More than 50% of parents with a child older than 18 are providing them with at least some financial support, according to a recent report by savings.com.

Key findings from the report:

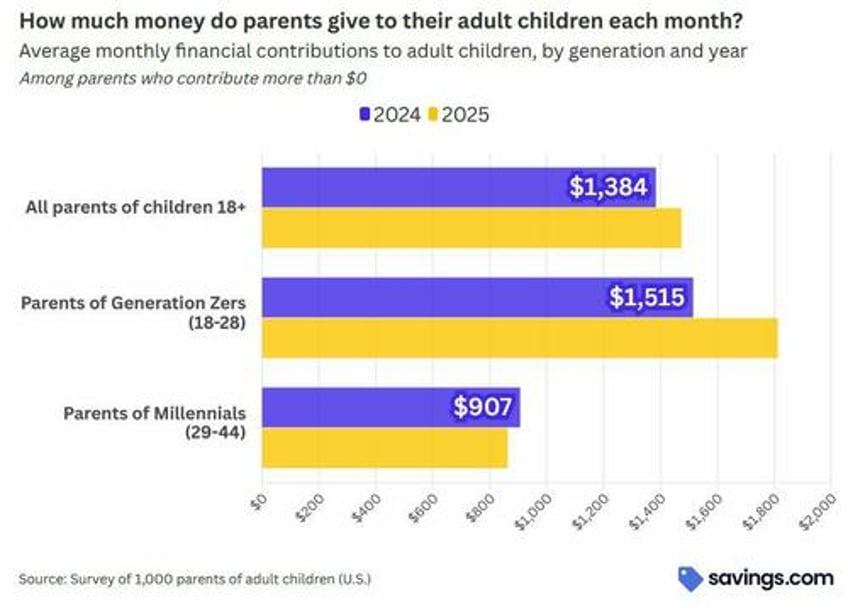

- Half of parents with adult children provide regular financial assistance to their grown offspring. The average support per adult child is $1,474 monthly, about 6% higher than last year.

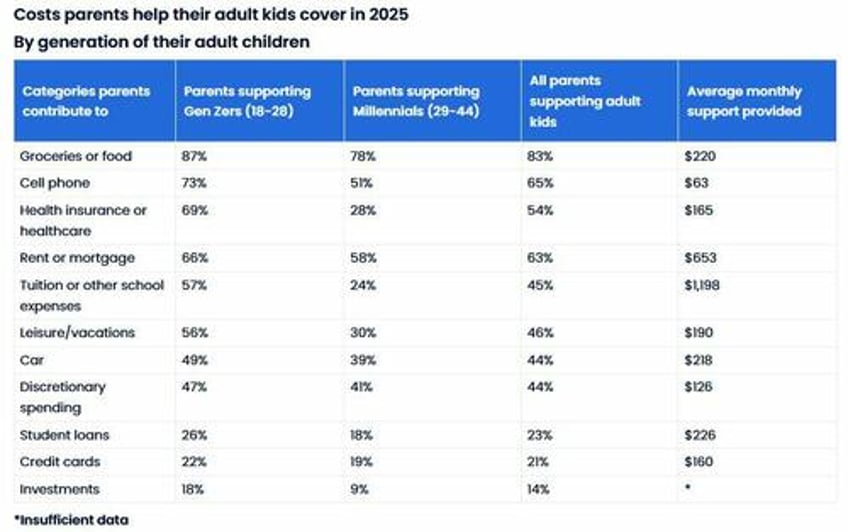

- 83% of supporting parents contribute to their adult kids’ monthly groceries; 65% help with cell phones, and nearly half (46%) pay for vacations.

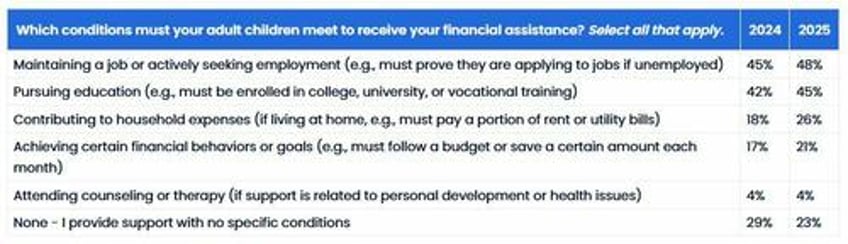

- More than three-quarters (77%) of supportive parents attach conditions to their financial assistance. 23% give money without any conditions.

- Nearly 50 percent of parents have sacrificed their financial security to help their grown kids financially, and most supporting parents feel obligated to help their kids with money.

