What’s behind the numbers?

As widely anticipated, the Federal Open Market Committee voted unanimously to keep the federal funds rate in a range of 4.25%–4.5%, after lowering rates by a full percentage point in the final quarter of 2024.

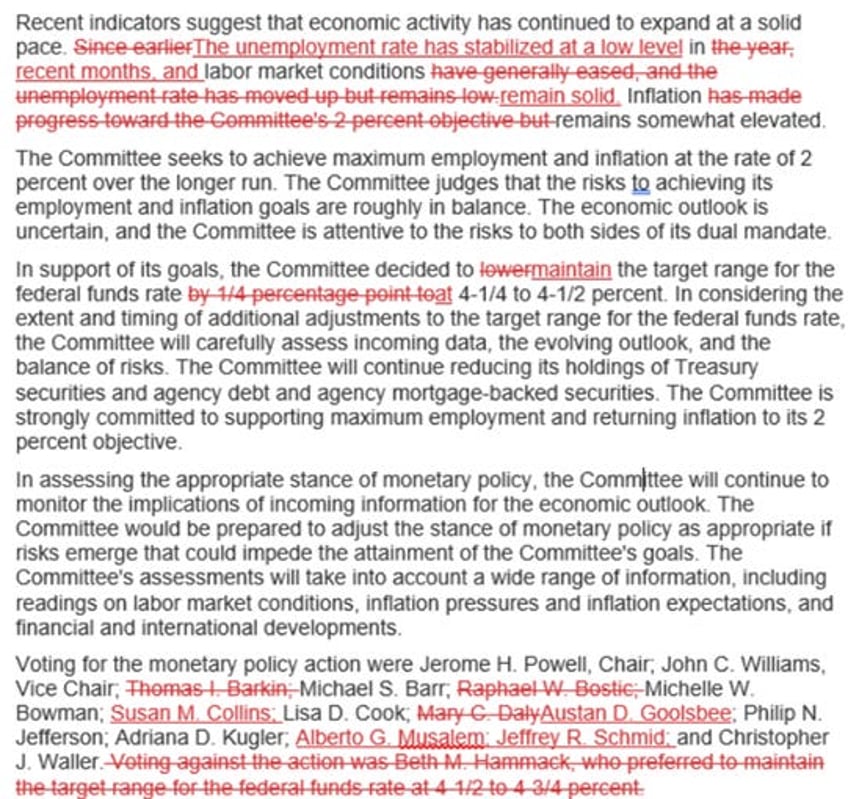

In a post-meeting press release, officials repeated that inflation remains “somewhat elevated” but removed a reference to it having made progress toward their 2% goal. Regarding the labor market, they stated, “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid.” This contrasts with the previous statement, which said, “Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low.”

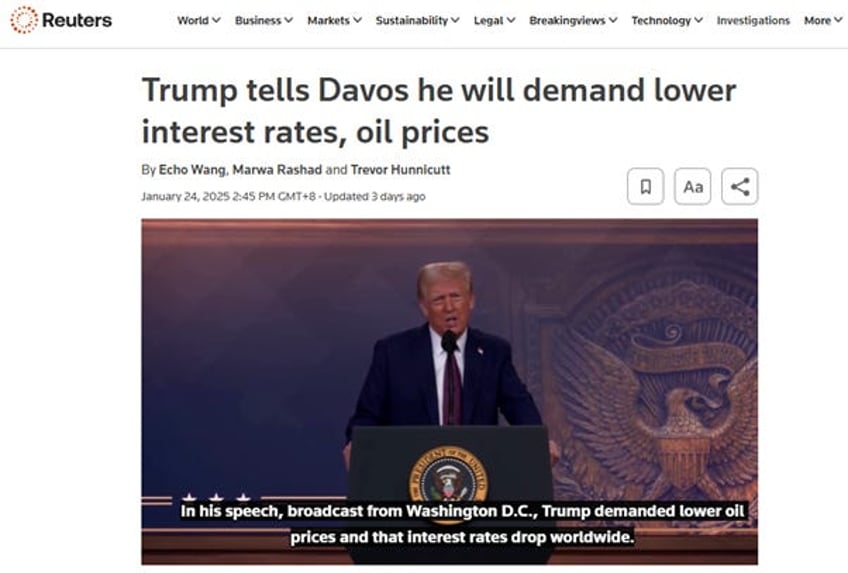

In his press conference, Powell began by stating that he has not and will not comment on Trump's demand for an "instant drop in interest rates," as he has had no contact with the 47th U.S. president.

