Published at The Bitcoin Layer. Follow Joe and Nik on X.

Welcome to TBL Weekly #95—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning everyone, happy Saturday ☕

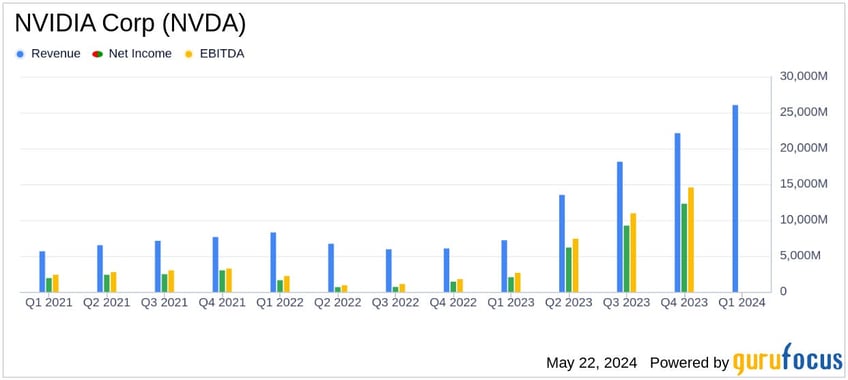

Nvidia smashed Q1 earnings on Wednesday, to no one’s surprise. The GPU manufacturer has led the way in the AI-fueled tech boom and has been smashing earnings reports left, right, and center with no sign of slowing down.

The company reported $26.04 billion in Q1 revenue, up 18% from Q4, and GAAP earnings per share of $5.98, up 21% from Q4:

NVDA is one of the only assets that has outperformed BTC over a 10-year time period, rising 24,840% compared to bitcoin’s 19,920% rise. Given its position spearheading the development of next-generation graphics processors as the AI boom is just beginning, we don’t expect this trajectory to falter all that much. Over the next decade, though, bitcoin will be our wealth preservation asset of choice.

Nvidia’s stock price now sits at $1,059 at the time of writing. The company also announced a 10-to-1 stock split to lower the barrier to entry for investors and make way for further stock issuance down the line.

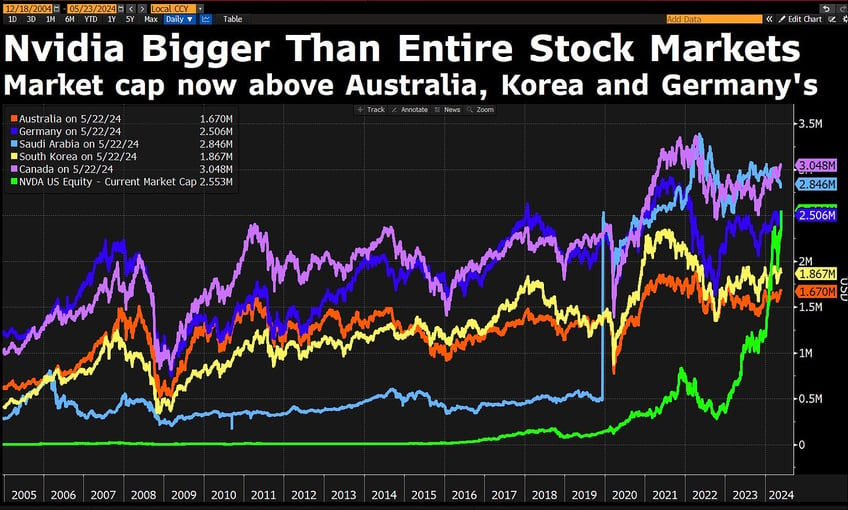

At a $2.553 trillion market cap, Nvidia is bigger than Australia, Korea, and Germany’s stock markets:

On May 23rd, the day following Nvidia’s excellent Q1 earnings release, everything in the US stock market was down, except for NVDA:

Gains are concentrated in the stock market, obviously. As the cycle trudges on and firms impacted more acutely by the Fed’s monetary tightening underperform, tech companies far more rate-agnostic are making up an increasing share of the gains:

That’s not to say the US stock market is just full of hot air with no fundamental strength behind it. The companies that are making up the gains are doing very well. The Nasdaq 100’s trailing 12-month earnings per share are at $592.28, an all-time high. Despite their high level and rapid ascent, equity prices are supported by strong underlying company performance:

