Follow us @gmgresearch on Twitter

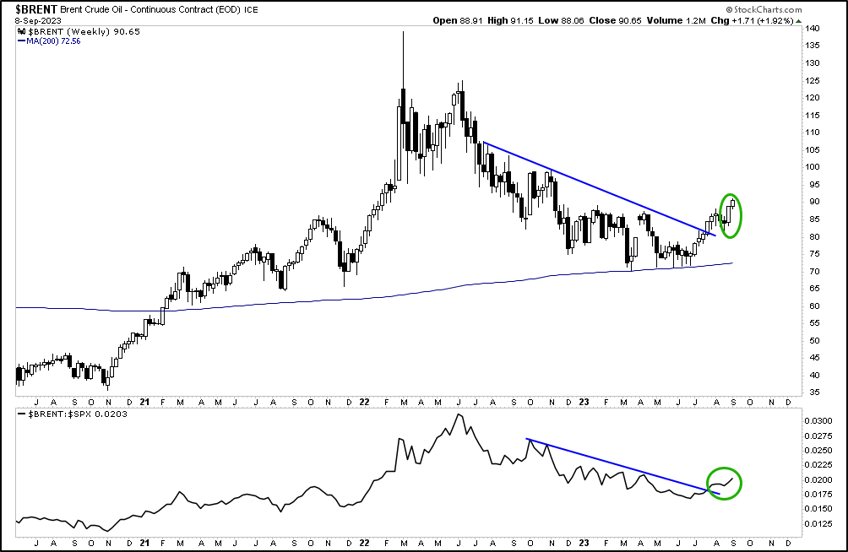

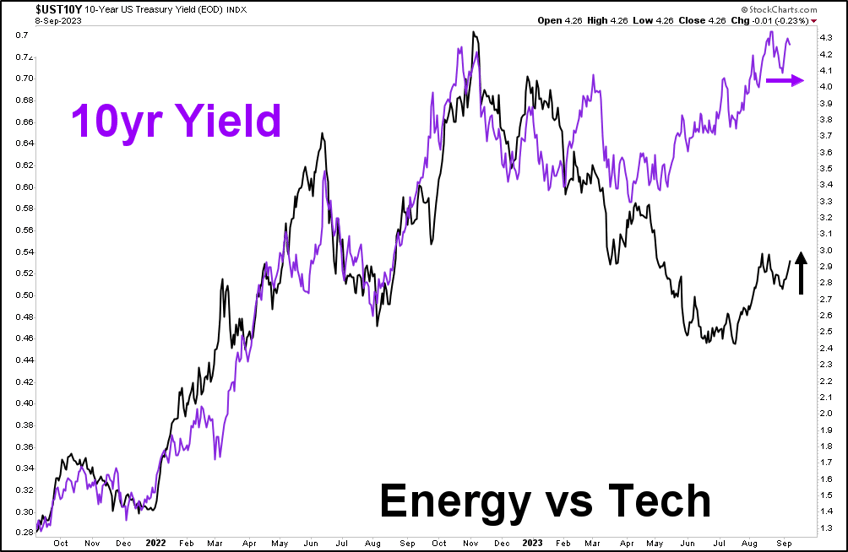

Oil is leading and will keep rates higher for longer.