Powell emphasized that the change in the statement's language on inflation was not intended to signal anything beyond the Fed’s commitment to its 2% inflation goal. More importantly, he added that it is still too early to assess the new policies and that the Fed will analyze the impact of tariffs and immigration once they are implemented.

At the end of the day, the January meeting was a "nothing burger" for the FED, as the stock market’s reaction to the statement was more muted than in December. However, FED days have become increasingly challenging for equities in recent months, marking a shift from how markets reacted in early 2024. This reflects growing jitters around inflation, particularly in light of looming tariff threats.

Thoughts.

While the FED has been attempting to influence business cycles for the past 60 years, examining the FED Funds rate changes alongside the business cycle, illustrated by the relative position of the S&P 500 to oil and its 84-month moving average, reveals a consistent pattern. A decline in the FED Funds rate has almost always coincided with the peak of the S&P 500 to oil ratio. Furthermore, no FED Funds rate cycle has ever prevented the ratio from falling below its 7-month moving average, signalling a shift from economic boom to bust in the US economy.

Upper Panel: FED Fund Rate (purple line); Lower Panel: S&P 500 to WTI ratio (green line); 84-months moving average of the S&P 500 to Oil ratio (red line).

The FED, like other central banks, is trapped in outdated Keynesian Economics, their only tool despite its diminishing relevance. The FED Watchers are deeply entrenched in mainstream media propaganda spun by Marxist academics who lack any experience in trading their own accounts, let alone observing the real world beyond their ivory towers. Much of this dogma has remained unchanged for centuries, originating from an era when the monetary system was in its infancy and based solely on the metal content of coinage, with insufficient premiums for economic power. In this context, investors should recognize that, regardless of the FED's actions over the next 12 months and beyond, as the US economy is driven by tariffs from an inflationary boom into an inflationary bust, long-dated yields, such as the 10-Year and 30-Year U.S. Treasury yields, will rise rather than fall. This will have a greater impact on the real economy than any additional hypothetical FED rate cuts could offset.

Upper Panel: US 10-Year Yield (blue line); US 30-Year Yield (green line); Lower Panel: Gold to Bloomberg US Treasury Index ratio (yellow line); 84-months moving average of the Gold to Bloomberg US Treasury Index ratio.

Indeed, since the FED implemented 100 basis points in rate cuts, the 10-year Treasury yield has risen by more than 100 basis points. In response to these upside risks to inflation, the FED is already cautiously shifting back into a wait-and-see mode. Notably, the Effective Federal Funds Rate (EFFR), which the FED targets with its policy rates, has remained at 4.33% since the December rate cut, down 100 basis points from pre-cut levels. It’s an unprecedented scenario: a 100+-basis-point surge in the 10-year yield following a 100-basis-point FED rate cut.

Effective Federal Funds Rate (EFFR) (blue line); US 10-Year Yield (red line).

Those who understand that the US economy is gradually shifting from an inflationary boom to an inflationary bust should not be surprised of the impotence of the FED. As the S&P/Gold ratio is hanging just above its 7-year moving average, a leading indicator, typically by 3 to 6 months, for a similar trend in the S&P/WTI ratio, which reliably signals a shift from economic boom to bust will understand that the action taken by the FED will not impact the trend in long dated yield as the USD (i.e., US Treasuries) remains a poor store of value compared to gold, the timeless and resilient store of value.

Looking at what the FED was forced to do historically when the S&P 500 to gold ratio broke below its 7-year moving average, such as between June 1971 and July 1983 or February 2002 and May 2013, pushing the S&P 500 to WTI ratio below its 7-year average a few months later, the FED has consistently been compelled to raise rates sooner rather than later to combat monetary illusion, ultimately leading to an economic bust. This suggests that if Powell and his PhD colleagues are genuinely committed to keep the USD, the world reserve currency, as a reliable store of value and therefore fighting inflation for the benefit of the American people, as proclaimed at every press conference, it seems inevitable that the FED will have to reverse course in 2025 and raise rates again, if only to maintain the appearance of not fully colluding with the Treasury to finance additional reckless government spending at the cost of increasingly entrenched inflation in the US economy.