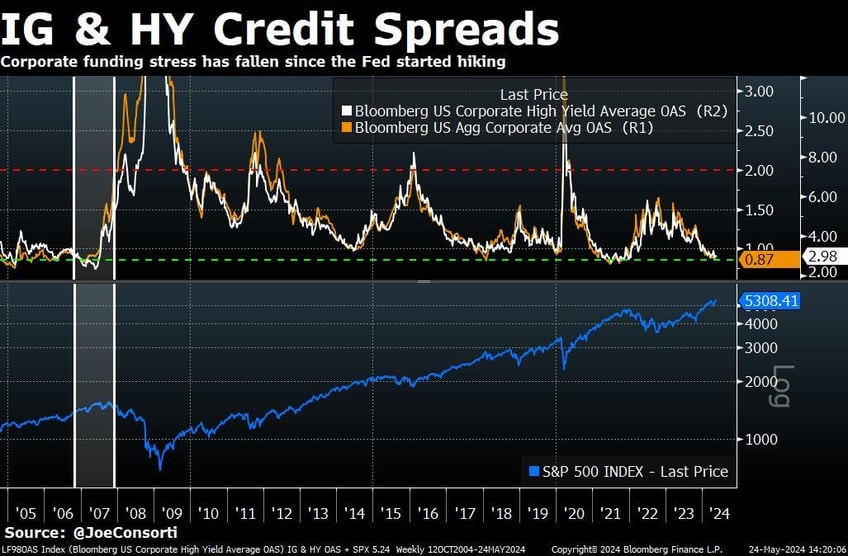

Credit spreads illustrate the same dynamic of heightened risk-on conditions that don’t necessarily suggest an imminent market top. IG and HY credit spreads are at their tightest cycle levels as the S&P 500 and Nasdaq continue making new highs. It would be disconcerting to us if spreads were beginning to widen out as equities made higher highs. As long as spreads continue making lower lows while the stock market makes higher highs, there’s no imminent cautious cycle shift afoot:

Switching over to macro—Fedspeak this week has reinforced what we already know. Fed members are content with the cooling off of price inflation as seen in CPI and PCE, but aren’t yet satisfied with their level. The trajectory of disinflation is good, but we are not at the Fed’s 2% long-run target yet. As such, the Fed remains firmly on hold as disinflation continues.

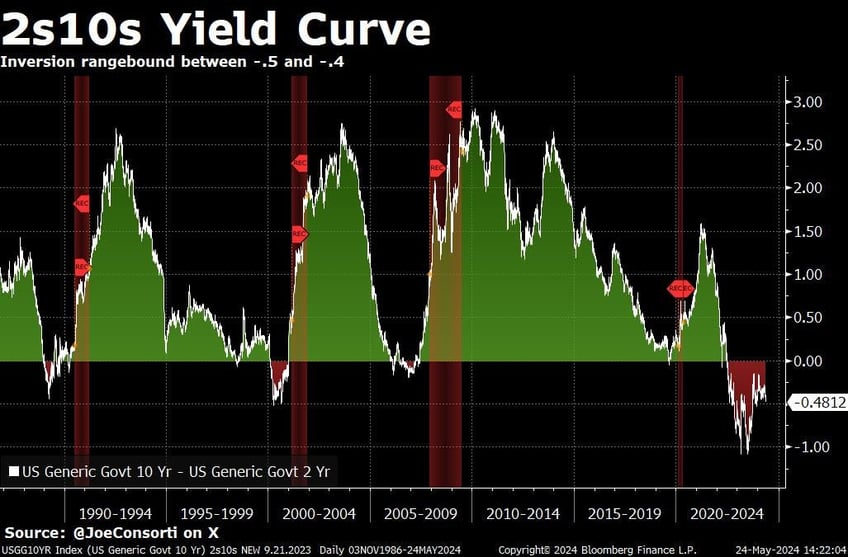

The yield curve reflects this in-betweenness of our position in the macro cycle, where rate expectations and growth expectations are both holding steady. Rather than rate expectations falling causing the yield curve to uninvert and eventually re-steepen above the 0-bps threshold, the 2s10s yield curve has stalled out, and is rangebound at a ~50-bps inversion:

With inflation cooling adequately in the eyes of the Fed, and consumption starting to slow on the back end as consumers run out of cash and are starting to pare back spending, the Fed’s focus will likely now shift to the other component of its dual mandate: making sure employment remains strong and intact.