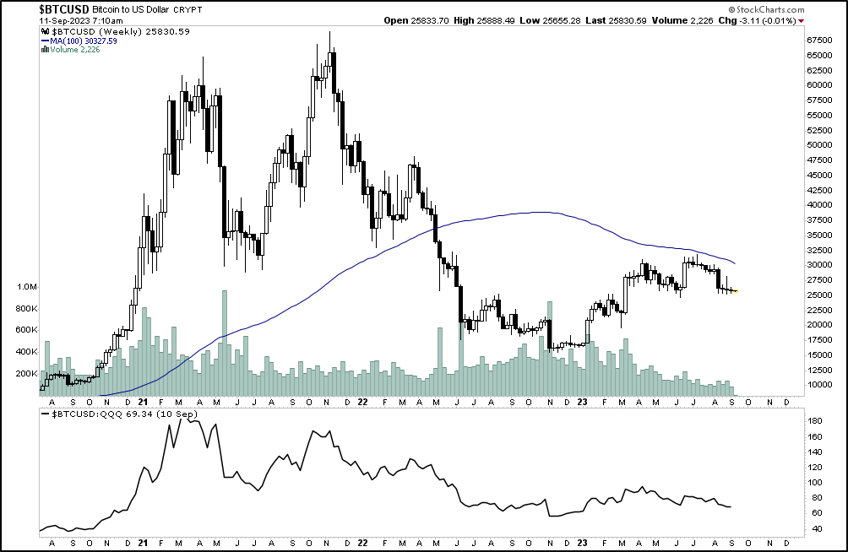

Bitcoin.

XLE is continuing to fill the gap.

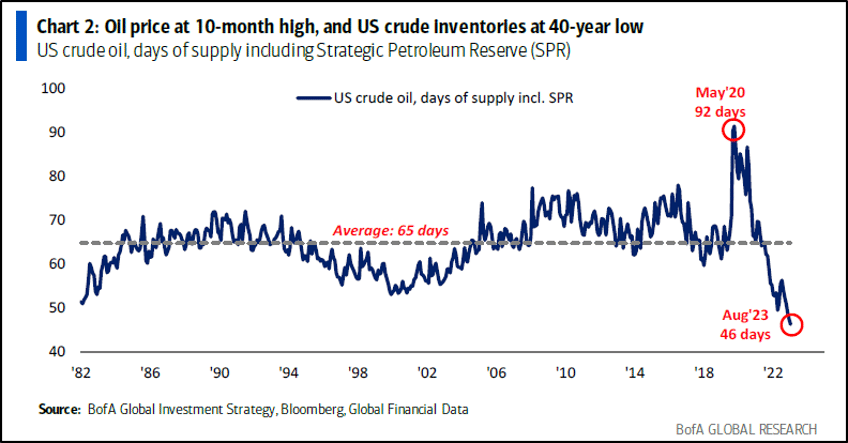

US crude oil inventories at 40 year lows

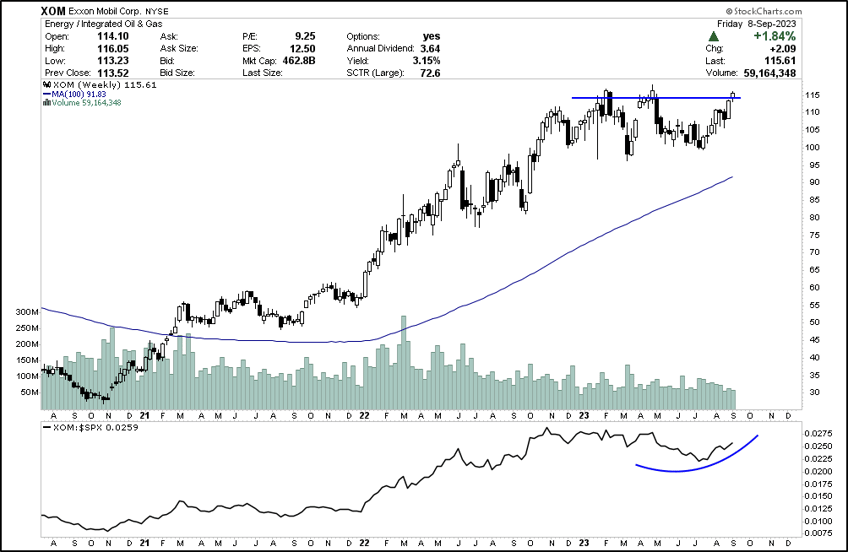

Exxon is pushing higher still. Over 85% of energy sector is above the 200-day moving average.

