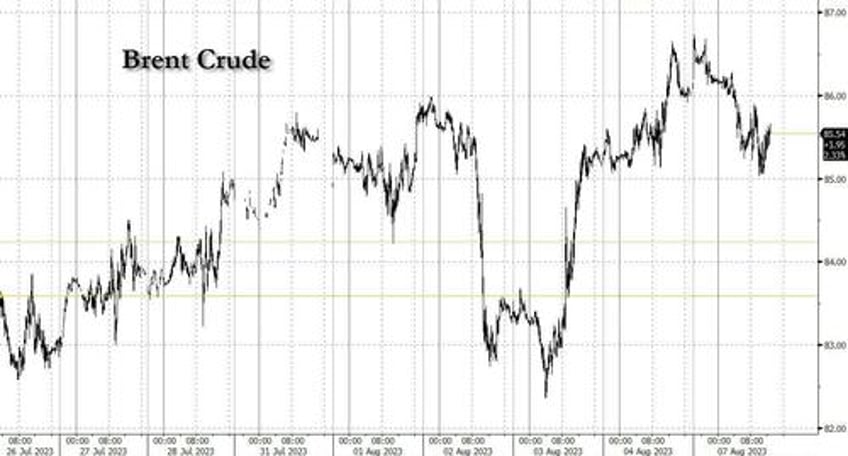

As Bloomberg Markets live commentator Jake Lloyd-Smith writes this morning, oil’s had "a curiously muted reaction" to the latest twist in the war in Ukraine, with Brent getting only a small lift before trading flat and then dipping into the red.

For those who missed the latest news, on Saturday a Russian oil tanker was hit by a Ukrainian sea drone in the Kerch Strait. In addition, on Friday, Ukraine attacked a Russian naval ship with a sea drone in the Black Sea port of Novorossiysk.

Kiev recently said that it had designated six Black Sea ports - a vital conduit for its crude - as being in "war risk" areas, indicating that there could be further attacks on Russian territory.

As Academy Securities reports, "Ukraine’s goal in attacking the tanker was to increase insurance costs for Russia’s partners that are buying oil and shipping it out of those ports, which raises the true cost of buying “discounted” Russian oil and hurts Russia financially."

The number of attacks in the Black Sea by both Ukraine and Russia have increased since Moscow terminated the grain deal last month that had allowed Ukraine to continue to export grain to alleviate the global food crisis.

With Ukraine’s land-based counteroffensive making no progress in the latest humiliation to NATO forces which are waging war against Russia by Ukraine proxy, Kiev is now looking to expand the conflict into the Black Sea and even into Moscow where Ukrainian drones attacked buildings last week; indeed, as Ukraine’s defense ministry said in a Saturday post that “Two can play that game” in response to Russian attacks on Ukraine grain infrastructure.

And, as we first noted late Friday...

First Novorossiysk now this: Ukraine targeting Russian oil exports. https://t.co/lZz1udrdLi

— zerohedge (@zerohedge) August 4, 2023

... for the first time, the attacks put at risk Russia’s commodity exports via the Black Sea, a route that accounts for most of the grain and 15% to 20% of the oil that Russia sells daily on global markets. Significantly higher insurance and shipping costs are likely to follow for Moscow, but there are risks to European and global markets, too.

Taken together, all this represents an important escalation. The spike in military activity comes as crude has recorded six consecutive weekly gains.

That's why Lloyd-Smith cautions that despite today's muted reaction, "oil prices are set for gains this week as more details of the shift become clear, and as traders factor the latest set of risks into outlooks that already looked positive. "

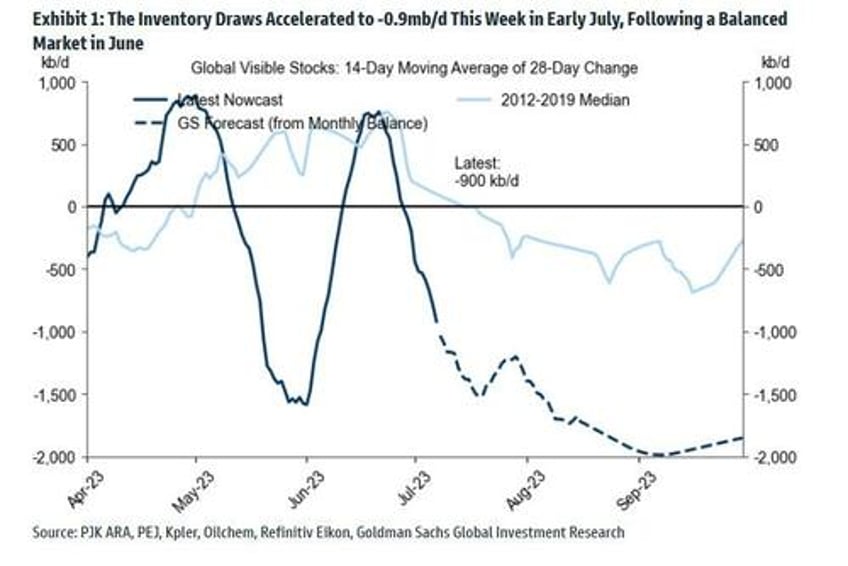

The recent oil rally was spurred by Saudi Arabia and Moscow extending voluntary supply cuts; expectations of oil deficits as large as 2mmb/d barrels in the coming months...

