“We are witnessing the birth of Bretton Woods III—a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and contribute to inflationary forces in the West. As a result, gold stands to benefit from this shift as a neutral reserve asset.”

– Zoltan Pozsar (March 2022)

On Gold's Role in Dedollarizaton

[Chapter from a forthcoming book]

Contents: (2600 words, 26 slides)

- Introduction: The Shift Away from the Dollar

- Causes of Dedollarization

- Gold Benefits

- The Mechanisms of Dedollarization

- The Future of Gold in a Dedollarized World

- Conclusion: The Path Forward

Introduction: The Shift Away from the Dollar

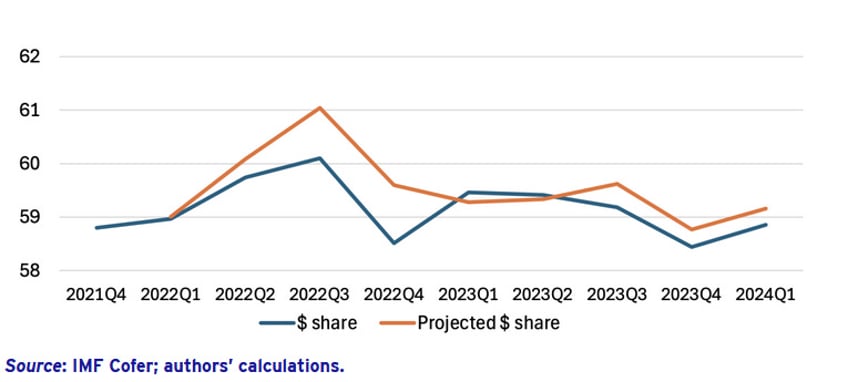

Dedollarization is no longer a fringe theory. It’s a real shift in global finance, driven by a range of factors from geopolitical tensions to sudden monetary policy changes. For decades, the U.S. dollar ruled as the world’s main reserve currency. Now, a growing number of countries are looking for alternatives. Sanctions, the “weaponization” of the dollar, and concerns over the Federal Reserve’s policy swings have all pushed central banks and governments to diversify.

In this changing environment, gold stands out. It’s neutral, widely trusted, and isn’t tied to any one nation’s policies. Many see it as a hedge against political risks and inflation. As new financial arrangements emerge—like bilateral trade deals, regional payment systems, and talk of gold-backed currencies—gold’s role expands. Below, we’ll explore the causes of dedollarization, the factors pushing gold to center stage, and how nations are paving the way for a future less bound to the dollar.

Causes of Dedollarization

1. The Weaponization of the Dollar

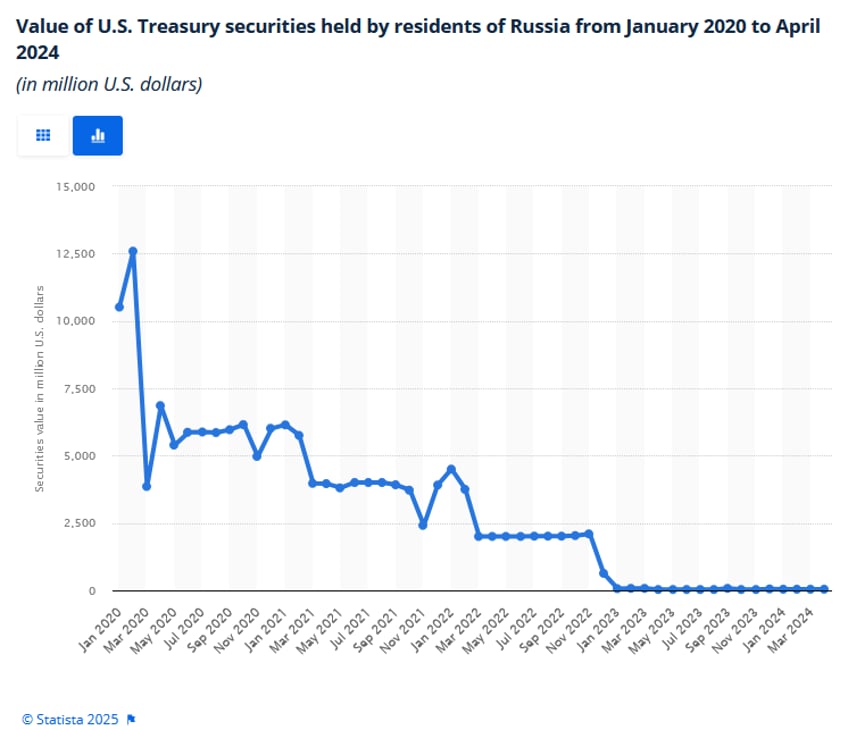

U.S. sanctions illustrate how the dollar can be used as a geopolitical tool. Freezing foreign reserves or denying access to dollar-based transactions puts countries like Iran, Russia, and Venezuela in a tough spot. After Russia’s reserves were partially frozen following the Ukraine invasion, many nations realized the dollar isn’t a neutral reserve asset. This move showed that heavy dependence on the dollar can be risky.