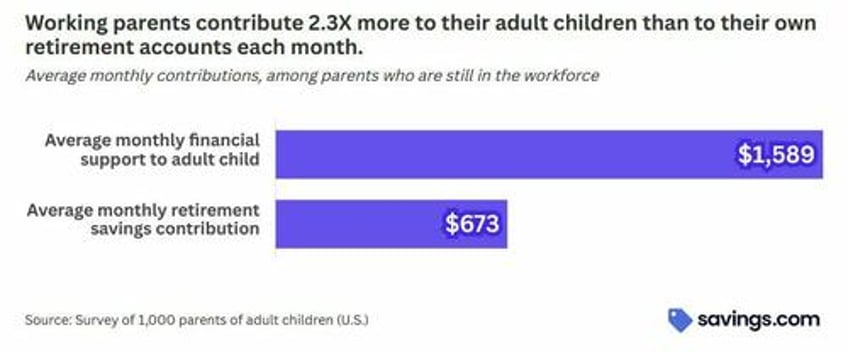

- Working parents who support grown kids contribute over 2X more money each month to their adult children than they do to retirement funds.

As savings.com continues, with inflation keeping the cost of living high, parents' financial support has reached a new peak, averaging nearly $1,500 per month (or almost $18,000 annually). This represents a six percent increase from the monthly contributions we reported last year.

As you might expect, Generation Z adults (ages 18-28) receive more financial support from their parents than their Millennial counterparts (ages 29-44), who've had more time to build careers and establish income streams. While the average contribution to Millennials decreased slightly, a significant increase in support for Generation Zers pushed the overall average higher. Members of Generation X (ages 45-60) rarely receive financial assistance from their parents, likely because they've either achieved financial independence or have inherited family wealth.

The financial strain of supporting grown children is particularly pressing for parents preparing a nest egg. Parents still in the workforce contribute over two times more money to their adult children each month than their retirement accounts.

The psychological and fiscal impact of such commitment translates directly to parental anxiety. At a time when many Americans haven’t set aside enough funds for their later years, 79 percent of those supporting adult children worry about setting themselves up for a comfortable retirement. In comparison, 72 percent of people who don’t support adult children financially feel stressed about their retirement savings.

What costs do parents cover for their adult children?

Parents report providing their adult children with financial assistance for various expenses, from educational costs to vacations to basic spending money.

Looking at the breakdown of this support reveals that food and groceries top the list of needs among financially dependent adult children. With food prices continuing to climb, it's understandable that four out of five parents providing assistance are helping with their grown kids’ grocery bills. Parents contribute an average of $220 monthly toward their adult child's grocery expenses.

Another two-thirds of parents with adult children assisted with cell phone bills and housing expenses. The need for specific types of support varied between Generation Zers and Millennials. Gen Z adults were far more likely to need help with healthcare, vacations, and tuition than Millennials, as many are still in school or just launching their careers in their early twenties. School expenses were the costliest for parents, averaging nearly $1200 monthly. That’s a massive increase over the average spending on tuition last year, at around $600 a month.

Parental financial support often comes with conditions

Accepting financial help from parents is one thing, but doing so while demonstrating effort and appreciation is another matter. Our findings suggest that parents may be growing less tolerant of adult children who appear to take advantage of their generosity.

Among parents providing financial support, 63 percent also offer housing to their adult children. While only 39 percent of these live-at-home adult children contributed to household expenses in 2024, that figure has increased substantially to 51 percent this year.

This improvement in shared financial responsibility likely stems from parents setting firmer boundaries. The percentage of parents establishing specific conditions for financial assistance has increased since our previous study—from 71 percent who gave conditionally last year to 77 percent who now attach requirements to their financial support.

The most notable increase appeared in parents requiring adult children living at home to contribute to household expenses. However, the most common conditions continue to be requirements that adult children actively seek employment or pursue education—practical approaches designed to guide grown offspring toward eventual financial independence.

Other conditions parents placed on their adult children included establishing financial goals and attending counseling or therapy sessions. Each such requirement reflects a caring concern designed to help adult children financially get on their feet.

What are parents sacrificing for their children’s financial security?

The parents in the study seemed more than willing to aid their children. Yet, that added financial burden often creates stress and demands lifestyle sacrifices. What compels them to keep giving?

Obligation is one driving force for parents who economically support their adult offspring. Most parents who provide monetary assistance do so out of some sense of duty.

