By Michael Every of Rabobank

We need a geopolitical AND data calendar

A kind request to Bloomberg and other global assemblers of the weekly data calendars around which so many in markets still pivot: can we please get a geopolitical addition rather than just the numbers and the option of the warbling of endless central bankers? Right now, what political leaders say, especially when they meet, matters far more for markets than a run of the mill number or “jazz hands, yada yada yada” from an expert on monetary policy.

Yesterday, on its third anniversary, the US voted against a resolution at the UN blaming Russia for starting the Ukraine War. Obviously, that’s a slap in the face for Ukraine and Europe, who in the latest White House foreign policy pivot have been left clinging to the fuselage of a departing Airforce One like Afghanis on the runway at Bagram Airbase.

🇺🇸 In another sign of US President Donald #Trump's shift away from Ukraine and its European allies, the US pushed through its own #SecurityCouncil resolution not framing #Russia 🇷🇺 as the aggressor in its invasion of #Ukraine 🇺🇦

— FRANCE 24 English (@France24_en) February 25, 2025

More here 🔗➡️ https://t.co/tmn564r7Lu pic.twitter.com/hghSopM4Jq

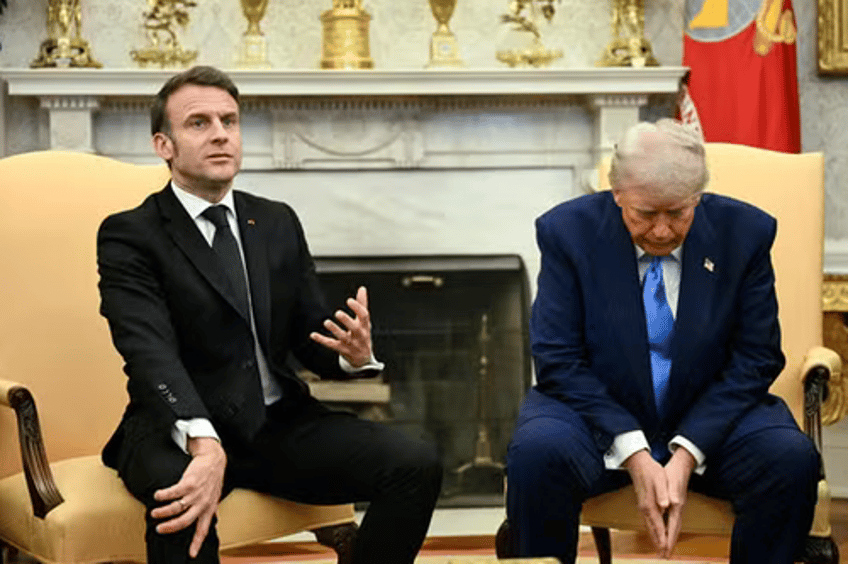

President Macron visited President Trump, where we heard that a push for a peace deal with Russia is on; and Trump said he’d like it in the economic sphere too. Russia then floated that it might mean rare earths and aluminium. Trump added President Putin has agreed to allow European peacekeepers into Ukraine, which Macron said he would send - if not to the front line.

Turkey backed Ukraine’s NATO membership. That’s a very powerful lever behind that cause, but Europe keeps failing to find the second-largest military power in NATO on a map or in any of its discussions.

Moreover, the US is reportedly close to an economic deal with Ukraine which will guarantee it as “free, sovereign, and secure.” This can be seen as predatory from the US side. It’s also the inverse of the ‘invade, then throw hundreds of billions at a country while failing to generate any profit from its resources, then get kicked out’ strategy employed in Afghanistan. It at least appears to cement US economic interests in keeping Ukraine viable despite apparent Russian appetites.

Next German Chancellor Merz, who stated, "Europe may need its own military alliance instead of NATO,” is discussing using the outgoing Bundestag to change the constitution to lift the country’s debt brake, unleashing €200bn in extra defence spending - which would cover a year of two of what would be needed. All Germany, and Europe, would then need to do would be to find the resources to match, including up to 300,000 young men and women prepared to serve at a time when there are fewer and fewer of them, and opinion polls show even fewer patriotic ones.

The US is reportedly considering merging its Pentagon Africa Command into Europe, effectively showing it no longer has the same global focus. For those who haven’t noticed, Africa is right next to Europe, not the Americas. That said, some areas far from it remain key.

US sanctions are back on vs. Iran’s shadow fleet, and this time they mean to enforce them vigorously: thus, the need for more Russian oil(?)

In geoeconomics, there was more will-he-won’t-he news on US Canada and Mexico tariffs: Trump said they are proceeding at 25% from 4 March as a US official said talks are ongoing, and Mexico said it’s studying new China tariffs. Reciprocal US tariffs begin early April regardless, for Canada, Mexico, Europe, and everyone, it seems.

The Trump admin is reported to want to tighten Biden-era chip controls on China and have held meetings with the key Japanese and Dutch firms involved, underlining that there is also going to be greater pressure to align with the US on this issue.

Senior Atlantic Council fellow @andrewmichta opines: “I've been thinking about what the return to the basics of state power means today. We are re-learning the basics about what military power is about… Perhaps we also misread what constitutes a working economy… In a world of state-on-state competition and war you need to be able to “make things” – manufacture. Every place I look I see signs of our civilisational decline that has been brought about by our elites’ post-Cold War arrogance about the “end of history” and “unipolar moment” – that bred ignorance about the fundamentals about geopolitics and geoeconomics.”

I summarized this back in November with one question: “What is GDP *for*?” And if you still aren’t asking that, then you aren’t going to be accurate in forecasting what GDP is going to *be*.

Put this together and we are still in our 2025 global outlook title of ‘The Year of Living Dangerously’: we have a stackable series of binary geopolitical scenarios with starkly different economic and market implications.

- Do we get a Ukraine peace deal or not? On whose terms – the West or Russia’s?

- Does the US de facto walk away from NATO or not?

- Does Europe rearm or not (even if the US does)?

- Do we get US tariffs vs everyone, so America Alone, or vs. some not others?

- Do we get a Monroe Doctrine US grand strategy base, or a break-up of the USMCA?

- Does Europe work with the US vs China, or look to Beijing and end up outside the US sphere?

- If the US and Europe rearm and jointly tariff China, then the key binaries are: if this stays in the economic realm or becomes geopolitical; if the economics involves a much weaker CNY or not; and/or if it involves the supply chains which the US and Europe still rely on for now.

One can see the room for massive volatility ahead – and how little most central bankers have to do with it except in their reaction function. (We certainly aren’t going to get any prediction from them. Indeed, the Fed’s Goolsbee just downplayed the leap to a 30-year high in US long-term inflation expectations, saying this doesn’t count unless it’s repeated for another few months, a time-period which will capture one of the binary tariff outcomes above. Visionary stuff well worth the big bucks.)

Meanwhile, Bloomberg says ‘China’s Repo Market Hit Hard as Yuan Defense Sparks Cash Squeeze.’ So, the PBOC trying to keep its currency stable vs the dollar as tariff fears rise is now draining local liquidity, hitting the economy. And that’s just with the Fed on hold, or grimly holding on, rather than talking hikes, and not (yet) looking at a how-to guides on geopolitics or geoeconomics. If/when it were to…