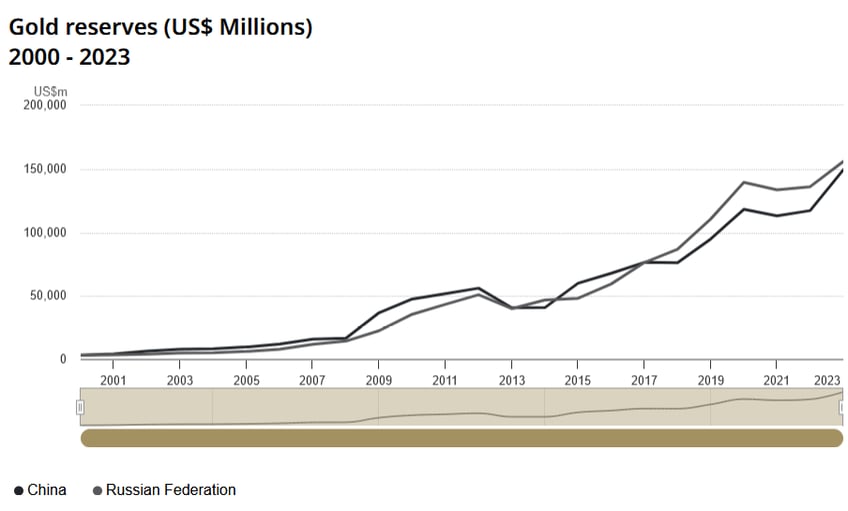

To reduce vulnerability, countries started diversifying their reserves. Gold, immune to sanctions and not controlled by any single government, became a top choice. Russia’s big purchases of gold showed how a country can insulate itself from dollar threats. Other nations took note. The fear that reserves could be locked at will has prompted them to hold more assets outside the dollar.

2. Monetary Policy Volatility

The Federal Reserve’s rapid policy shifts have also caused concern. In crises, the Fed injects liquidity through massive quantitative easing, which can weaken the dollar’s value. When inflation rises, the Fed reverses course with sharp rate hikes, which can disrupt global markets. This unpredictable cycle leaves countries exposed if they rely too heavily on dollar reserves.

Holding gold can offset this volatility. Gold doesn’t hinge on the Fed’s next decision. It’s seen as a stable store of value, so central banks in emerging markets have increased their gold reserves. This strategy helps them hedge against exchange rate swings and inflation spikes that can undermine the dollar. By diversifying with gold, they’re aiming for greater stability in a fast-changing monetary landscape.