... as US inventories last week sunk by a weekly record; and reports that global demand is at a record high. Expect further validation of the bullish story later this week, when both the IEA and OPEC weigh in with revisions to their market outlooks, while in the US, the Energy Information Administration will present its Short-Term Energy Outlook as well.

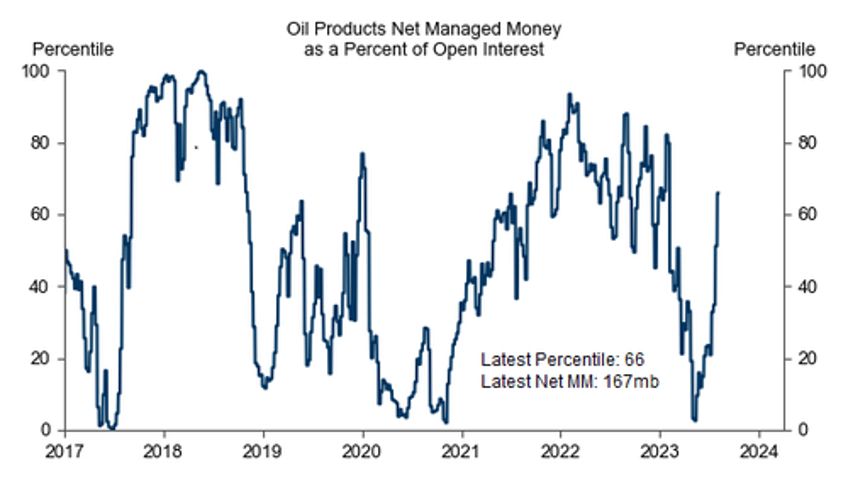

Bottom line: there’s plenty of headline risk here, on top of any developments on the battlefield, and traders are rapidly preparing to take advantage of the coming price spike: according to the latest CFTC data, money managers posted further increases in bullish bets for most oil products last week, the highest since April while WTI outright longs were the highest since July last year......

... oil products Net Managed Money surged by 30mb this week, stood at 66 percentile

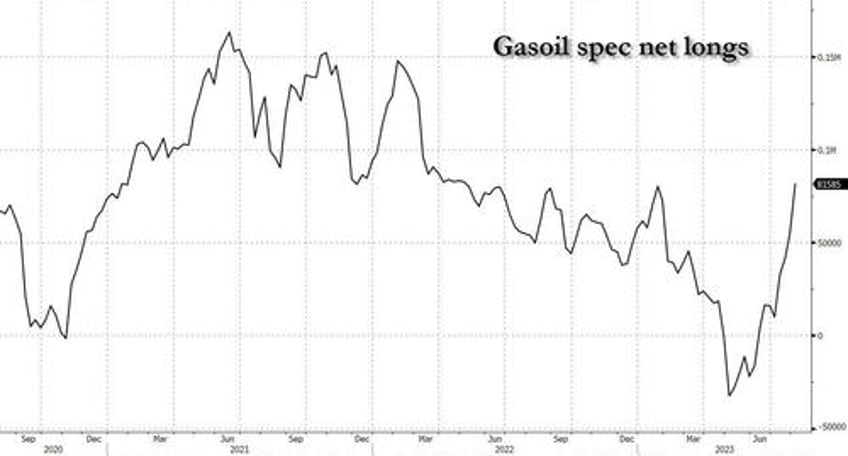

... and ICE gasoil net-longs hit the biggest since May 2022.

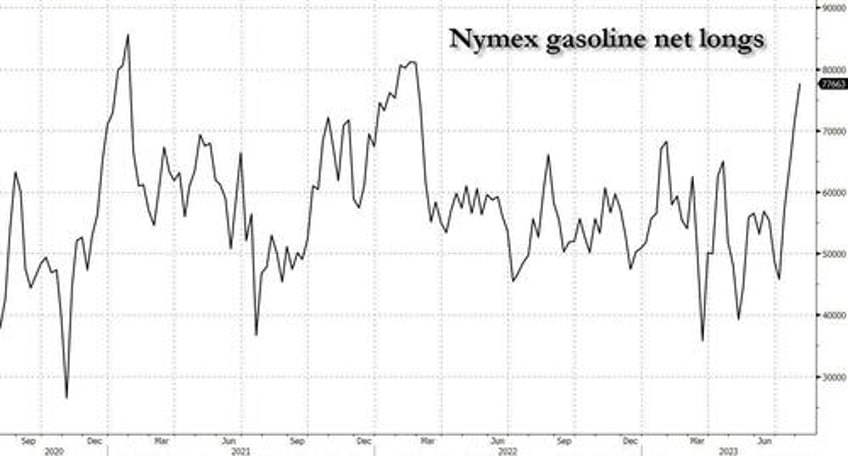

Meanwhile, Nymex gasoline net-bullish positions hit the highest since February last year.