China's National Medical Products Administration has approved Novo Nordisk A/S' blockbuster Wegovy drug for "long-term weight management" in the world's second-largest economy.

Wegovy will first be made available to Chinese patients with a body mass index (BMI) of 30kg/m2, which qualifies as obese, and who also have at least one weight-related disease, according to a press release from the Danish big pharma company posted on WeChat. Novo Nordisk also noted that Ozempic, the diabetes treatment version of the drug, was approved in China in early 2021.

"Up to now, there is still a lack of effective clinical drug treatments for obesity patients in China, and there is a huge medical need to be met," Novo Nordisk said.

The much-anticipated approval means Novo Nordisk could soon capitalize on some of the more than half of China's 1.4 billion overweight population. It comes as the patent on the drug's active ingredient, semaglutide, is set to expire in China in 2026 (this is five years ahead of Europe and six years earlier than in the US).

Meanwhile, more than 15 generic versions of Ozempic and Wegovy are in clinical trials in China, Reuters reported last month.

Last month, Eli Lilly's diabetes drug, Mounjaro, received approval in China. Meanwhile, Zepbound, the company's obesity drug, which contains the same active ingredient as Mounjaro, called tirzepatide, is still undergoing regulatory review.

In markets, Novo shares rose more than 2% in Copenhagen to new record highs.

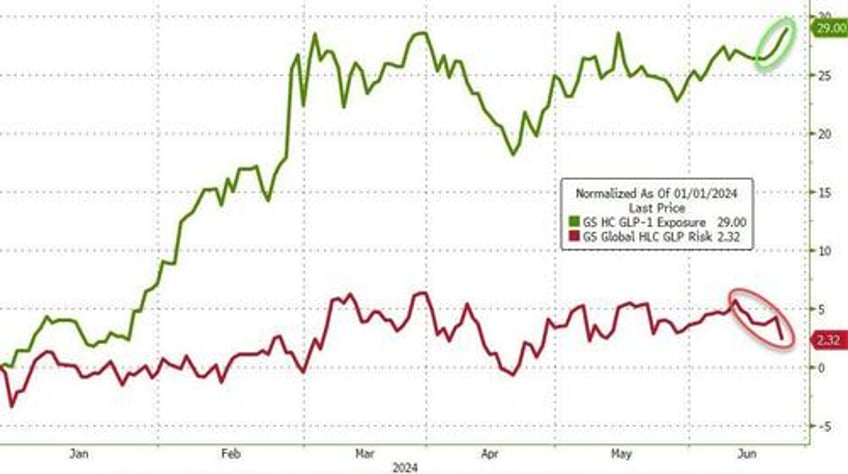

Companies with exposure to GLP-1s are re-accelerating this week after pausing as companies at risk from GLP-1s' success are fading fast...

On Monday, Novo Nordisk announced a $4.1 billion investment to expand its manufacturing capacity in the US as sales of its weight loss drug soar.

In a recent Goldman note titled "Weighing The GLP-1 Market," analysts expect the rising popularity of GLP-1 drugs and healthcare innovations to be larger in the US than anywhere in the world, explaining this in three bullet points:

First, the US has relatively more to gain from the widespread adoption of GLP-1 drugs than other economies given its higher rates of obesity and generally worse health outcomes, although China has the largest number of people with obesity in the world and therefore looks poised to majorly benefit from GLP-1 drugs.

Second, the US will likely outpace other economies in its rate of innovation and adoption of new health treatments. Indeed, historical patterns suggest that over half of all new drugs are first launched in the US, with an average delay of one year before launch in other major markets.

And third, while the scope for health improvements in EM economies is significant, near-term health advances in these economies will likely stem from high-impact investments in relatively inexpensive existing therapies rather than cutting edge research and development.

The GLP-1 craze is going worldwide.