Upper Panel: S&P 500 to Gold ratio (yellow line); 84-months Moving average of S&P 500 to Gold ratio (red line); FED Fund Rate (axis inverted; green line); Lower Panel: S&P 500 to WTI ratio (blue line); 84-months moving average of S&P 500 to WTI ratio (orange line); FED Fund Rate (axis inverted; green line).

Sooner rather than later, Federal Reserve Chairman Jerome Powell and Donald Trump will most likely clash again over interest rates, with Trump already demanding immediate rate cuts at Davos, accusing the FED of stifling growth. While the FED remains independent, the belief that lower rates stimulate the economy is outdated Keynesian thinking. Lower rates do not drive investment unless opportunities are perceived as attractive. Unlike the past, government debt now functions as collateral, reshaping its economic impact. Everyone with a modicum of common sense and understanding of the economy know that every fiscal policy in recent years has exacerbated inflation and the FED cannot keep up with government spending. QE FAILED. The artificially low interest rates of the recent past were completely unsustainable and relied on outdated theories.

The biggest challenges to the economy, war, taxation, and government spending, are beyond the FED's control. Fed Chair Jerome Powell called Biden-Harris administration spending ‘unsustainable,’ warning of long-term harm. In 1951, the FED resisted buying debt to curb rate hikes during the Korean War, and today it remains vigilant, monitoring global variables. Sanctions on Russia and other nations risk fuelling inflation and driving long-term rates higher, while Japan, a major holder of U.S. debt, faces potential sovereign default, threatening a contagion that could spread to Europe sooner rather than later.

US Treasury Securities Foreign Holders Japan (blue line); US 10-Year Yield (axis inverted; red line).

As an additional example that what the FED does with interest rate is irrelevant, savvy investors know that financial asset performance hinges on liquidity, not interest rate changes. On the second day of the 47th U.S. president’s term, the debt limit suspension ended. From that day, the government will operate on cash reserves and extraordinary measures until the next debt ceiling resolution, likely in July or August 2025. Until then, U.S. debt remains frozen at $36.2 trillion, and the Treasury General Account (TGA), holding $670 billion, will be drained to zero. This liquidity boost, due to reduced bill supply and a lower TGA, will support asset prices like the S&P 500. However, the need to replenish the TGA this summer will shift to a major headwind for financial markets in the second half of the year.

S&P 500 Index (blue line); US Treasury General Account (axis inverted; red line).

At the end of the day, as the US economy heads slowly but surely into an inflationary bust, regardless of the FED's actions, investors should remember that in such an environment, neither stocks nor bonds provide a positive inflation-adjusted 12-month return once the S&P 500 to WTI ratio breaks below its 7-year moving average, which is anticipated by mid-2025 once tariffs start to have their effects in the real economy.

S&P 500 to WTI ratio (blue line); S&P 500 to WTI ratio 84-months moving average (red line); S&P 500 adjusted to inflation 12-months Rate of Change (middle panel; yellow histogram); Bloomberg US Treasury Total Return Index 12-month adjusted to inflation Rate of Change (lower panel; purple histogram).

This will also be a painful period for investors who still follow the biased Wall Street narrative that they should buy dips in energy consumers and sell rallies in energy producers. Indeed, the opposite approach would be more appropriate as unloved and under-owned energy producers will outperform cherished and over-owned energy consumers in such an environment.

Upper Panel: S&P 500/WTI ratio (blue line); 84 months Moving Average of the S&P 500/WTI ratio (red line); Middle Panel: Relative Performance of S&P 500 IT sector to S&P 500 Energy sector (green histogram); Lower Panel: S&P 500 IT index 12-month rate of change (yellow histogram).

In a nutshell: After a 100-basis-point cut last year and signaling a more cautious approach, the FED decided to hold rates, as anyone with a basic understanding of inflation base effects already knew that reaching the 2% target in the foreseeable future (before 2027) remains an unattainable goal.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/nothing-more-than-language-cleanup

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.