3. Emerging Multipolarity and China’s Progress

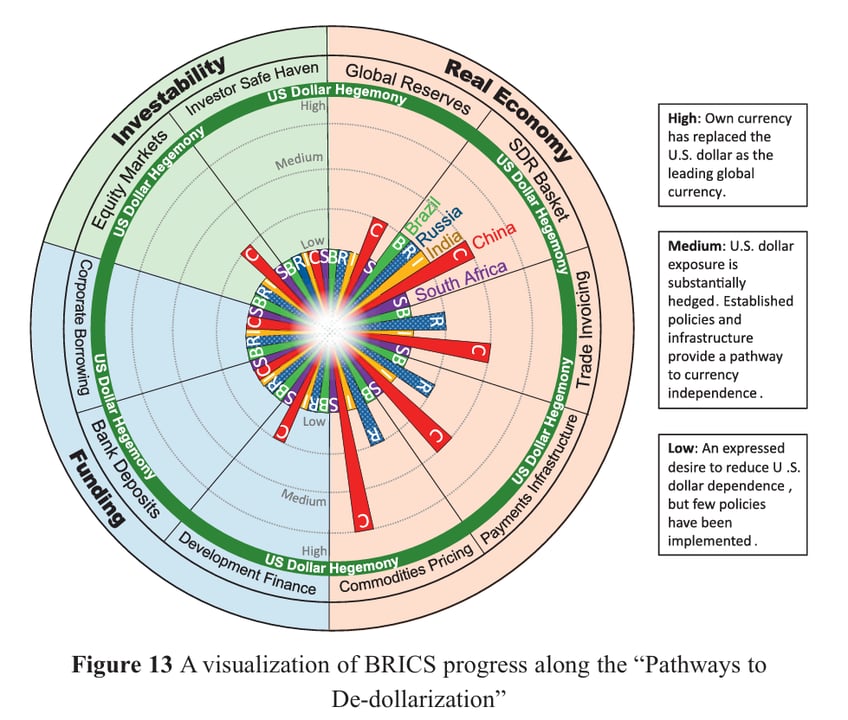

The rise of economies like China, India, and Russia has made global power more multipolar. The BRICS bloc (Brazil, Russia, India, China, and South Africa) is pushing for ways to bypass the dollar in trade and finance. China’s deals with Brazil to use the yuan and India’s push for rupee-based transactions are signs that these nations want to reduce dollar dependence.

In this environment, gold’s neutrality gains importance. It’s a universal asset that doesn’t favor any single economy. The idea of a BRICS currency backed by gold or other real assets also shows how these nations might reshape global finance. By pooling resources, they hope to create an alternative financial structure that doesn’t rely on U.S. monetary policy or Western banking systems. If they succeed, the dollar’s status as a universal yardstick could erode.

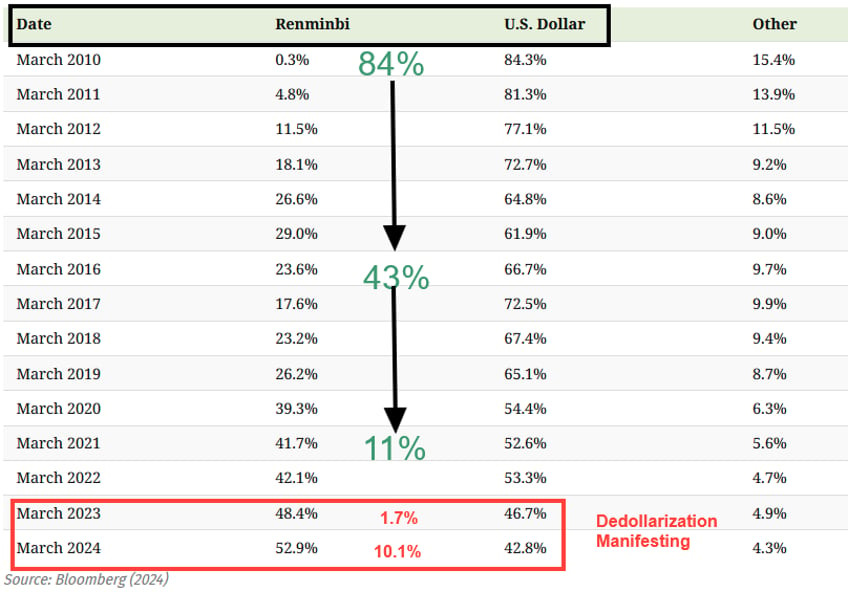

China’s Dedollarization Progress

Brazil, Russia, India footnoted1

4. Commodity Trade and Settlement Shifts

Commodities—oil, metals, and agricultural goods—have long been priced in dollars. This “petrodollar” system cemented the dollar’s global status. Now, countries like China are advocating for alternative pricing and settlement in their own currencies. Deals like the China-Brazil arrangement, which uses the yuan and real, are small steps in this direction.

As more trades move away from the dollar, the need for large dollar reserves declines. This is where gold can step in. Gold’s global acceptance makes it an attractive bridge when trust in paper currencies fades. Its liquidity and independence from political control allow countries to settle trades without relying on the dollar. Barter systems or partial payments in gold can also bypass currency risk. Over time, these shifts break the dollar’s monopoly on commodity pricing.

Gold Benefits

1. Gold’s Role as a Neutral Asset

Gold is viewed worldwide as a stable store of value. It doesn’t depend on the creditworthiness of a single government and isn’t subject to direct political pressure. If a country faces sanctions or central banks worry about the impact of another nation’s monetary policy, gold offers protection. That’s a key reason countries with uncertain relations to the U.S. are keen on expanding their gold reserves.

Gold’s intrinsic worth sets it apart from fiat currencies, which can be devalued through inflation or policy decisions. Its price can move, but gold maintains appeal as a hedge. This impartial character makes it a logical choice in a world where alliances shift and confidence in fiat currencies can waver. When a nation parks part of its reserves in gold, it gains a buffer against both political and financial shocks.

2. Gold in the BRICS Strategy

The BRICS nations are leading the way in reevaluating gold. China discreetly increases its gold reserves, while Russia openly does so. Both want to shield themselves from Western sanctions and reduce reliance on dollar-denominated assets. India, with its cultural affinity for gold, also sees bullion as a strategic resource. This collective interest among large emerging economies boosts gold’s global stature.