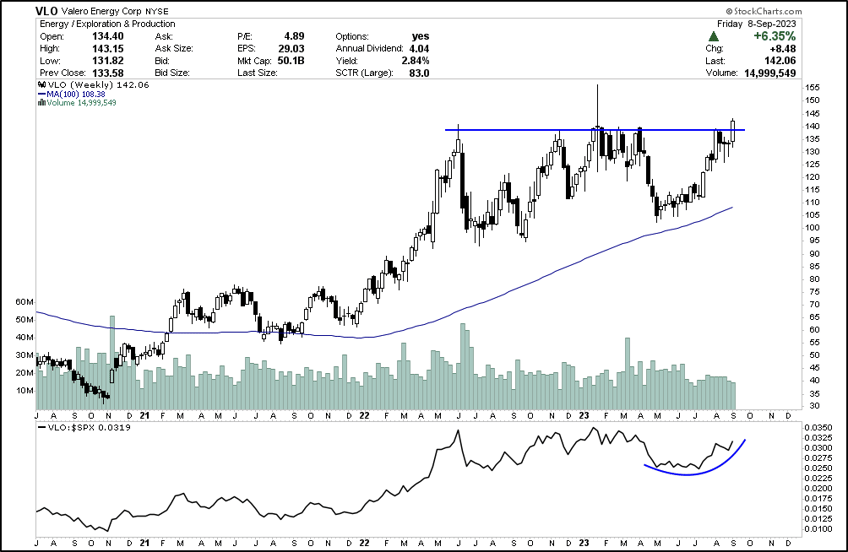

Valero is even outperforming the XLE.

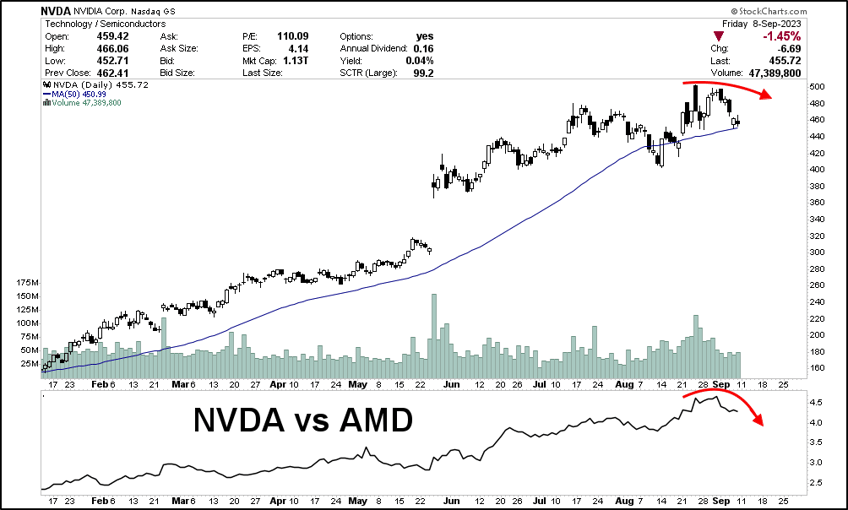

NVDA can give some flows back to the semi index. (AMD)

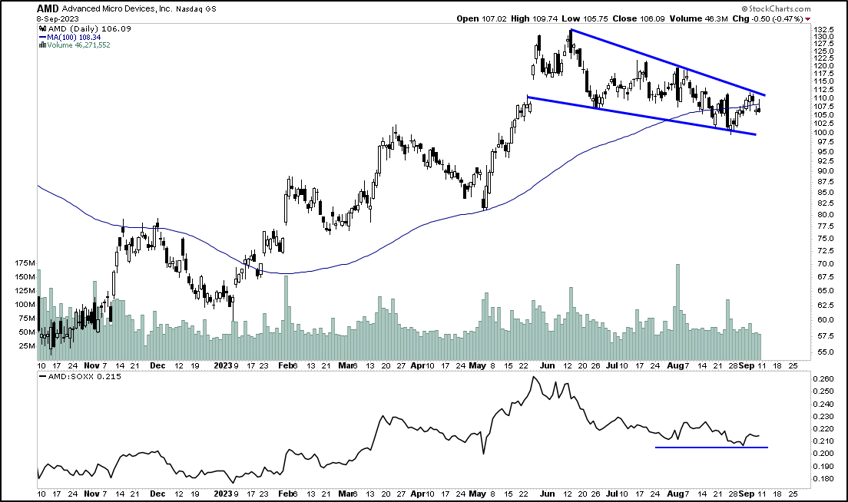

AMD moving relatively higher against the Semiconductor ETF (SOXX)