As such, further moves in rates are likely to respond to employment prints more than CPI and PCE prints. We have our eyes on nonfarm payrolls and JOLTS data prints in the coming weeks as our primary labor market data points to watch. As always, keep it here at The Bitcoin Layer for the latest on the developments in the labor market.

Subscribe for BTC & Macro Research

Another fly in the ointment is commercial real estate, where distress among borrowers is starting to pick up in pockets across the US. Here’s the latest headline about it—buyers of the AAA tranche of this $308-million CMBS note on a Manhattan skyscraper were only paid back 74% of their investment. All the lower-tranche creditors got smoked, 100% loss. Stress in the highest-rated CRE debt gives us pause on how much more the CRE sector can take before we start to see big defaults and impairment, which would ripple through the financial and real economy. We have our eye on it.

And now for the biggest development this week.

Spot ether ETFs were approved by the SEC in a surprising move given Gary Gensler’s outspoken hesitancy to approve these vehicles for anything other than bitcoin.

VanEck, ARK Investments, and the other big names who also launched bitcoin ETFs earlier in January are among the hopefuls who plan on launching ether ETFs for trading as soon as possible. This is approval of the early application documents; other approvals will take at least a couple of weeks, and the process until vehicles launch for trading usually takes 5 months or more. This is likely to be on an accelerated track, as the powers that be who fast-tracked this approval will want them live before the November election.

Our own narrative here is that we didn’t expect spot ETH ETFs to be approved for risks around the asset and network itself. The Ethereum network isn’t sufficiently decentralized, and it is prone to grow more centralized as time goes on due to its Proof-of-Stake consensus mechanism funneling issuance power into fewer and fewer hands as time goes by. Those with more tokens have more influence, leading to a concentration of power with the ether-wealthy and raising the barrier to entry for people who want to join the network and begin issuing ETH. This is fundamentally different from bitcoin’s Proof-of-Work consensus mechanism, wherein computing power determines your slice of the protocol’s issuance schedule, meaning far less centralization risk of governance power.

Chair Gensler stated numerous times his concerns about spot ETH ETFs. Nevertheless, they have been approved. The complete 180-degree turnaround in approval odds from Bloomberg’s sub-30% to application approvals in less than a week tells us that this isn’t a decision made by the SEC, rather, the decision came from the top. Bloomberg ETF analyst James Seyffart agrees. The crypto asset ecosystem is more political than ever, and the incumbent’s disapproval and bashing of the ecosystem has turned on a dime to a supportive tone in an effort to buy as many votes as possible.

This is the first crypto election, and while we believe that bitcoin will eventually detach entirely from ETH and all the others, the two are joined the hip for now.

The news here is this: Washington D.C. is now in support of it all. It is a losing position to be anti-crypto”in 2024, and both parties are working together to make the US the best place to be for both investors and companies looking to build in it.

Looking to ETH/BTC, our favorite chart to indicate crypto dominance relative to bitcoin, popped on this news, from 0.45 to 0.55 and climbing. This marks the end, for now, of the break under this key psychological threshold. It still may have some room to climb in the weeks and months ahead as these ETFs launch and the early-bird inflows come in. We believe that its secular downtrend will remain intact, and that interest in assets other than bitcoin will continue to wane as it has been for years now. This view would be nullified by the price of course—somewhere in the 0.065 range would be a material break of the downtrend of the past couple years.

For ETF investors, the value prop of bitcoin is straightforward: digital gold. A simple selling point for people who otherwise wouldn’t have touched it. For ETH? We don’t know what will attract them to these vehicles other than bitcoin beta. Beta that we believe will wane as the years and decades go on and these assets continue to diverge:

River CEO Alex Leishman put it best: the only things in “crypto” that matter are bitcoin and low-friction USD, everything else is gambling. There’s nothing necessarily wrong with that, but it’s disingenuous to act like it is something more virtuous.