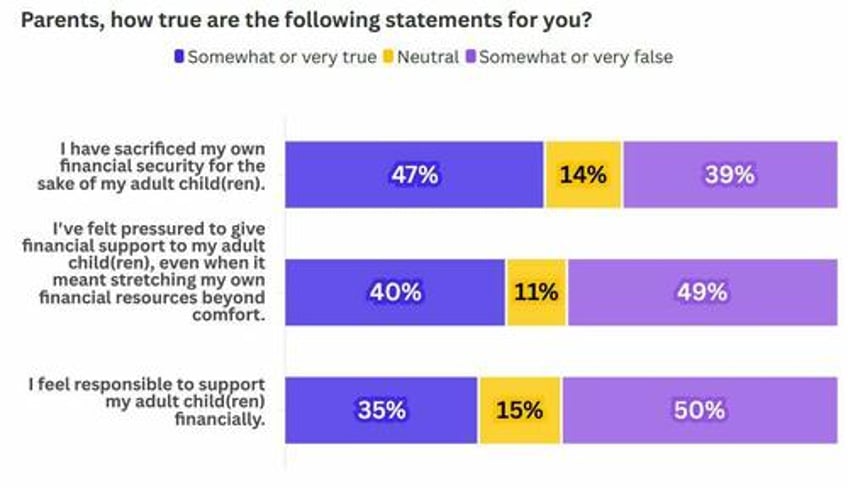

Fifty-three percent of contributing parents feel responsible for financially supporting their grown kids. That number is down from 61 percent one year ago, another potential indicator that such gravy train sentiments may be slipping.

This responsibility causes great strain on parents. Nearly 50 percent of providing parents sacrifice financial security for the sake of supported children, and 40 percent felt pressured to give financial assistance even when it meant uncomfortably stretching their resources.

Those numbers mirror the findings from past reports. Despite the hardship and stress sometimes created by these contributions, devoted moms and dads remain ready to dig deeper to help their struggling kids. Nearly nine in ten parents would make one or more additional financial sacrifices to aid their offspring.

Specifically, more than 60 percent of parents would be willing to live a more frugal lifestyle to support their adult children, half would pull money from their savings or retirement accounts, and one-third would postpone retirement or take on debt so that they might shift funds to provide for their progeny.

Many supporting parents would be willing to come out of retirement or refinance their homes to help their children. Grown kids struggling through financial straits are fortunate to find such selfless family support. They shouldn't take it for granted or become perpetually dependent.

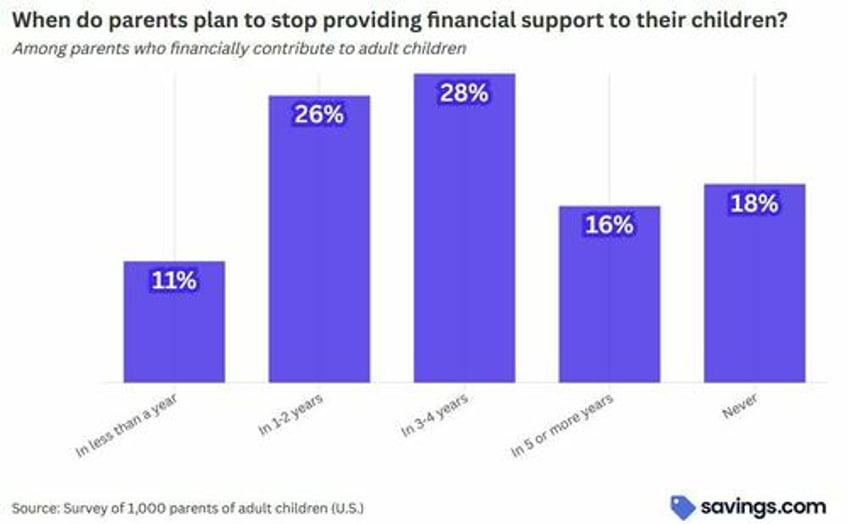

When asked how long they planned to continue financial support of adult children, parents admitted there may be a shelf life on their generosity. Less than 20 percent of those supplying aid said their largesse would continue indefinitely.

More than one-third of parents who give money to their adult kids say they’ll cut off support within the next two years. Their aim is likely to encourage their children towards financial independence. However, terminating assistance before a potential recession could deal a double blow to younger generations.

Conclusion

The last four years of our research findings collectively illustrate remarkable parental commitment. Parents continue to accept financial stress and make personal sacrifices to support their adult children's economic well-being. However, even as we see more parents providing financial assistance than in any previous year of our research, we've also detected some emerging cracks in this foundation of support.

The percentage of parents who feel financially responsible for supporting their adult children has declined, while more are establishing specific conditions for continued assistance. Perhaps most notably, almost 40 percent of parents plan to end their financial support within the next two years.

Despite these subtle shifts away from unconditional assistance, our survey essentially confirms what we've seen in recent years: the ongoing need to financially support struggling adult children is placing significant strain on many parents' financial security. This concerning pattern may face additional pressure if economic conditions worsen in the coming months. We'll examine how these trends evolve in our 2026 report.