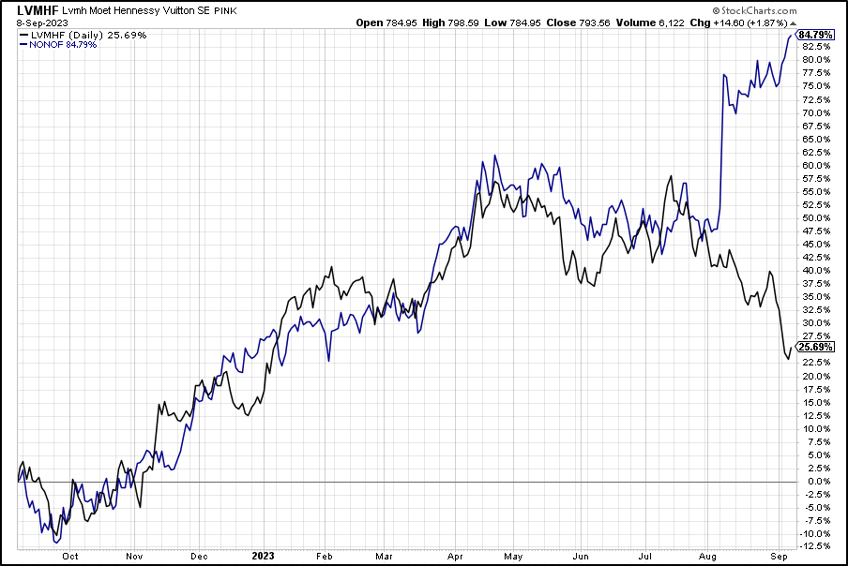

Novo Nordisk’s GLP-1 (obesity) drug is ripping through the markets. Just as “Europe’s tracking-error bellwether” counterpart, LVMH, makes fresh lows on the year.