Next Week with Nik

In the week ahead, Treasury will auction a ton of paper in the front end of the curve. Recent flattening action in the yield curve might be caused by all this front-end paper, and the lack of selloff in the long end is notable given how much has been made about all the supply coming to the market. Month end, Treasury auctions, and a settlement/QT day should make next week a little more exciting in the money markets, so we’ll be watching for any repo hiccups. On the economy, we’ll see some indicative data but nothing that jumps out. The following week will bring the return of tier-1 data, but next week’s Case Shiller home prices, jobless claims, and Friday’s PCE will have to make do.

Here are some technical levels I will be watching in June as price action progresses:

2s: 5.0-5.1% resistance—a break above 5.1% in 2s would be extremely noteworthy and suggest an end to any hope of a pre-election rate cut

10s: we are extremely close to a close above 4.5%, which could get the bears involved and put pressure on stocks

Bitcoin: the local high around $72,000 continues the consolidation, but a break above puts $80,000 in play

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Subscribe to The Bitcoin Layer

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Nik summarizes his recent conversation with CrossBorder Capital founder Michael Howell. After Nik interviewed Michael on May 9th, viewers asked us for more education surrounding some of the key concepts covered, including how to understand Howell's liquidity index itself, Treasury bill monetization by banks, and duration's impact on financial markets. Nik concludes with why global liquidity matters for bitcoin.

Check out—Explaining Michael Howell's Global Liquidity Framework

Tuesday

There are weeks when nothing happens, and there are days when weeks happen. On Monday, 4 to 5 weeks’ worth of developments in the bitcoin ecosystem were jammed into one day:

Ethereum ETF moved from ~25% approval odds to 75% odds after Washington decided to fast-track it for political reasons

Overnight, being anti-crypto was made a losing political position in D.C.

ETH/BTC is up above our 0.05 death watch threshold, still weak

Grayscale’s CEO of 10 years is stepping down, replaced with a former leader of institutional asset managers like Goldman Sachs and BlackRock

The same day, its parent company DCG settled with New York for $2 billion after defrauding investors with the Gemini Earn program

Bitcoin is soaring, has broken out of its bull flag (which I called last week), and has forcefully reclaimed $71,000. New all-time highs next? Most definitely.

Folks: sit down and grab a cup of coffee. It’s going to be a juicy one today.

Check out—Bitcoin Forcefully Retakes $71,000, New All-Time Highs Next, ETH ETF Is Here

In today's video, Joe discusses the latest developments in bitcoin and the broader ecosystem. In the last 24 hours, the SEC has pivoted from not approving a spot Ethereum ETF to fast-tracking its approval, causing Ethereum to jump 20% and ETH/BTC to move above 0.05. He discusses how the House and Senate are now majorly pro-crypto, passing 3 separate bills in the last 10 days in support of the ecosystem. Finally, Joe wraps it all up with a look at bitcoin's bull flag breakout, signaling a bull market continuation if we can get past this brief consolidation period near $70,000.

Check out—Washington Goes PRO-CRYPTO: BTC SURGES, ETH ETFs

Wednesday

In this episode, Nik is joined by bitcoin on-chain analyst James Check (Checkmate). They present an overview of realized price and MVRV, two of bitcoin's foundational on-chain metrics to help people understand the importance of this new study. Checkmate presents bitcoin market analysis and his highest signal on-chain charts to demonstrate why he believes bitcoin is exhibiting classic bull market behavior. Nik finishes with some bullish thoughts on bitcoin's maturation.

Check out—Bitcoin Is In A Classic BULL MARKET with Checkmate

Thursday

Lately, I’ve spent a lot of time considering the power structure between the Treasury and the Federal Reserve. As an aspiring American financial historian, I’ve closely studied the Fed’s founding, the private nature of the individual Federal Reserve branches’ shareholders, the Board of Governors’ history of representing US government interests, and periods of unorthodox coordination. A recent bill proposed to Congress would end the Fed and abolish the Federal Reserve Act (1913)—is this a good idea?

Check out—Do we need to end the Fed?

Friday

It’s time to put our thinking caps back on as we deep dive into student debt forgiveness and what it means for the US economy, a potential cash crunch in a real estate fund, and the race to dominate the semiconductor market.

TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy.

Check out—TBL Thinks: Student loan forgiveness, REITs trouble, and the chip war

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Subscribe to The Bitcoin Layer

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.