A potential gold-backed BRICS currency would be a game-changer. Linking their joint currency to a hard asset would address trust issues and unify member economies. It might offer a serious challenge to the dollar, especially if global traders see this currency as more stable than a floating fiat currency vulnerable to unilateral U.S. actions. While it’s still an idea under discussion, the mere possibility captures the world’s attention. It highlights gold’s central role in the dedollarization narrative.

3. Facilitating Trade Settlement

Gold can serve as a neutral link in trade deals, especially when countries don’t fully trust each other’s currencies. It’s an old concept dating back to mercantilist times, but it’s getting a modern update. For example, countries can use gold as collateral or as a direct settlement tool for cross-border trade. This bypasses exchange rates tied to the dollar.

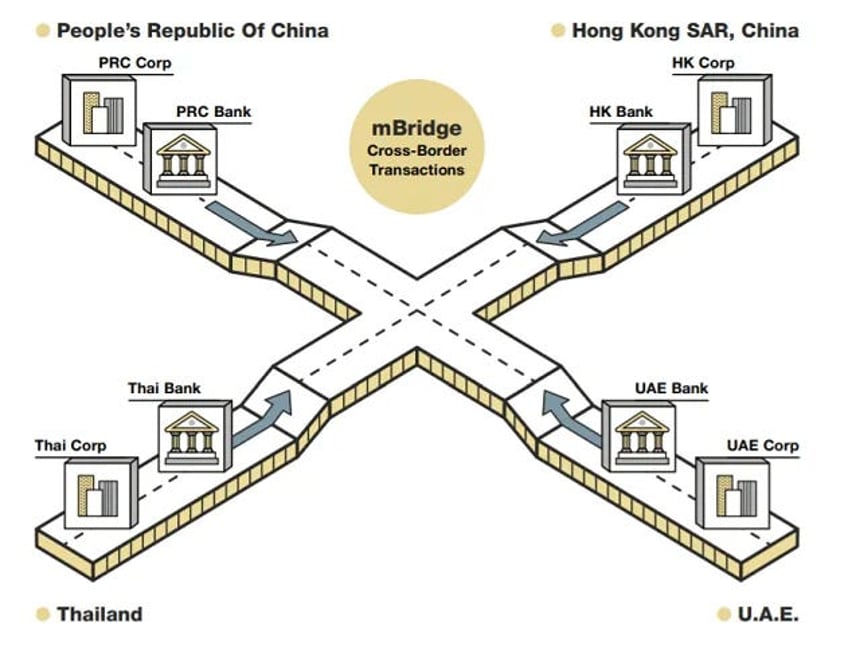

China is testing such ideas in how it structures global payments, sometimes involving gold-based arrangements. Digital platforms could soon make it easier to settle trades with tokenized gold. That way, an exporter sending goods abroad can be paid in a gold-backed digital asset, redeemable for physical bullion. This approach removes the risk of currency manipulation and aligns with the BRICS drive for independence from Western financial systems. Gold’s universal recognition is key to its appeal in such setups.

4. A Hedge Against Inflation and Currency Depreciation

Inflation undermines fiat currencies by eroding their purchasing power. Gold stands out as a store of value that often holds firm when prices rise. This makes it especially attractive for central banks in regions vulnerable to currency swings. If your domestic currency devalues, your gold reserves typically become more valuable, protecting the bank’s overall balance.

During past crises, gold’s safe-haven status has shone through. As countries pivot away from the dollar, gold can help them navigate inflation or other financial pressures. Its longstanding track record offers comfort: When currencies falter, gold tends to remain a reliable fallback. This stability is a huge draw for nations wary of tying their fortunes to the decisions of foreign central banks.