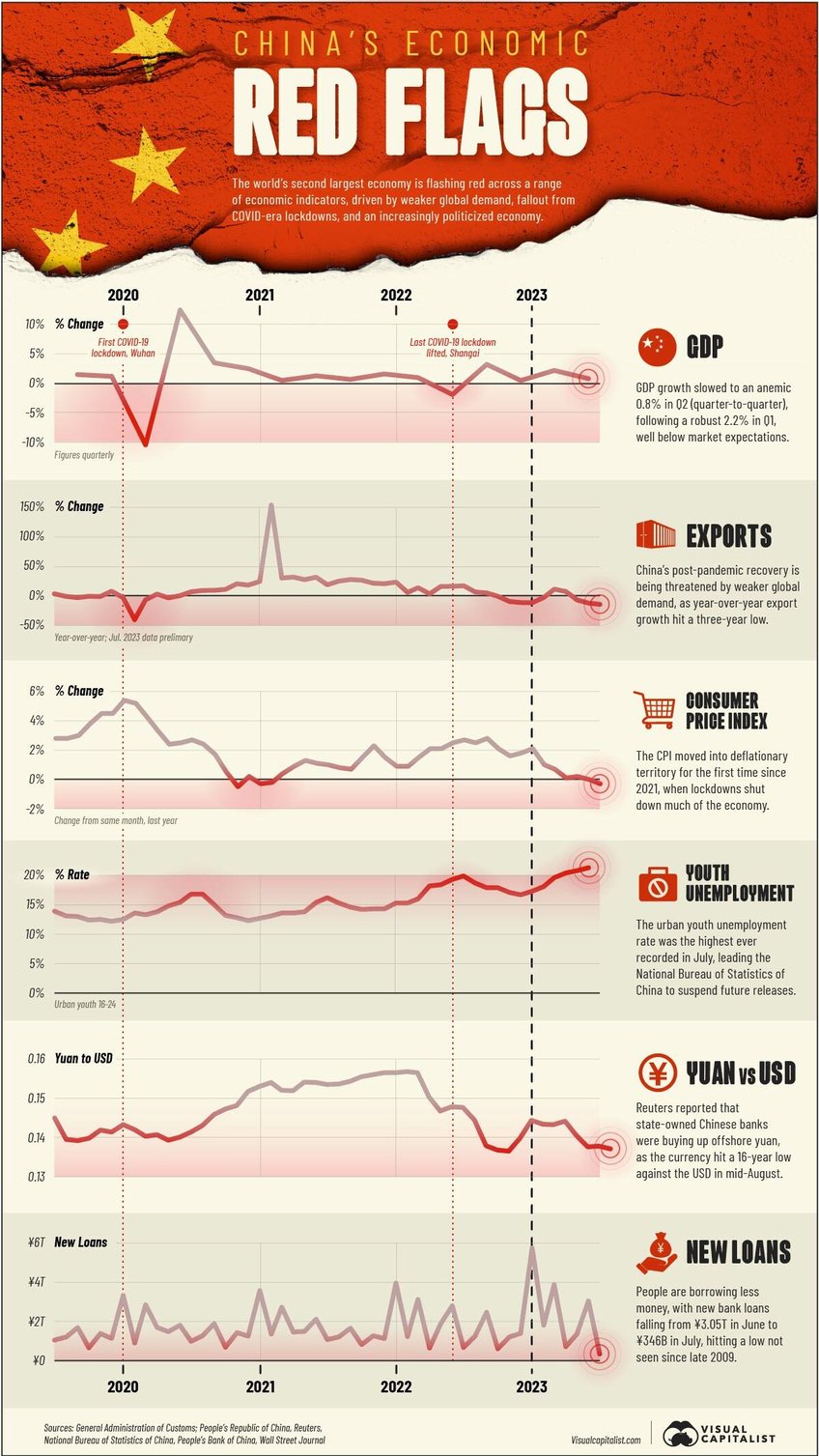

The China fear mongering is at highs. There’s only one thing China can do, print $.

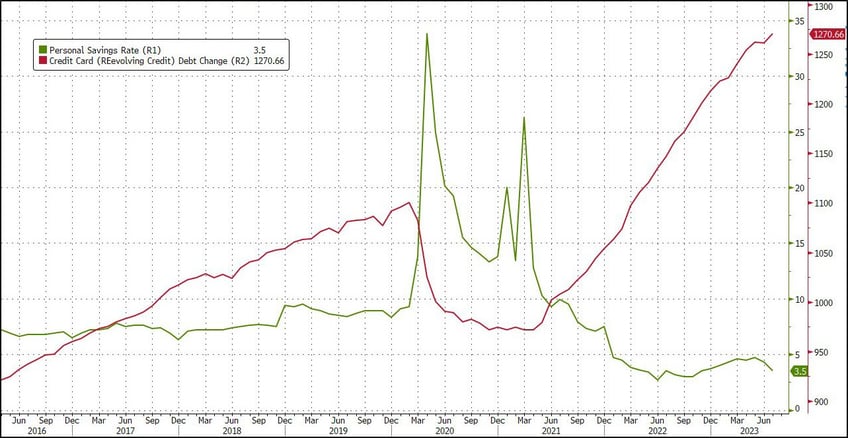

Personal Savings & Credit Card: Lower-income individuals in today's economy tend to borrow, while those with higher incomes are more likely to be savers and accumulate that interest.

Return always wants its risk payment. Enjoy the alpha.

Not Investment Advice, only entertainment.