February.

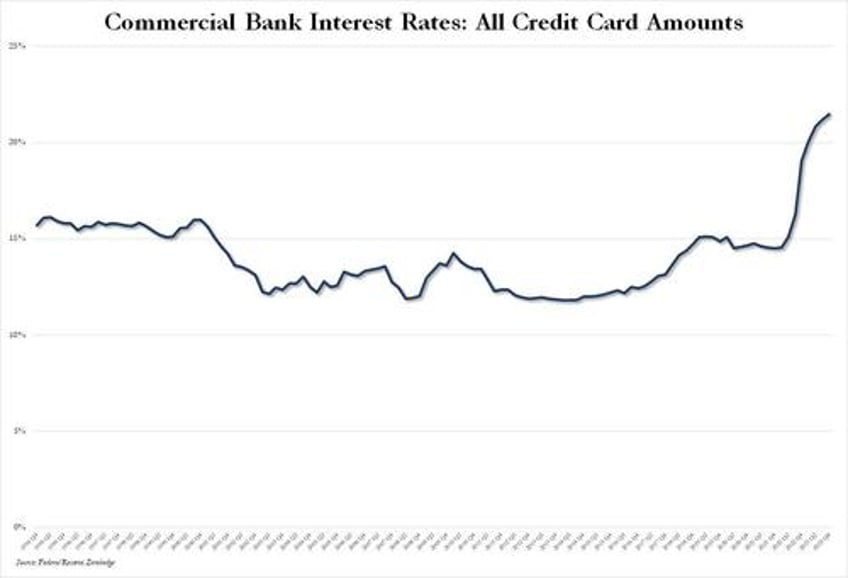

The average rate across all commercial banks on all credit card amounts hit a new record high of 21.47% in the fourth quarter of 2023.

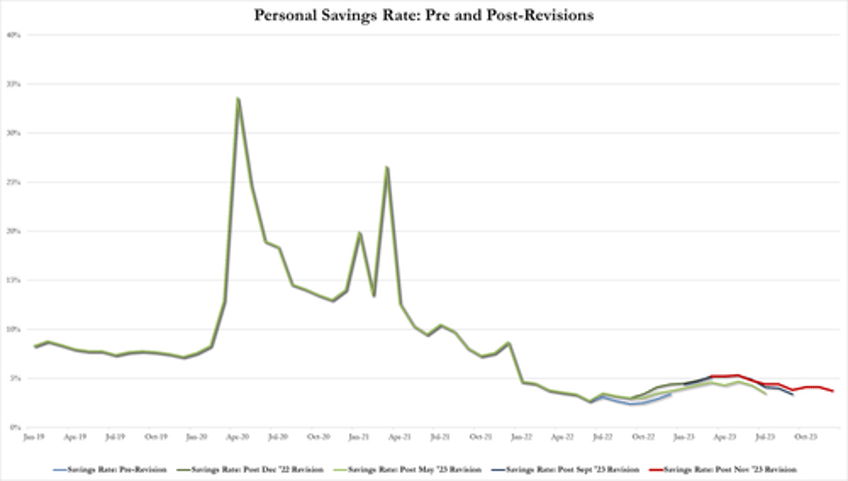

Meanwhile, the personal savings rate has collapsed.

Another concerning piece of consumer data comes from Credit Managers' survey that shows the rate of rejections for credit applications and the number of accounts moved to 'collections' is surging back to near GFC levels.

... and about that 'strong consumer' narrative the Biden administration keeps pushing in corporate media.