The Mechanisms of Dedollarization

1. Building New Payment Chains

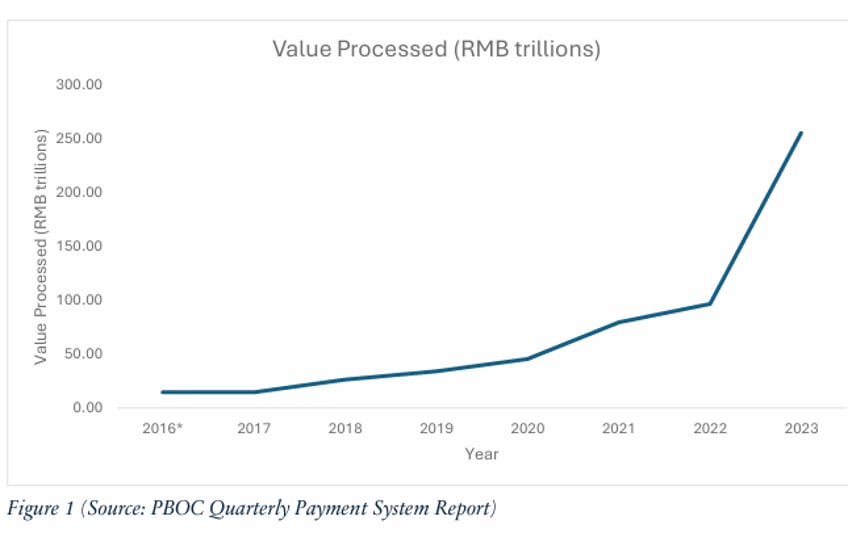

Alternative payment systems are a cornerstone of dedollarization. The BRICS nations, especially China, are pushing platforms like the Cross-Border Interbank Payment System (CIPS). CIPS reduces reliance on SWIFT, which is dollar-focused. Meanwhile, blockchain-based projects like mBridge aim to enable settlement in central bank digital currencies (CBDCs). These innovations allow countries to trade without going through U.S. dollar channels.

2. Regional Trade Agreements

Regional and bilateral trade deals, denominated in local currencies, are expanding. China and Brazil have made headlines by shifting a slice of their trade to the yuan and real. This reduces the need for both sides to hold dollars. Over time, a web of such deals can chip away at the dollar’s share of world trade.

Gold can play a supporting role. Countries can complement these local currency arrangements with gold reserves. If trust in a partner’s currency isn’t complete, using gold as a settlement option provides added security. This approach blends modern trade policies with a centuries-old asset. Nations forge closer ties and worry less about external sanctions or currency volatility. They can also tap into gold-based instruments to smooth out imbalances in their bilateral deals.

3. Gold-Backed Financial Instruments

Beyond physical bullion, gold-backed bonds or digital tokens are on the rise. Countries peg these instruments to actual gold reserves, offering investors security. If a government defaults, holders still have a claim on the gold. This structure can make the debt more appealing, possibly lowering borrowing costs.

Some central banks also consider partial gold pegs for their currencies. By tying a portion of a currency’s value to gold, they signal a commitment to stability. The idea is that while the currency can float, a gold buffer prevents extreme depreciation. Such steps align with a broader move to reduce exposure to dollar fluctuations. If enough nations adopt gold-based financial tools, the collective effect can weaken the dollar’s global grip.

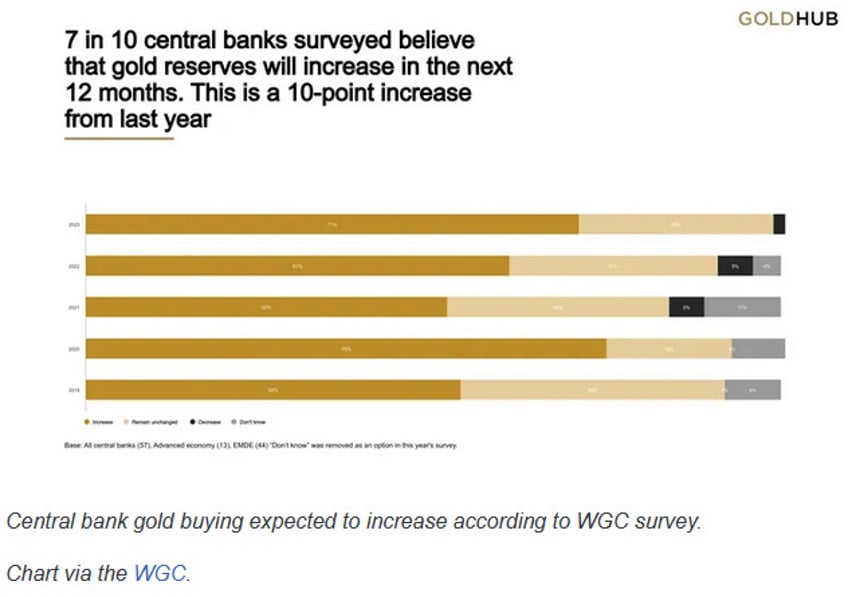

4. Central Bank Accumulation

Central banks worldwide are boosting their gold holdings. China, India, and Russia are the most prominent examples, but the trend isn’t limited to them. As more banks add gold, it diversifies their portfolios and reduces risk tied to dollar assets. It also shows a growing recognition that a more multipolar financial system is taking shape.

Continues here

Free Posts To Your Mailbox