Return always wants its risk payment.

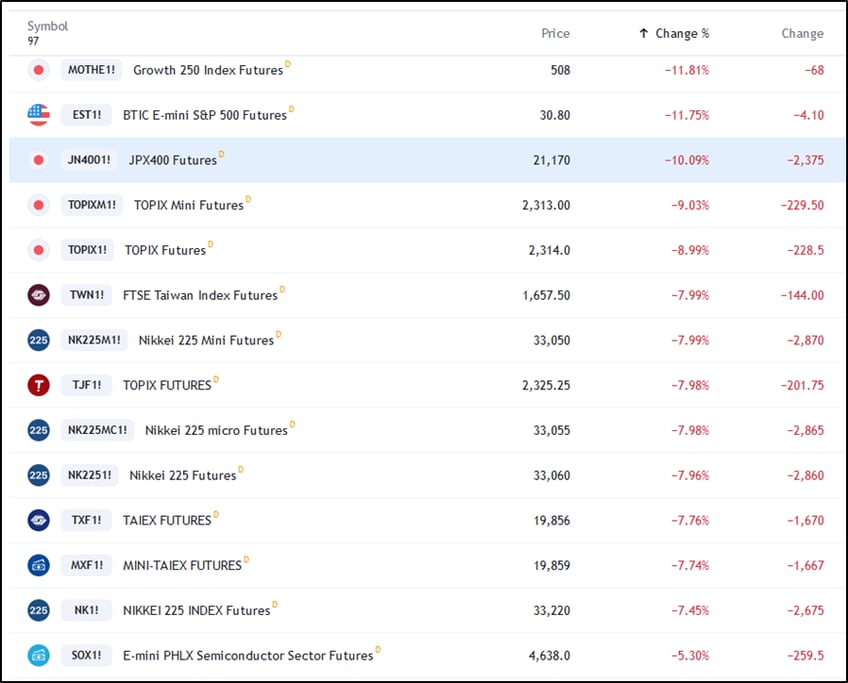

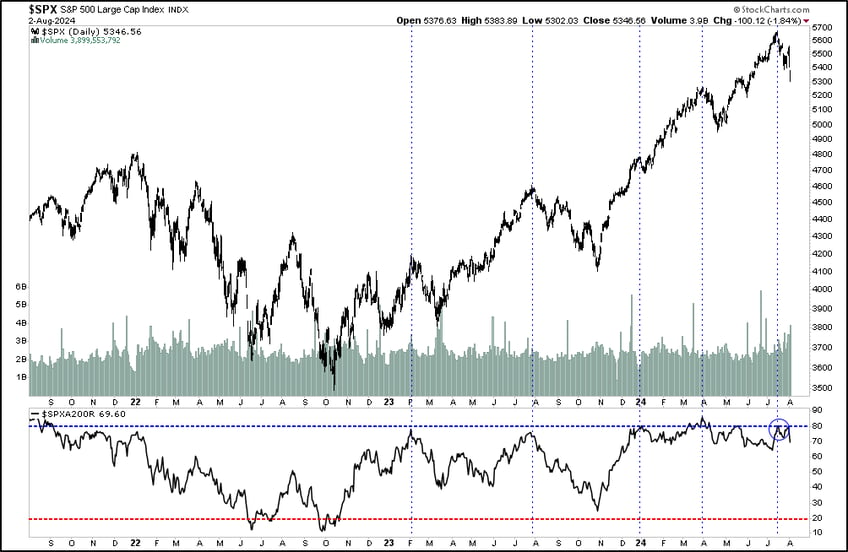

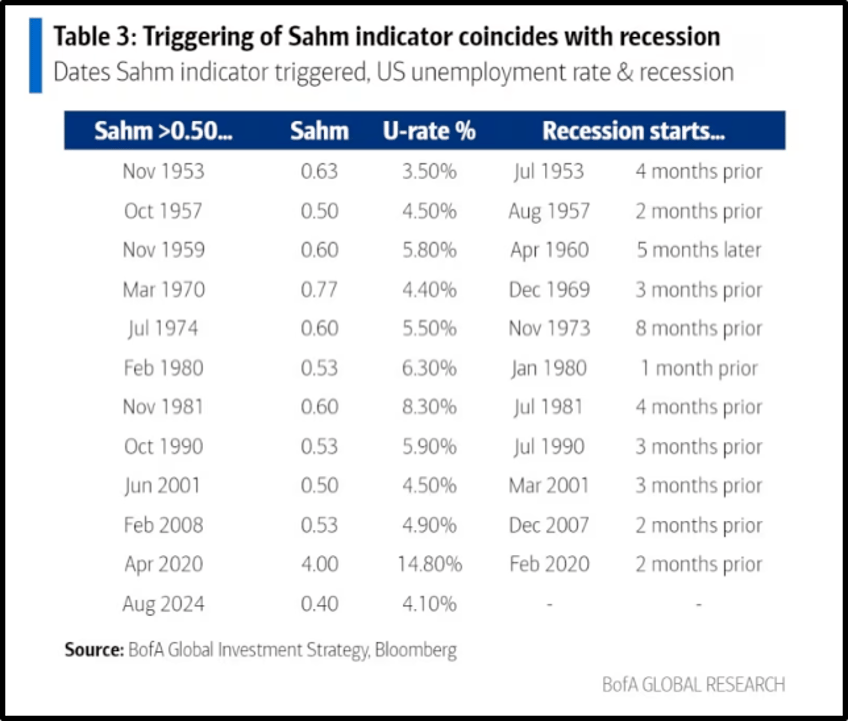

Two major events are happening at the same time right now. The Japanese carry trade is blowing up pouring fear into ALL ASSET CLASSES and the Sahm rule, designed to signal the start of a recession, has officially been triggered in the US.

Collapse in Japan will roll into all assets. Limit Down.

"Japanese government's balance sheet is, simply put, one giant carry trade."

Why hasn’t this carry trade collapsed in the face of the massive global fixed income sell-off in recent years? BoJ keeps government funding costs at zero or negative, despite rising inflation. This has led to a massive yen depreciation, boosting the value of Japan's foreign assets. The government benefited from both FX and fixed income legs of the carry trade, while falling real rates have also favored asset owners, particularly wealthy older households.