By Graham Summers, MBA | Chief Market Strategist

The stock market is setting up to offer a buying opportunity in the next week or two.

The S&P 500 hit a new all-time high last week. Every dip was bought as the markets finished the week in a solid “risk on” framework.

However, beneath the surface, several market leading indicators show a dip is coming…

High yield credit, which has led every turn for stocks in the last four months, has rolled over. As I write this Monday morning, it suggests the S&P 500 will fall to 5,300 in the near future. This is just a “dip” and we see it as a buying opportunity.

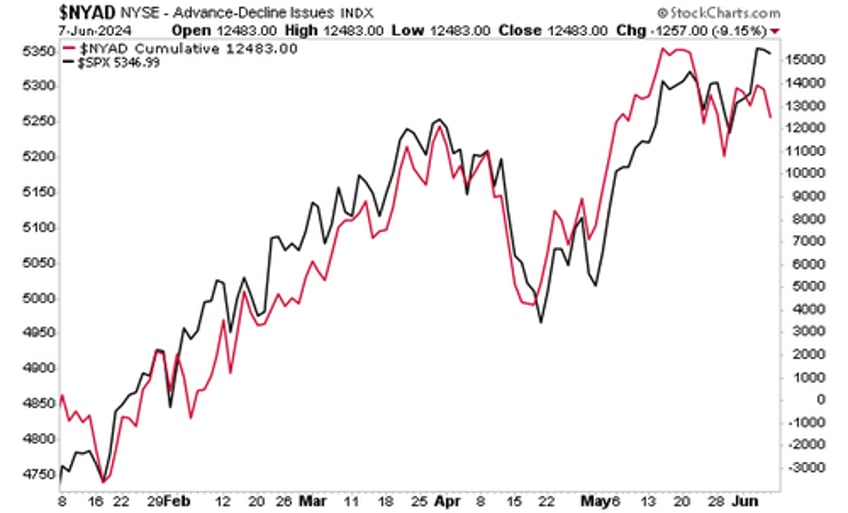

Breadth, another market leading indicator, is saying the same thing direction-wise. But it suggests the dip will be slightly deeper with the S&P 500 dropped to the 5,200s . The fact both breadth and high yield credit are saying the same thing, adds weight to the forecast for a risk off move.

Will this risk off move open the door to something worse? Could stocks crash some time in the near future?

To answer those questions, I rely on certain key signals that flash before every market crash.

I detail them, along with what they’re currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research